- U.S. electricity demand is rising for the first time in two decades—driven by electrification, reshoring, and the looming AI data center boom.

- Planned capacity additions are almost entirely intermittent, raising concerns about grid reliability during seasonal peaks.

- Natural gas peakers are typically inefficient and dirty, but only used for the highest demand times of the year. Replacing natural gas peakers with seasonal use batteries is over 20 x more expensive and only saves ~1% carbon emissions.

By now everyone knows that electric power demand in the U.S. is growing again for the first time in 20 years even before the huge build-out of AI data centers. At its base, this renewed growth results from the diminishing benefit of replacing older machines powered by electricity (air conditioners, industrial motors, lighting, appliances, etc.) with newer ones that are – on average – 50-80% more efficient than they were 20-30 years ago[i]. It’s also the electrification of more devices (cars, heat pumps, etc.) and the reshoring of manufacturing, which is why power demand has been growing at about 1-2% over the last three years[ii]. And all that is before we add the new AI data centers. By the electric power industry’s own estimates, demand over the next 4-5 years will exceed planned capacity additions, which are – on a net basis – over 100% intermittent wind and solar[iii]. Here’s where the controversy starts between the two tribes inhabiting Energyland.

Since the cost of utility scale wind and solar declined by over 50% and 80%, respectively about 15 years ago[iv], they became – without the benefit of tax credits – the cheapest new form of power generation capacity. Add in those tax credits and it is easy to understand their growth which along with cheap shale-gas has decimated coal fired generation. Exhibit 1 illustrates this massive shift.

Exhibit 1: U.S. Power Generation Transition

Source: Electric Power Monthly March 2025, EIA as of May 1, 2025. Power Supply Outlook, September 19, 2024, Wolfe Research Utilities & Power Research. Information contains EIP’s opinions which may change at any time without notice.

Supplanting 68% of coal fired generation with wind, solar and natural gas drove the 17+% reduction in U.S. carbon emissions since 2005 but it also drove a steady decline in electric generation coming from always-available sources: nuclear, natural gas, oil and coal, what the industry refers to as “dispatchable” generation[v]. Compared to peak seasonal demand which is typically in July and August, (which is about 2x trough demand in the shoulder months of spring and fall)[vi] the decline in dispatchable generation has set off alarm bells by those responsible for the reliability of the grid. Exhibit 2 shows the problem.

Exhibit 2: Dispatchable Power Supply vs Peak Seasonal Demand

Source: EIA, SSR Research and EIP Estimates. The Navy line is determined using the peak electricity demand history from EIP for the period from 2019 to 2024. EIP calculated the peak for 2004 – 2024 based on grossing up actual peak month demand provided by EIA by a factor of 1.26. Estimates from 2025 to 2030 are taking the 2024 peak demand and multiplying that by 2.2%. A reserve margin of 15%, the standard for the industry, is added to this peak demand number. A reserve margin of 15%, the standard for the industry, is added to this peak demand number.

The seasonal peak only lasts a few weeks in July and August so why not stick with wind and solar and simply add battery storage that could be charged during periods of low demand instead of adding more dispatchable power that lies idle over 90% of the time and emits carbon?

Short answer: Costs. Spare dispatchable capacity is much cheaper than batteries, over 20x cheaper. [vii]

This is why the industry still builds natural gas fired “peaking” units that are relatively simple gas turbines that are only about 35% efficient (ratio of energy input to energy output) and are used less than 10% of the time,[viii] In fact, industry estimates are that the cost of providing supply only during high demand periods is about 15-25 cents per kilowatt hour ( /kWh), 3-5x the average wholesale price of electricity in the U.S.[ix]. Other dispatchable power that runs more frequently, combined-cycle (baseload) natural gas, coal and nuclear, have lower costs. But let’s just look at peaking units for now as they are the most expensive.

So wait, batteries are 20x more expensive than 15-25 cents/kWh? But we read all the time that batteries are now economic for utility scale applications. Who is right and why is there so much confusion?

The confusion about batteries arises from the difference in utilization rates between a battery used for seasonal peaks, which is only cycled a few times per year, versus a battery paired with solar generation and used for daily peaks and troughs of generation that is cycled every day. That difference in utilization rates results in an enormous cost difference.

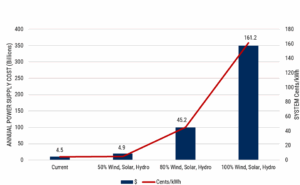

The economic impact on system-wide costs for an electric system that is all wind, solar and batteries was conducted a number of years ago by the Clean Air Task Force (CATF) the results of which are shown in Exhibit 3 below.

Exhibit 3: Impact of Required Battery Storage on Wholesale Electricity Price

Source: Clean Air Task Force, “Armond Cohen Testimony in Support of the Climate and Community Protection Act, S. 2992” February 12, 2019.

California Independent System Operator (CAISO) Power Supply Costs. CAISO is the grid operator that oversees the operation of California’s bulk electric power system, transmission lines, and wholesale electricity market.

Today, about 30% of California’s power generation comes from wind and solar[x] and the wholesale price of electricity is about 4-5 cents/kWh [xi]. In CATF’s analysis, as the portion of wind and solar rises and is supported solely by batteries (and not natural gas, nuclear and imported power), so too does the clearing price of wholesale electricity. This is because the annual financing and depreciation costs of batteries and related infrastructure increases the annual cost of providing reliable power from less than $20 billion to about $350 billion per year, implying a battery investment cost of about $3 trillion if 100% of California’s power were to come from wind, solar and hydro backed up by batteries. This enormous capital investment pushes the cost of wholesale electricity from 4-5 cents per kWh to over 160 cents per kWh. And that assumes battery capital costs fall to $100 /kWh versus the roughly $280 /kWh today[xii]. But the crux of this analysis applies everywhere, not just California.

