By now the broader investment and policy community are learning about the step change in anticipated electric power growth we energy geeks have known about for some time.

While the biggest driver is AI data centers, it’s also re-shoring industry and the growing electrification of vehicles and heating systems. It’s also the flattening adoption curve of more efficient appliances and lighting (halogen, compact fluorescent, and LED).[i]

And this increase in growth expectations has just happened over the last 6 months. In their December 2023 annual Long-Term Reliability Assessment, the North American Electric Reliability Council (NERC) raised its 9-year forward U.S. demand growth forecast from 222 terawatt hours last year to 564 terawatt hours this year, a 155% increase.[ii]

Over the last 20 years, U.S. electric power demand growth has averaged about 0.4% per year. This new forecast is about 1.5% per year.[iii] While these growth rates seem unexciting, the revised forecasts represent a need for new power generation 50% greater than what is currently in the utility industry’s combined 5-year plans.[iv] For an industry with 5+ year lead times that has gotten used to virtually no growth slowly eating away at the excess capacity that accumulated in the 1990s,[v] the sheer amount of new generation required presents a historic challenge to the electric power industry.

Why? Because virtually all the planned capacity increases over the next 5 years are coming from intermittent wind and solar while the incremental demand is coming from data centers that need power 24/7/365 with 5 “9s” of reliability meaning they need a reliability rate of 99.99999%.

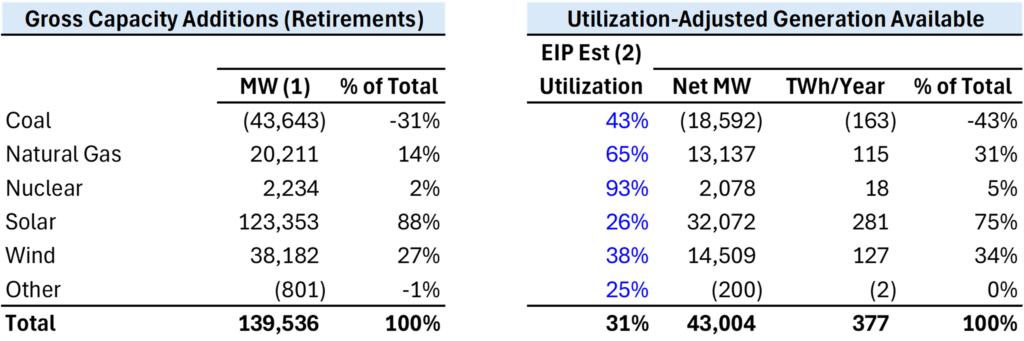

Exhibit 1: Capacity Additions by Fuel Type 2023-2027

Source: Wolfe Research Power Supply Outlook: Implications for Power, Rails, Natural Gas, Turbines September 15, 2023. Storage Capacity additions planned were 25,213 MW and are excluded above. EIP estimates, using 2023 EIA data for average U.S. capacity factors by energy source. EIP added 5% to both Wind and Solar to account for battery storage. For Natural Gas, the 2023 average capacity factor was 43%, but EIP assumed new fleet additions would run at 65% on average.

Moreover, the primary users of these data centers; Amazon, Google, Microsoft, Meta, etc. have a commitment to their customers and shareholders to become net-zero emitters of carbon.[vi] While battery capacity additions to the grid are ramping up, it mostly functions as short-term storage that only slightly improves wind and solar utilization rates but cannot offset seasonal fluctuations.

If only we had a power source that was zero carbon, is not weather or location dependent[vii], and is energy dense needing far less new transmission than wind and solar farms scattered across thousands of square miles.

Oh wait, we do. It’s called nuclear power.

It’s zero-carbon and has about 90-95% up-time, the highest by far of any source of electricity.

The problem with nuclear, however, has been cost. The most recently completed nuclear plant in Georgia in 2023 (only the second new plant in nearly 30 years) will require a price of electricity of about 21 cents per kilowatt hour to cover its operating and capital costs given the plant’s significant cost overruns.[viii] That compares with a U.S. wholesale price that averages about 5 cents.

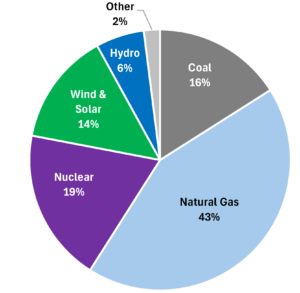

But what about existing nuclear power that makes up about 19%[ix] of U.S. power generation?

Exhibit 2: U.S. Power Generation by Source – 2023

Source: EIA. https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

Well, as it happens, Talen energy recently inked a deal with Amazon to preferentially sell power to a co-located data center from their Susquehanna nuclear facility in Berwick, PA. While the price for this long-term contract is undisclosed all the body language indicates it is at a significant premium to the current wholesale market.[x]

Why would Amazon pay more than the prevailing wholesale price? Well for one, electrons available on the U.S. grid are not zero carbon, at least not yet, and Amazon[xi] has committed to be net zero by 2040. And for another, the wholesale price for any commodity does not come with a reliability guarantee.

