Last year’s blackouts and the California Independent System Operator’s (CAISO), which runs the state’s power grid, recent warnings that the system will hit a “critical inflection point” made us take a closer look at the state’s electric supply and demand situation.

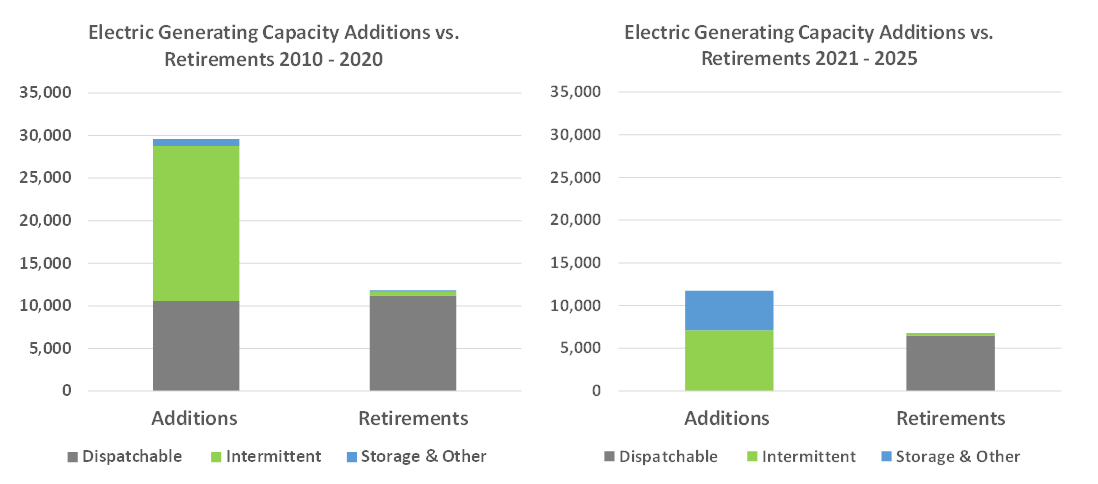

Over the last decade, California has retired and replaced 13% (11 gigawatts) of its dispatchable generation capacity on a one-for-one basis, mainly by adding natural gas-fueled generating capacity but also adding another 18 gigawatts of intermittent (non-dispatchable) wind and solar capacity. (Source: 2020 Form EIA-860, June 3, 2021) Dispatchable generation capacity is defined as capacity that is always available and is primarily fueled by natural gas, coal and nuclear. Despite these net additions, the state’s power markets are tight once again as hot weather pushes demand higher in early summer.

When we took another look at the longer-term plans to add capacity, we discovered that California plans to shut down additional dispatchable natural gas and nuclear capacity accounting for 8% (6.5 gigawatts) of the state’s total capacity over the next 4 to 5 years and replace nearly ALL of this dispatchable capacity with intermittent resources and storage. Even worse, Diablo Canyon, the 2.4 gigawatts nuclear plant set to retire in 2024, is extremely reliable and produces electricity 80% of the time (vs ~25% -30% on average for wind and solar). This one facility alone produces around 9% of the state’s electricity (Source: California Energy Commission: 2019 Total System Electric Generation).

Source: 2020 Form EIA-860, June 3, 2021.

Source: 2020 Form EIA-860, June 3, 2021.

Dispatchable generating capacity is important to the stability of a grid as these units can be quickly ramped up as needed, whereas intermittent sources such as wind and solar only generate electricity when it is windy or sunny. Currently, 58% of California’s generating capacity is dispatchable with 37% intermittent and 5% storage. Factoring in planned retirements, the state’s dispatchable generation falls to 47% of total capacity by 2025. For comparison, approximately 78% of total U.S. electric generating capacity is dispatchable with 20% intermittent and the remaining 2% storage. (Source: 2020 Form EIA-860, June 3, 2021).

California’s growing dependence on variable power sources is compounded by its reliance on electricity imports from other states for nearly a third of its power needs. This is the highest of any state. However, when a heat wave covers the entire western U.S., needed imports are not available. What lies ahead? Again, a look at future plans does not bode well for California as neighboring states’ pursuit of their own clean energy targets makes it less likely they will have power to share with California.

A review of Department of Energy (DOE) data reveals that states outside of California (that are part of the western grid) currently plan to retire dispatchable generation that would represent 35%-40% of the roughly 77 Gigawatt-hours of electricity that California imported in 2019—remember, California imports a third of its power supplies! (Source: 2020 Form EIA-860, June 3, 2021) DOE data also shows that California’s neighbors are following their own aggressive plans to add intermittent renewable capacity and storage in the coming decade—nearly twice the capacity of the planned retirements. These plans will further erode utilization rates of big coal plants as the economics of running these plants—particularly in the afternoon when solar output peaks—will almost surely decline. Indeed, our conversations with a number of western coal plant owners suggests a bias towards earlier coal retirements than has been reported in the DOE data used for our analysis.

We have also recently written about the California Public Utility Commission’s (CPUC) revised 10-year plan which anticipates no decline in gas fired generation in 2030 compared to 2021. But, the planned retirements of additional natural gas generation capacity over the next few years implies that the utilization rate of the remaining plants will have to rise significantly.

Following the extreme heat experienced across the West, around July 1st, CAISO, the California Public Utilities Commission (CPUC) and the California Energy Commission (CEC) issued a joint statement declaring that California will use “all available tools” to increase electricity reliability this summer because of a 1300 MW summer shortfall (2% capacity). Reasons cited:

- Worsening drought conditions – Droughts have reduced available hydroelectric capacity by approximately 1000 MW.

- Declining thermal resources – Unforeseen circumstances have rendered an additional 300 MW of thermal capacity unavailable this summer.

- Incremental resource delays – The resource adequacy program had relied on incremental resources coming online for the summer months. The CPUC recently received notice that several will be delayed by one to several months, and in some cases will push in-service dates past the summer window.

What might some of those “all available tools” look like? Over two decades ago, a hotter-than-expected summer caught some midwestern utilities off-guard, triggering a need for incremental peaking power capacity that could be deployed quickly. The solution was multiple groupings of 2-3 megawatt portable diesel–powered backup generators (diesel is much more carbon intensive than natural gas generated electricity). Because of bad planning, California may find, to its horror, that the hasty closure of natural gas-fired plants may lead it to a more carbon-heavy solution to avoid blackouts.

So, we continue to watch California closely for clues on how an energy transition may unfold. California’s goal is to supply 100% of retail electricity sales with renewable and zero-carbon resources by 2045. As investors in publicly traded utility companies, we favor companies that can achieve these kinds of environmental goals while not sacrificing reliability and safety and containing costs. To achieve these multiple goals takes cooperation with regulators and policy makers to arrive at the right outcomes and resist the temptation to mandate solutions.

The Information provided in this article is believed to be accurate as of the date above. EIP reserves the right to update, modify or change information without notice. Any statements of opinion are EIP’s opinion and should not be relied upon as a prediction of any future event. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. Investors are encouraged to seek their own legal, tax, or other advice before investing. EIP is not responsible for any information provided in third party links.