This is how Armond Cohen, the co-founder and head of the CATF explained it in his testimony to the New York State Senate Assembly Environmental Conservation Commission:

“The consequence of this seasonal variation is that, even when New York procures enough wind and solar output to meet total electricity demand on an annual basis, roughly 25% of hours of the year cannot be served by wind and sun. Storing the energy [during surpluses]…would cost $3.16 trillion…assuming $100/kWh…because this storage capacity would be used at a very low rate – about 1% of capacity in an average year”[xiii]

Here is a simpler way of understanding the confusion between the economics of batteries used to compensate for the daily cycle of solar versus the seasonal shortfall of both wind and solar. Imagine the cost of batteries, including the cost of converting the power from DC to AC and connection to the grid fell from that $280 to $100 /kWh. Further, assume a world with no taxes, that the battery has no operating costs, that the battery lasts forever and a capital market full of investors that demand a 10% cash on cash return. In that world, that $100 /kWh battery costs $10 per year in perpetuity. Cycle it once and that hour of stored electricity costs, well, $10. Cycle it twice, it costs $5 or 500 cents per kWh. Cycle it 365 times and it costs 2.7 cents per kWh. See the difference?

But businesses do pay taxes, batteries don’t last forever, and they don’t cost $100 per kWh, they cost $280 /kWh. And seasonal batteries are cycled only a few times per year, not 365 times per year making seasonal batteries cost at least ~20x more per kWh than those gas peaking units.

The counter argument to these economics is to imagine excess wind and solar capacity rather than such a large investment in batteries the same way gas peaking units represent massive excess capacity most of the time. Sure enough, the CATF also did a joint study with the Environmental Defense Fund on just such a scenario for California. They found that overbuilding wind and solar capacity is in fact cheaper than the scenario above but that it would still require a doubling of the wholesale price (ex-transmission costs) from about 5 cents to about 10 cents per kWh[xiv]. But, and there’s always a “but,” it would require a land area of about 6,250 square miles, larger than the combined size of Connecticut and Rhode Island[xv]. And this still assumes California imports 20-30% of its power from other states, which, as demand rises, will be increasingly problematic[xvi]. (Check out our piece from 2021 about California’s predicament) Being self- sufficient using just renewable resources would require an amount of land that is just not feasible.

But what about the environmental impact? The answer to that should always be to be viewed through the lens of the avoided cost of carbon emissions, which the above CATF analyses says is extremely expensive. But more than that, how much carbon are we talking about?

The U.S. has about 1,000 peaking units that generate about 129 terawatt hours per year (about 83% of which is generated from natural gas), representing about 3% of all U.S. generation. Since the power system makes up about 25% of U.S. carbon emissions, these peaker plants represent less than 1% of all U.S. carbon emissions[xvii].

I’m no politician but I would bet anyone a dollar that U.S. voters would not trade that 1% carbon emission benefit for a 20-30x increase in the wholesale price of electricity.

Check out the EIP Expert Corner for short videos from EIP’s Thought Leaders.

This information presented contains EIP’s opinion which may change at any time and without notice. The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. The above includes publicly available information about certain companies. EIP may or may on invest in such companies. The information provided is for informational purposes only and is not an offer to purchase or sell particular securities or securities of a particular company. Investors are encouraged to do their own research and consult with their own advisors prior to making an investment decision. Past performance is no indication of future performance.

[i] Sources: https://energyefficiencyimpact.org/buildings/; Lawrence Berkeley National Laboratory: LBNL-45825: Impacts of U.S. Appliance Standards to Date.

[ii] Source: EIA, Today in Energy, May 13, 2025.

[iii] Source: Wolfe Research Power Supply Outlook: Implications for Power, Rails, Natural Gas, Turbines September 19, 2024 and EIP estimates. The statements are EIP’s opinions based on the data shown above which may change at anytime without notice.

[iv] Source: Lazard June 2025, LCOE Analysis. The Lazard analysis is based upon a number of assumptions and include the assumption the wind and solar resources are ample.

[v] Source: Electric Power Monthly March 2025, EIA as of May 1, 2025. Power Supply Outlook, September 19, 2024, Wolfe Research Utilities & Power Research. Information contains EIP’s opinions which may change at any time without notice.

[vi] EIA

[vii] Source: Lazard June 2025, LCOE Analysis. The Lazard analysis is based upon a number of assumptions and include the assumption the wind and solar resources are ample.

[viii] Source: https://www.powermag.com/simple-cycle-combined-cycle-or-a-hybrid-approach/

[ix] Source: Lazard June 2025, LCOE Analysis. The Lazard analysis is based upon a number of assumptions and include the assumption the wind and solar resources are ample.

[x] Source: EIA, California State Energy Profile, June 20, 2025.

[xi] Source: California ISO: Q4 2024 Report on Market Issues and Performance, March 26, 2025.

[xii] Source: Lazard June 2025, LCOE Analysis. The Lazard analysis is based upon a number of assumptions and include the assumption the wind and solar resources are ample.

[xiii] Before the State of New York Senate-Assembly Environmental Conservation Committee. Testimony in Support of the Climate and Community Protection Act, S. 2992 Armond Cohen, Executive Director Clean Air Task Force, February 12, 2019.

[xiv] Clean Firm Energy is the Key to California’s Clean Energy Future, Jane C.S. Long, Ejeong Baik, et al. April 21, 2021, https://issues.org/california-decarbonizing-power-wind-solar-nuclear-gas/

[xv] Ibid

[xvi] Ibid

[xvii] Source: U.S. Government Accountability Office, Electricity: Information on Peak Demand Power Plants, May 21, 2024.