The four publicly traded merchant power generator stocks are up an average of about 190% this year as the large tech companies have shown a willingness to sign long term contracts for clean reliable power well above the prevailing wholesale price of electricity. While the announced deals regarding nuclear have attracted more attention, there have also been contracts announced for more conventional power. Here is a list of the more prominent announcements[i]:

Mar 2023 Amazon-Talen data center co-located at Susquehanna nuclear facility

Jun 2024 Google-NV Energy (Nevada) contract for geothermal

Sep 2024 Microsoft-Constellation contract to fund restart of Three Mile Island nuclear reactor

Oct 2024 Google-Kairos contract for nuclear power from advanced SMR reactors

Nov 2024 Hallador coal-fired generator term sheet with undisclosed data center developer

Dec 2024 Meta-Entergy contract for 3 natural gas-fired generators representing ~ 17% of Louisiana demand

Dec 2024 Meta RFP for 1.4 GW of nuclear power

Dec 2024 ExxonMobil plans 1.5 GW natural gas-fired facility with carbon capture

These higher prices for nuclear power and the long-term contracts (with undisclosed pricing) for conventional power are ushering in the beginning of a two-tiered pricing scheme. The Amazon-Talen deal is about a 70% premium to the average 5-cent per kilowatt hour wholesale price while the Microsoft-Constellation deal is more than a 100% premium.[ii]

Merchant power generators came into being in the late 1980s and 1990s when the federal government -through a long series of legislative and regulatory changes – established a fully functioning de-regulated power sector with open access to power transmission. Prior to this the two functions of transmission and generation were the responsibility of a monolithic collection of state-regulated, vertically integrated, cost-plus, monopoly utilities.

Deregulation was a necessary response to poor cost management by these cost-plus monopolies that drove up wholesale prices to levels well above where large industrial users could generate their own power[iii]. Now a different set of large industrial users wants to self-generate and self-source power, not because of price, but because of performance. They want lower or zero-carbon power and they want it with five “9s” of reliability[iv]. Nuclear power provides both, with 100% uptime between refueling and zero-carbon[v].

We know the zero-carbon aspect of nuclear power has value to big tech because they have zero-carbon commitments to their customers and shareholders, and they have funded about 1/3 of the utility scale wind and solar in the U.S. over the last 10 years. But, wind and solar, while cheap, is intermittent, running less than 30% of the time (vs about 93-95% for nuclear)[vi].

Nuclear Power

About 20% of U.S. power comes from 94 nuclear power plants generating nearly 100 gigawatts (GW) of electricity. 15% of this capacity is owned by government agencies. The remaining 85% is owned by 14 publicly traded companies, 3 of which are merchant power generators and 11 of which are state-regulated, vertically integrated utilities[vii].

The first deal in March, 2023 between Amazon and Talen, a merchant generator, didn’t catch a lot of attention because Talen was still privately owned. But after its IPO on June 1, 2023, investors began to take notice and it soon became clear the other merchant generators were having similar conversations. The stocks soared.

But on November 1st, the Federal Energy Regulatory Commission (FERC) denied the required transmission interconnection service agreement (ISA) between Talen and Amazon. An ISA must be reviewed by FERC to ensure that open access is being provided to all generators and customers and goes back to the establishment of our de-regulated markets. After initially selling off, as of this writing, Talen’s stock is up over 25% from the intra-day low on the first day of trading after this seemingly adverse ruling[viii].

By contrast, Constellation Energy, which jumped 15% on its September 20 announcement of a long-term deal to restart the undamaged reactor at Three-Mile Island for a Microsoft data center for 10-11 c/KWH, is now below the closing price on that day[ix].

What gives?

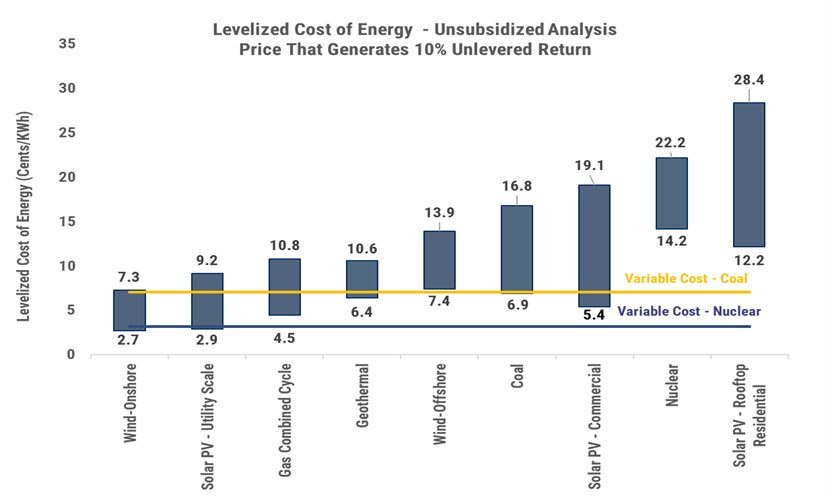

One explanation could be the difference between the cost of running an existing nuclear plant (about 3-4 cents per kWh) and the cost of restarting one (about 10 cents) or building a new plant (14-22 cents). Talen isn’t taking the risk of building a new nuclear plant[x].

