At the end of the Wizard of Oz, Dorothy, back at home amongst her family and friends, declares: “If I ever go looking for my heart’s desire again, I won’t look any farther than my own backyard.”

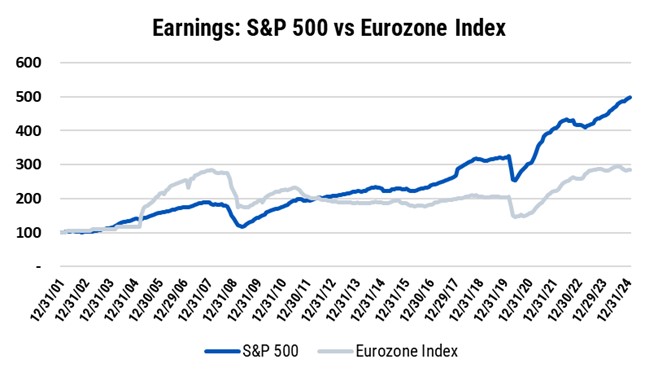

Stock investors seeking value, however, are looking overseas, particularly in Europe because those equity indices have lagged by so much – about 5.3% per year over the last 10 years (Euro Stoxx 50 vs S&P 500)[i]. While some of this outperformance in the U.S. is a relative increase in valuation, the bulk is driven by faster earnings growth of 8.0% for S&P 500 vs 4.2% for EuroZone Index[ii]. A dollar invested in the U.S. on 12-31-04 is now worth $7.16 while a dollar invested in Europe is worth $2.67 [iii]

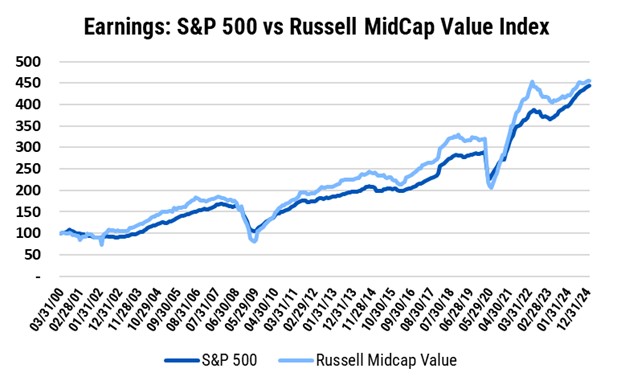

Yes, the S&P 500 is expensive versus its history, now trading at 21.5x forward earnings estimates[iv], but that is a large-cap phenomenon. The Russell Midcap Value Index trades at about 16.1x[v]. Perhaps that explains why Europe has lagged; they don’t have the super large cap stocks that have driven the returns in the S&P 500. But the slower earnings growth in Europe is not explained by their market cap nor their characterization as “value” stocks. After all, the long-term annual earnings growth of the Russell Midcap Index over the last 25 years is 6.3% just above that of the S&P 500’s 6.2%[vi].

We are energy investors and in our research on why European energy stocks are so cheap, we keep running into a hostile business environment driven by Brussels and many member states. Those currently in power treat those who produce fossil fuels – not those who consume fossil fuels – as the cause of a warming climate, so policies are aimed at killing local production of oil and gas, leaving global demand unaffected. And policy makers still rank climate policy as more important than economic growth, employment, national security, inflation and the refugee crisis. If I ran an energy company, Europe would be the last place I would locate.

That brings us back to Kansas, or the U.S. in general.