Of course, this deal merely re-allocates a reliability asset away from the grid at large to a customer willing to pay more for it.

But what about new nuclear capacity?

The hope is that smaller “module” reactors (SMRs) made in a factory and assembled in the field can be more cost effective. Microsoft seems to be headed in the direction of building their own as they were in the marketplace to hire a “principal program manager for nuclear technology”.[xii] In addition, Google, Microsoft and steel maker Nucor have banded together to purchase clean reliable power, including nuclear, to encourage development of new facilities.[xiii]

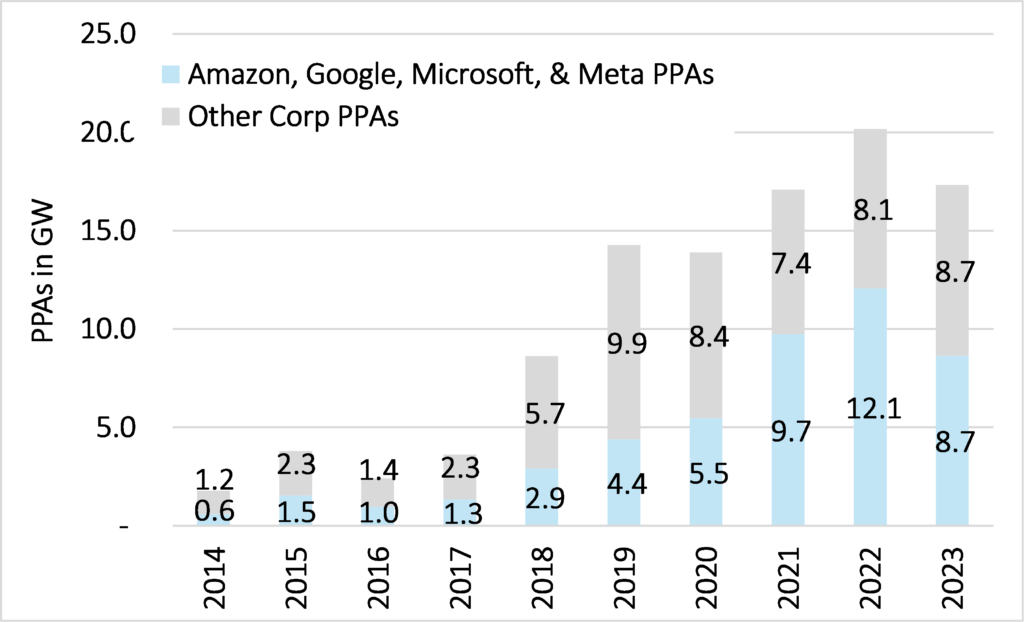

It may seem strange that these tech companies would want to be in the electric power business, but they are already involved in a huge way. Microsoft, Google, Amazon and Meta have supported the development of over 40 gigawatts of wind and solar facilities over the last five years.[xiv] That is equivalent to 35% of all utility-scale wind and solar capacity additions to the grid between 2019 and 2023.[xv] However, this support rolled over last year as their contractual offtake agreements fell by nearly 30% in 2023 compared to 2022 (See Exhibit 3). Why is that? Is it the intermittency of wind and solar and the prohibitive cost/availability of seasonal battery storage? Is it the continued difficulty in running new transmission wires to these dispersed energy resources? Is it the growing pushback from local residents? Or is it all of the above combined with the explosive power needs of AI that exacerbates their dependence on a grid that does not meet their requirements?

Exhibit 3 – Wind & Solar Corporate Power Purchase Agreements in Gigawatts

Source: EIA Form 860M data, January 2024.

The last time industry began producing its own power on a large scale was the late 1970s and early 1980s. Cost overruns on – ironically – nuclear power plants built by regulated utilities that passed these costs along in higher per kilowatt charges made self-generated electricity on an industrial scale cheaper than grid purchases. The concern back then was that industrial cord-cutting would saddle the remaining smaller users (commercial and residential) with a growing portion of the grid’s fixed costs resulting in a negative feedback loop. The result was de-regulation of power generation, which as we have written about before (The Most Reliable Part of the Energy System: Politicized Criticism of its Unreliability), led to a 60+% decline in wholesale power prices in the U.S..

This time around it is not price that is causing industrial customers to self-generate, its performance. Big Tech wants power that is more reliable yet zero carbon. Of course, many policy makers and environmental advocates would say that we are on course to do just that by building wind and solar backed up by batteries. But while short-term batteries cycled each day when the sun goes down are economic, the low utilization/high cost of seasonal batteries for a system that is all wind and solar would raise wholesale prices from 5 cents a kilowatt hour to over $1.00 according to the Clean Air Task Force.[xvi] Compared to this, the 15-20 cents per kilowatt hour for nuclear power doesn’t look so bad.[xvii]

Utility CEOs and the state-level public utilities commissions that oversee them and approve their capital plans have not seen fit to accelerate either reliability investments or zero-carbon technologies to the point where power prices would rise in real terms. Said another way, they don’t believe the public would support the expenditure. But now comes a particularly important group of industrial customers that are willing to pay more for these attributes and will procure them on their own and at a higher price because their customers who have become dependent on their products and services demand it. But the information technology industry is so large and so ubiquitous it would be difficult to distinguish between their customers and the “public” those utility commissions represent.

