Advised Mutual Funds

EIP Growth and Income Fund was launched in August 22, 2006 and seeks to provide a high level of total shareholder return that is balanced between current income and growth. As a secondary objective, the Fund seeks low volatility. The Fund’s Manager, Energy Income Partners LLC (EIP), primarily invests in a diversified portfolio of equity securities of issuers in the energy industry that seek to pay out as dividends or distributions a portion of income or distributable cash flow in excess of the average for listed equities as a whole. EIP focuses the Fund’s portfolio on businesses in energy infrastructure such as pipelines, storage facilities and terminals, regulated utilities and renewable energy production.

EIP Growth and Income Fund (EIPIX) received an overall Morningstar Rating of 4 stars out of 99 Energy Limited Partnerships funds as of 6/30/2024.◊ Based on a weighted average of the Fund’s 3-, 5- and 10-year returns.

Recent Performance

as of 6/30/24

| Quarter | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Inception to Date ** | |

| EIPIX | 3.46% | 12.01% | 16.57% | 12.70% | 9.46% | 4.36% | 9.22% |

| EIPFX | 3.37% | 11.79% | 16.19% | 12.26% | 9.03% | – | 6.30%*** |

| SPTR† | 4.29% | 15.29% | 24.56% | 10.01% | 15.05% | 12.86% | 10.54% |

| AMZX† | 3.35% | 17.71% | 35.79% | 22.74% | 12.17% | 2.03% | 8.17% |

**EIPIX inception date 8/22/2006. ***EIPFX inception date 10/18/16

† The Alerian MLP Total Return Index is a composite of the most prominent energy MLPs calculated by Standards & Poor’s using a float-adjusted market capitalization methodology on a total-return basis. Alerian MLP Index, Alerian MLP Total Return Index “AMZ” and “AMZX” are trademarks of Alerian. The S&P 500 Total Return Index (SPTR) is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

The performance data quoted represents past performance and is no indication of future performance. Historical return data includes the reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694 for the most recent month-end performance.