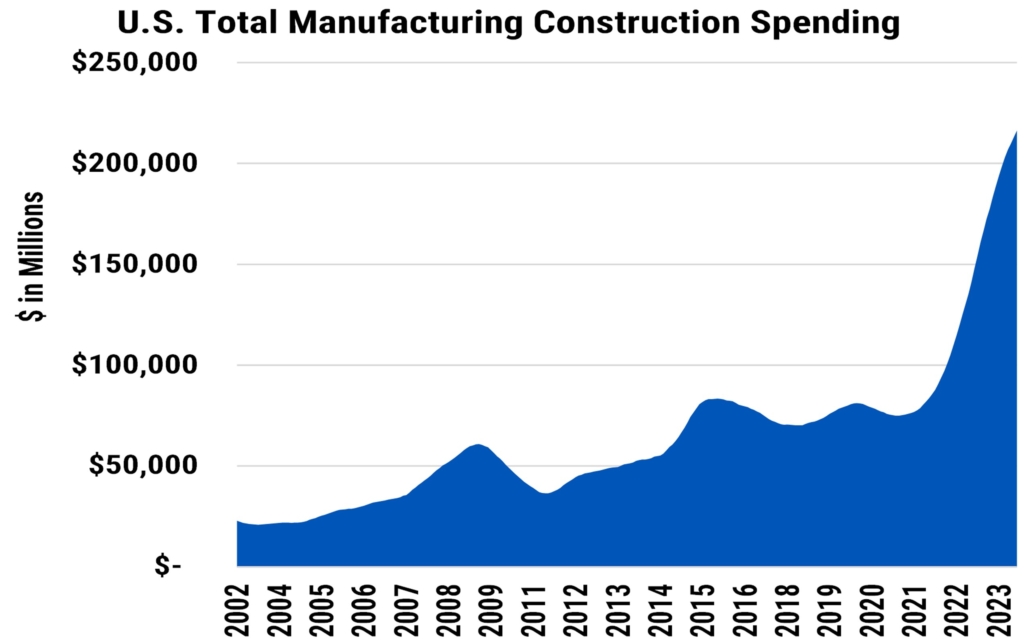

Construction spending on manufacturing in the U.S. has nearly tripled over the last three years[vii]. Yes, a lot of this is due to data centers. But the need for related power generation will lead to even more investment in the U.S. as will a re-shoring of other manufacturing. The multiplier effect of this capital formation will of course drive economic growth in other sectors as well.

There are fundamental reasons for this business and economic success that are reflected in the earnings growth rates of U.S. companies versus those overseas. And stocks – in the long run – follow their trends in earnings.

Just like Dorothy follows her heart’s desire, so too will the capital markets that seek higher risk-adjusted returns.

Check out the EIP Expert Corner for short videos from EIP’s Thought Leaders.

This information presented contains EIP’s opinion which may change at any time and without notice. The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. The above includes publicly available information about certain companies. EIP may or may on invest in such companies. The information provided is for informational purposes only and is not an offer to purchase or sell particular securities or securities of a particular company. Investors are encouraged to do their own research and consult with their own advisors prior to making an investment decision. Past performance is no indication of future performance. Information about indices is for informational purposes only. Investment cannot be made in an index.

S&P 500 Index: A capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries

Eurozone Index: combination of SXXP, SXXE and SX5E, see below.

STOXX Europe 600 Index (SXXP): Derived from the STOXX Europe Total Market Index and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization across 17 countries of the European region.

EURO STOXX Index (SXXE): A broad yet liquid subset of the STOXX Europe 600 Index. With a variable number of components, the index represents large, mid and small capitalization companies of 11 Eurozone countries.

EURO STOXX 50 Index (SX5E): Europe’s leading blue-chip index for the Eurozone, provides a blue-chip representation of supersector leaders in the region. The index covers 50 stocks from 11 Eurozone countries. The index is licensed to financial institutions to serve as an underlying for a wide range of investment products such as exchange-traded funds, futures, options and structured products.

Russell Midcap Index (RMV): Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

[i] Source: Bloomberg, Euro Stoxx 50 vs S&P 500, 12-31-14 thru 12-31-24.

[ii] Source: Bloomberg, 12-31-14 thru 12-31-24.

[iii] Source: Bloomberg, Euro Stoxx 50 vs S&P 500, 12-31-04 thru 12-31-24.

[iv] Source: Bloomberg as of January 16, 2025.

[v] IBID.

[vi] Source: Bloomberg, 3-31-00 thru 12-31-24.

[vii] Source: U.S. Census Bureau. Data as of July 18, 2024.