The European energy crisis has been a harsh lesson in Economics 101: commodity prices are set by the highest cost producers. Since natural gas is now the highest cost way of producing electricity, the electricity price has more than quintupled because the natural gas price has more than quintupled [source: Bloomberg].

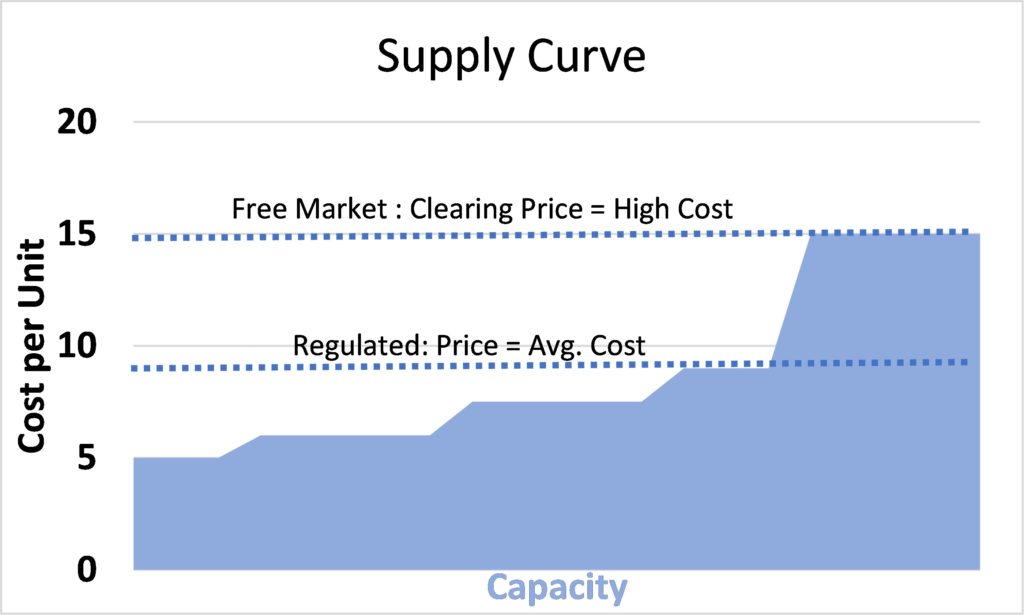

Some articles have described this as a peculiar feature of the European electricity market design. It’s not. It’s how all markets work. The alternative is a regulated market where the average cost determines the price consumers pay. Regulated monopoly utilities around the world operate this way. The differences are illustrated in the schematic below:

The above graph is an illustration of supply and demand and not a reflection of any particular commodity, industry or performance.

From a public policy perspective, one can see the attractiveness of setting up a system that charges the public a price equal to the average cost rather than the highest cost for an essential service like electricity, natural gas, and water.

This is essentially what the European Union (EU) is trying to get back to for electric utilities with their windfall profits tax on certain power generators while maintaining a pretense of a free market construct.

Average cost pricing for utilities was in fact the norm for nearly a century all around the world. Private companies agreed to limits on their profitability (as measured by return on equity) in return for operating a monopoly utility business that avoided duplication of capital; (think: three sets of poles and wires running down the same street).

The problem was the moral hazard of granting an allowed rate of return on invested capital with few, if any, incentives for capital or operating efficiencies. The result was cost inflation and “cord cutting” by large industrial users who could generate power cheaper than they were buying it for. This led to a negative feedback loop of higher costs for those not big enough to generate their own power.

Deregulation was the result, where the business of producing the commodity was separated from the business of delivering it which stayed as a regulated monopoly. This deregulation happened around the world and in the U.S… From a cost standpoint it was a huge success. In the 1980s, U.S. wholesale electricity prices for the largest industrial customers was about 14-17 cents per kilowatt hour in today’s dollars versus less than 5 cents over the last five years. (Source: EIA, Bloomberg)

We have written before how difficult it is to enjoy the benefits of a regulated monopoly (average cost pricing, avoidance of duplicate assets, lower cost of financing, etc.) while maintaining incentives for efficiency. The answer, in our view, is an incentive system where allowed rates of return are scaled with performance on cost, reliability, environmental impact, etc.

That is not what the EU is proposing. Instead, they are in effect punishing the low-cost producers by taking away some of their “windfall” profits while allowing the higher-cost producers to pass along their costs. This is the opposite of an incentive for efficiency.

During a war, it is understandable that a lot of free market principals are compromised so that everyone can get through it together. But very often the policy implications of a political imperative executed during an emergency have long lasting negative effects. (see: Federal Reserve easy money policy)

Our advice to the EU: all of this has been tried before with plenty of evidence of the failures of incremental policy changes to a very complex system. You are rhyming with history.

The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. This information is based upon EIP’s opinion which may change at any time and without notice.