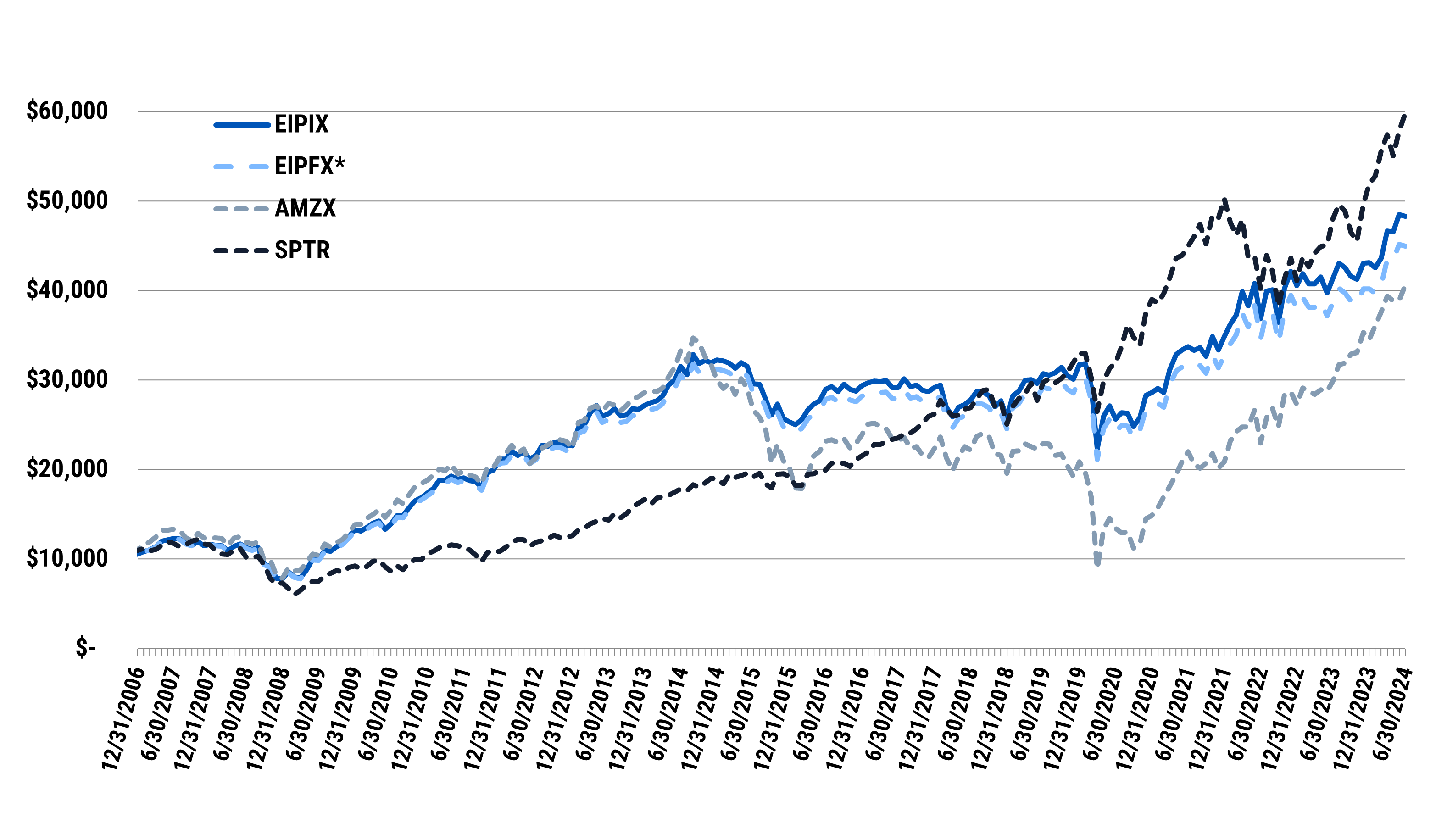

Growth of $10,000

*EIPFX: The gross and net expense ratios include interest expense, Distribution (12b-1) and Administrative Service Plan fees. The expense limitation and reimbursement is a contractual agreement between the Adviser and the Fund that was initiated in February 2016 at a 2.00% expense cap, amended January 1, 2018 to 1.50% and amended again April 29, 2018 to 1.25%, effective until February 28, 2024. If such contractual agreement were not in place, the Fund’s performance would be reduced during that time period.

The Class I Shares (EIPIX) commenced operations on 08/22/2006, performance shown of the Investor Class Shares (EIPFX) prior to inception, 10/18/16, is based on the performance of the EIPIX Shares, adjusted for the higher expenses applicable to Investor Class Shares including the 12b-1 fee and the administrative services fee. This performance has not been experienced by any Investor Class shareholder and there is no assurance that the Investor Class shareholder will experience this performance in the future.

The performance data quoted represents past performance and is no indication of future performance. Historical return data includes the reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694 for the most recent month-end performance.

The Fund was registered under the Investment Company Act of 1940 on August 22, 2006 and offered through a confidential private placement memorandum. On October 14, 2016, Fund shares were registered under the Securities Act of 1933. The Fund performance is net of actual fees and expenses incurred by the Fund.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Morningstar RatingTM for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

With respect to the Energy Limited Partnerships funds, EIP Growth and Income Fund (EIPIX & EIPFX) received a Morningstar Rating of 1 star for the three-year and 5 star for five- and ten- year periods, out of 99, 97 and 62 Energy Limited Partnership funds respectively, as of 6/30/2024, based on risk adjusted returns.

Before you invest with Energy Income Partners and its Funds, please refer to the statutory and summary prospectuses for important information about the fund and the investment company, including investment objectives, risks, charges and expenses. An electronic copy of the prospectus is available for download on the Mutual Fund page of this website. You may also obtain a hard copy of the prospectuses by calling 1-203-349-8232 or by emailing ir@eipfunds.com. The prospectuses should be read carefully before you invest or send money.

Mutual fund investing involves risks including loss of your entire investment.

Because the Fund concentrates its investments in the Energy Industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting industries within that sector than if its investments were more diversified across different industries. Energy Companies are highly sensitive to events relating to international politics, governmental regulatory policies, including energy conservation and tax policies, fluctuations in supply and demand, environmental liabilities, threats of terrorism and to changes in exchange rates or interest rates. MLPs are subject to various risks related to the underlying operating companies they control, including dependence upon specialized management skills and the risk that such companies may lack or have limited operating histories. The value of the Fund’s investment in an MLP will depend largely on the MLP’s treatment as a partnership for U.S. Federal Income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the fund which could result in a reduction of the fund’s value. Investments in Non-U.S. companies (including Canadian issuers) are subject to risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The Fund invests in Small and Mid-cap companies, which involves additional risks such as limited liquidity and greater volatility than larger companies.

The Fund may invest in Fixed Income securities which typically decrease in value when interest rates rise, this risk is usually greater for longer-term debt securities. Investment in Lower-rated and Non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may engage in Short Sales which are speculative and more risky than long positions (purchases) in securities because in theory, securities sold short have unlimited risk. Short selling will also result in higher transaction costs and may result in higher taxes. The Fund’s use of Derivatives could lead to substantial volatility and losses. Some derivatives are “leveraged,” which means they provide the Fund with investment exposure greater than the value of the Fund’s initial investment in the derivative instrument.

As a result, these derivatives may magnify or otherwise increase losses to the Fund. Derivative instruments may not correlate well with the performance of the securities or asset class to which the Fund seeks exposure. Derivatives may be illiquid and difficult to price, and the counterparty to a derivatives contract may be unable or unwilling to fulfill its obligations to the Fund. The Fund’s use of leverage, via short sales or derivatives, may cause volatility in returns as it typically magnifies both gains and losses. When the Fund increases its investment exposure through the use of leverage, a relatively small market movement may result in significant losses to the Fund. This is not a complete outline of the risks involved in investing in the Fund. Investors are encouraged to read the prospectus carefully prior to investing.

EIP Funds including the EIP Growth and Income Fund are offered only to United States residents, and information on this site is intended only for such persons. Nothing on this website should be considered a solicitation to buy or an offer to sell shares of the Fund in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. EIP does not give any advice or make any representations through the Site as to whether any security or investment is suitable to you or will be profitable. Past performance is no guarantee of future results. This data is provided for information only and is not intended for trading purposes.

Nothing contained in this communication constitutes legal, tax, or investment advice. Information provided herein is accurate as of the date provided and may be changed or updated without any notice to you. Investors should consult their counsel for advice and information concerning their particular situation. Energy Income Partners, LLC is an investment advisor registered with the Securities and Exchange Commission.