While tariffs have created significant volatility in the broader market, most energy infrastructure stocks have been relatively calm. In part, this is due to the predominance of their businesses’ activities serving the logistical needs of domestically produced and domestic consumed energy products like natural gas and electricity.

But it is also due to the “cost-plus” model of these natural and legal monopolies. Utilities, for example, earn a regulated return on equity capital employed and pass along operating costs and interest on debt. Utility costs would be affected by tariffs on new projects as steel and aluminum are widely used for the power grid– cables, wires, conductors, generators, substations, transformers, etc. Should the cost increases be too great, utility commissions may seek lower growth investment plans because their bosses – the governors of their respective states – don’t want to have to explain rising electricity bills. So, while earnings growth rates might moderate somewhat, reductions to earnings for utilities as a whole is simply not in the cards, no matter how deep the next recession. The S&P 500 is down 10.0% YTD while the S&P Utilities Sector is up 2.5% YTD.[i]

Then, there are the companies operating pipelines and related storage and processing. For our portfolio, the vast majority of the earnings derive from regulated pipeline tariffs and medium- and long-term contracts for other services (like storage), performance of this group is up 4.1% YTD[ii] which reflects the resilient underlying businesses and tariff immunity. Similar to utilities, these companies have stable earnings because of take-or-pay contracts or a return on capital regulatory construct. This structure protects returns under federal pipeline regulation similar to utility regulation at the state level. Nevertheless, any company that has a growth program is potentially exposed to higher project costs from tariffs on non-U.S. goods, specifically steel and aluminum. Typically, once a project is sanctioned, a company will secure much of the equipment and service contracts to lock in project economics/costs. Then, a company will typically try to share any remaining cost risks with customers, depending on the details of the long-term take-or-pay contract. For most companies we talk to, projects currently under construction have already locked in costs.

While a much smaller part of the portfolio, there are variable businesses embedded in some of our energy infrastructure companies that are exposed to demand risk – lower volumes resulting from decreased drilling activity due to low oil prices (Crude Oil Transport & Storage) and tariffs/potential retaliatory tariffs (NGL Exports and LNG Exports). EIP seeks to keep this exposure small on purpose. If we can find the best dividend yields and growth opportunities in fully regulated businesses, why take-on any additional risk?

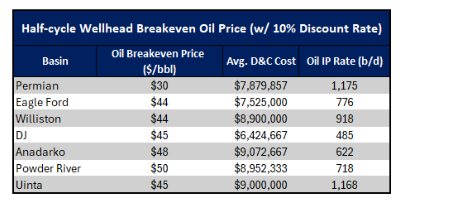

Similar to all the macro calls for increased probability of recession and downgrades to GDP estimates, there have been downgrades to oil demand that range from 300– 500,000 barrels a day,[iii] a drop of less than one-half of one percent. Oil markets have also been hit with a large OPEC+ planned production increase of 411,000 barrels a day to take effect May 2025.[iv] Oil price has responded by dropping to $60 a barrel (down $10/bbl).[v] There is a fear that volumes gathered by energy infrastructure may go down because of reduced drilling activity in response to lower oil price. Regardless of the price, volumes are a function of relative cost. That is why oil and gas production from the Permian Basin is still the fastest growing region in the world (see breakeven oil prices below).

Source: East Daley, Tariffs, OPEC+ Rattle Crude. What is the Supply Risk?, Gage Dwan, April 15, 2025

But how about exposure to China where tariffs of over 100% seem focused on isolating them in the new trade war? Oil and gas made up just over 10% of total U.S. exports to China, constituting a small proportion of total U.S. energy exports and Chinese imports, most of which can be re-routed. However, Chinese purchases of ethane and U.S. liquefied petroleum gas or LPG (essentially propane and butane) which are oil and gas byproducts used to manufacture plastics, are proportionately large and likely to be disrupted. Energy infrastructure companies in our portfolio own LPG and ethane export terminals which are largely contracted on a take or pay basis. The total portfolio exposure is negligible, around 1% of operating income. (source: Bloomberg) Further, the contract term for this business is typically 3-5 years, which means only 20-30% of capacity is up for renewal each year which, further dampens negative retaliatory tariff effects[vi].

But offsetting these small negatives to a small portion of our portfolio’s operating income is an interesting development in the trade wars. Last week, the Trump administration offered tariff relief in exchange for the increased purchase of U.S. energy. Early signs are positive, Indonesia has made an offer to purchase an additional $10 billion worth of U.S. Oil and LPG.[vii] The conversation with EU is more complicated. Dismissing the EU “zero-for-zero” tariff on cars and goods as insufficient, Trump remains focused on the ‘$350 billion’ EU trade deficit and floated the idea that EU commit to purchasing a like amount in energy. This solution avoids the need to pursue other less likely concessions such as opening EU agricultural markets or reducing other non-tariff trade barriers.[viii]

Each day brings a new tactic in the trade wars which has unsettled markets because of the unpredictability of future outcomes. Having grown up in cyclical commodity businesses, we found an investment approach that avoids most or all of this disruption. The earnings of our longest running portfolio from 2007-2009 during the Global Financial Crisis? UP double digits. During the oil price correction/crash during 2014-2016? UP 1%. The only time the earnings of portfolio companies in our longest running portfolio declined was during the pandemic -6%, while earnings for the S&P 500 dipped about 22% (Source: Bloomberg).

Our approach is building a portfolio of companies with earnings stability, dividend yields and long-term earnings growth higher than the S&P 500 and valuations lower than the S&P 500. You might say it’s approach that is above reproach.

Check out the EIP Expert Corner for short videos from EIP’s Thought Leaders.

This information presented contains EIP’s opinion which may change at any time and without notice. The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. The above includes publicly available information about certain companies. EIP may or may on invest in such companies. The information provided is for informational purposes only and is not an offer to purchase or sell particular securities or securities of a particular company. Investors are encouraged to do their own research and consult with their own advisors prior to making an investment decision. Past performance is no indication of future performance.

Information about indices is for informational purposes only. Investment cannot be made in an index.

S&P 500 Index (SPXL1): A capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries

Standard and Poor’s 500 Utilities Index (S5UTIL): a capitalization-weighted index. The parent index is SPXL1. The index was developed with a base value of 100 as of December 30, 1994. This is a GICS Level 1 Sector group. Intraday values are calculated by Bloomberg and not supported by S&P DJI, however the close price in HP<GO> is the official close price.

[i] Source: Bloomberg, as of April 16, 2025

[ii] Source: Bloomberg as of 4/16/2025. Includes ENB, KMI, TRP, WMB, AMZX. Weightings based on market cap.

[iii] Source: IEA: Oil Market Report – April 2025 and Bloomberg, Oil Watchers Are Ripping Up Their Demand Forecasts One by One, April 17, 2025

[iv] Source: IEA Oil Market Report – April 2025

[v] IBID

[vi] Source: Morgan Stanley: North American Midstream & Renewable Energy Infrastructure, Infrastructure Weekly, April 14, 2025.

[vii] Source: Reuters: Indonesia to propose $10 billion US energy imports increase in tariff talks, April 15, 2025.

[viii] Source: Wall Street Journal: Trump Has a $350 Billion Deal for Europe: Buy Our Energy, April 11, 2025.