This sets up competition with the state-regulated monopolies. Not on price but on performance. And while most industries are more flexible on carbon emissions than the tech giants, they too need more reliability. If governors want to attract more tech industry and re-shoring dollars to their states, they may begin to rethink the value proposition in their current regulatory regimes. It is, after all, the state-regulated utilities who are ultimately responsible for reliability and there are a lot of investments the utilities can make that would improve reliability, lower carbon emissions, and provide more growth for their shareholders. But being risk-averse, virtually none would go so far as embarking on nuclear power to achieve it.

Not so the tech giants.

Coming to a theatre near you: “Revenge of the Nerds V: Nuking the AI Data Centers.”[xviii]

This information presented contains EIP’s opinion which may change at any time and without notice. The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided.

[i] Sources: New Your Times article: “America’s Light Bulb Revolution by Nadja Popovich”, March 8, 2019. https://www.nytimes.com/interactive/2019/03/08/climate/light-bulb-efficiency.html, and EIA article: “Nearly half of U.S. households use LED bulbs for all or most of their indoor lighting”, March 31, 2022. https://www.eia.gov/todayinenergy/detail.php?id=51858

[ii] Source: Washington Post article “Amid explosive demand, America is running out of power”, March 7, 2024 by Evan Halper, sourced from North American Electric Reliability Corp. (NERC) Long Term Reliability Assessment (LTRA) reports. https://www.washingtonpost.com/business/2024/03/07/ai-data-centers-power/

[iii] Sources: EIA Table 7.2a Electricity Net Generation-All Sources, Jan 2024; and NERC’s 2023 LTRA report

[iv] Source: EIP estimate calculated by comparing NERC’s 2023 LTRA estimate of 564 TWh of incremental demand load over their forecast period to the 377 TWh estimated in Exhibit 1.

[v] The capacity factor (utilization) for natural gas plants in the U.S. in 2023 doubled to 42% from 21% back in 2003. Source: EIP calculations using EIA Table 7.2a Electricity Net Generation-All Sources, Jan 2024.

[vi] Source: World Nuclear News article “Google, Microsoft and Nucor team up on clean energy development”, March 20, 2024. https://www.world-nuclear-news.org/Articles/Google,-Microsoft-and-Nucor-team-up-on-clean-energ

[vii] Wind turbines are only competitive where it’s windy and solar is only competitive where it’s sunny.

[viii] Lazard’s Levelized Cost of Energy Analysis – Version 16.0, April 2023. Slide 39, using the high case of ~$14/Watt capital cost, which approximates the total cost including overruns for Vogtle ($35bn cost inclusive of $3.7bn Westinghouse payment to walk away on 2,430 MW of capacity) . EIP notes that Vogtle essentially restarted the U.S. nuclear industry’s supply chains and would expect additional nuclear plants to fall within the 14-cents to 22-cents per KWh that Lazard estimates as the range for new build nuclear plants in their LCOE analysis.

[ix] EIA. https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

[x] Nuclear Newswire 3-7-24 “Amazon Buys Nuclear-powered data Center From Talen”; https://www.ans.org/news/article-5842/amazon-buys-nuclearpowered-data-center-from-talen/

[xi] IBID, 9.

[xii] Wall Street Journal article: “Microsoft Targets Nuclear to Power AI Operations” by Jennifer Hill, December 12, 2023. https://www.wsj.com/tech/ai/microsoft-targets-nuclear-to-power-ai-operations-e10ff798

[xiii] World Nuclear News “Google, Microsoft and Nucor Team Up on Clean Energy Development” 3-20-24; https://www.world-nuclear-news.org/Articles/Google,-Microsoft-and-Nucor-team-up-on-clean-energ

[xiv] Bloomberg New Energy Finance (BNEF) Corporate PPA Deal Tracker, January-February 2024, March 11, 2024.

[xv] EIA Form 860M data, January 2024.

[xvi] Clean Air Task Force, “Armond Cohen Testimony in Support of the Climate and Community Protection Act, S. 2992” February 12, 2019. California Independent System Operator (CAISO) Power Supply Costs. CAISO is the grid operator that oversees the operation of California’s bulk electric power system, transmission lines, and wholesale electricity market.

[xvii] If nuclear power begins to be built in the U.S. EIP expects the cost to come down with the experience curve and supply chain competition.

[xviii] There were four Revenge of the Nerds movies between 1984 and 1994: the original “Revenge of the Nerds” in 1984, “Revenge of the Nerds II: Nerds in Paradise in 1987, “Revenge of the Nerds III: The Next Generation” in 1992 and “Revenge of the Nerds IV: Nerds in Love” in 1994.