Exhibit 1 shows the breakeven electricity prices needed to achieve a 10% cash-on-cash return – without any subsidies or tax credits – for each type of power generation.

Exhibit 1 : Breakeven Price of Electric Power

Source: Lazard June 2024, LCOE Analysis. The above analysis and statements are based upon a number of assumptions listed above and include the assumption that wind and solar resources are ample. Wolfe Research

Another explanation could be that the market sees that big tech is willing to pay a premium for always-available, zero-carbon electricity. And maybe the terms of the Amazon-Talen deal can be modified to satisfy FERC’s concerns while still yielding a premium over the wholesale market price. After all, the subsequent announcements for long term contracts for new nuclear, gas-fired, coal-fired power support the idea that new contract structures, struck at a premium, will be necessary to bring forth the required new power generation investment.

Exhibit 2 shows the results of a bottom-up analysis of planned electric power capacity additions for the next five years in the U.S.

Exhibit 2 : 2024-2028 Capacity Additions

| Gigawatts | % of Total | |

| Coal | (56) | -38% |

| Nat Gas | 33 | 23% |

| Nuclear | 2 | 1% |

| Solar | 132 | 90% |

| Wind | 37 | 25% |

| Other | (2) | -1% |

| Total | 146 | 100% |

| Note: Storage | 37,699 | 20% |

Source: Wolfe Research Power Supply Outlook: Implications for Power, Rails, Natural Gas, Turbines September 19, 2024. The statements are EIP’s opinions based on the data shown above which may change at anytime without notice.

The table shows that planned capacity additions on a net-basis are coming entirely from wind and solar. The net additions of 146 gigawatts using an average solar/wind utilization rate of 23% would add only 33 gigawatts of effective generation which when multiplied by the 8,760 hours in a year, would create 294 terawatt hours of supply. The problem is that demand growth estimates for the U.S. have recently increased to over 2.5% per year for the same five-year period requiring about 600 terawatt hours of new supply[xi]. Moreover, the “net” generation numbers for wind and solar still over-estimate their value to the overall supply demand balance, even when battery storage is brought into the equation, because those batteries cannot compensate for the seasonal changes in wind and solar generation.

It is becoming increasingly apparent that the only way to balance supply with this accelerating demand is natural gas-fired generation, as new nuclear plants take over 8 years to build, wind and solar are intermittent and are constrained by the friction of adding new power transmission, geothermal resources are too limited and no one in the U.S. would build a new coal plant.

For investors, the question arises as to where to place their bets; merchant power generators, vertically integrated utilities, infrastructure and equipment providers, nuclear power related companies, etc. In our view, the safest choice is the vertically integrated monopoly utilities operating on a cost-plus model where new investments will earn their allowed rate of return. Moreover, it is these companies that can sign 20-year agreements for the new natural gas pipelines necessary for new gas-fired generation. The deal made between Meta and Entergy in Louisiana is perhaps a bellwether. Even though Entergy is a cost-plus, vertically integrated utility, it secured a 15-year contract from Meta that will fund the entire $3.75 billion investment. This contract protects retail electric customers if datacenter demand disappoints, and it may even serve to lower retail rates as existing fixed costs are spread over 17% more demand.

Now let’s see if the other vertically integrated utilities can also begin extracting value for performance, funding their growth and lowering the price of economy tickets for everyone else.

Check out the EIP Expert Corner for short videos from EIP’s Thought Leaders.

This information presented contains EIP’s opinion which may change at any time and without notice.The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. The above includes publicly available information about certain companies. EIP may or may on invest in such companies. The information provided is for informational purposes only and is not an offer to purchase or sell particular securities or securities of a particular company. Investors are encouraged to do their own research and consult with their own advisors prior to making an investment decision. Past performance is no indication of future performance.

[i] Bloomberg (12/31/23-12/11/24). These are just examples of deals and is not a comprehensive list of all of the deals in this space, EIP may or may have invested on behalf of those companies described above.. The above contains EIP’s opinion which may change at any time without notice.

[ii] Bloomberg: “Amazon’s Nuclear Deal Stalled, AI Power Need Won’t”, Liam Denning Nov 4, 2024, MS-CEG Deal source: Bloomberg

[iii] The irony here is that it was the massive cost overruns on nuclear power plants that fueled the higher prices.

[iv] Five 9s of reliability is reliability 99.999% of the time.

[v] Refueling every 18-24 months of about 6 weeks = about 5% downtime

[vi] EIA, Electric Power Monthly, November 22, 2024, IBID

[vii]DOE EIA 860 Report, September 23, 2024

[viii]Bloomberg 11/4/24 – 12/12/24

[ix]Bloomberg 9/20/24 – 12/12/24

[x] Source: Lazard, June 2024, LCOE Analysis.

[xi] Source: EIA, Grid Strategies 2023 Forecast, & Raymond James 2024 Forecast, EIA Short-Term Energy Outlook, October 2024