Energy MLP Income Fund, LP

2Q 2017 Letter to Investors

Performance

The Energy MLP Income Fund, LP (“EMIF”) was down 3.21% (net of fees) this quarter.[1] This compares to the Alerian MLP Total Return Index (“AMZX”) which was down 6.35% and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) which was down 6.12% over the same period.[2]

While the SEC requires us to use a benchmark when reporting our performance, bear in mind that about 42% of our portfolio is not in the broader Alerian MLP Index. That percentage has varied over time and is significantly lower than 12-18 months ago when we began to add significantly to our undervalued MLP positions. The balance of the portfolio is in companies not formed as partnerships involved primarily in transmission, distribution and storage of hydrocarbons, and the transmission and distribution of electric power.

While movements in the equity markets in general, rotations between sectors, interest rate expectations and commodity prices all have the ability to move our portfolio day to day, the yield of the portfolio, combined with capital appreciation – ultimately driven by earnings and dividend growth – drive our long-term returns. The current yield of the portfolio is 5.7% and the growth in dividends over the last year weighted according to the portfolio’s current positions is 4.4%.

[1] Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

[2] Indices do not incur fees and expenses. Indices are unmanaged and an investment cannot be made directly in an index.

MLP Correlation to Oil Prices

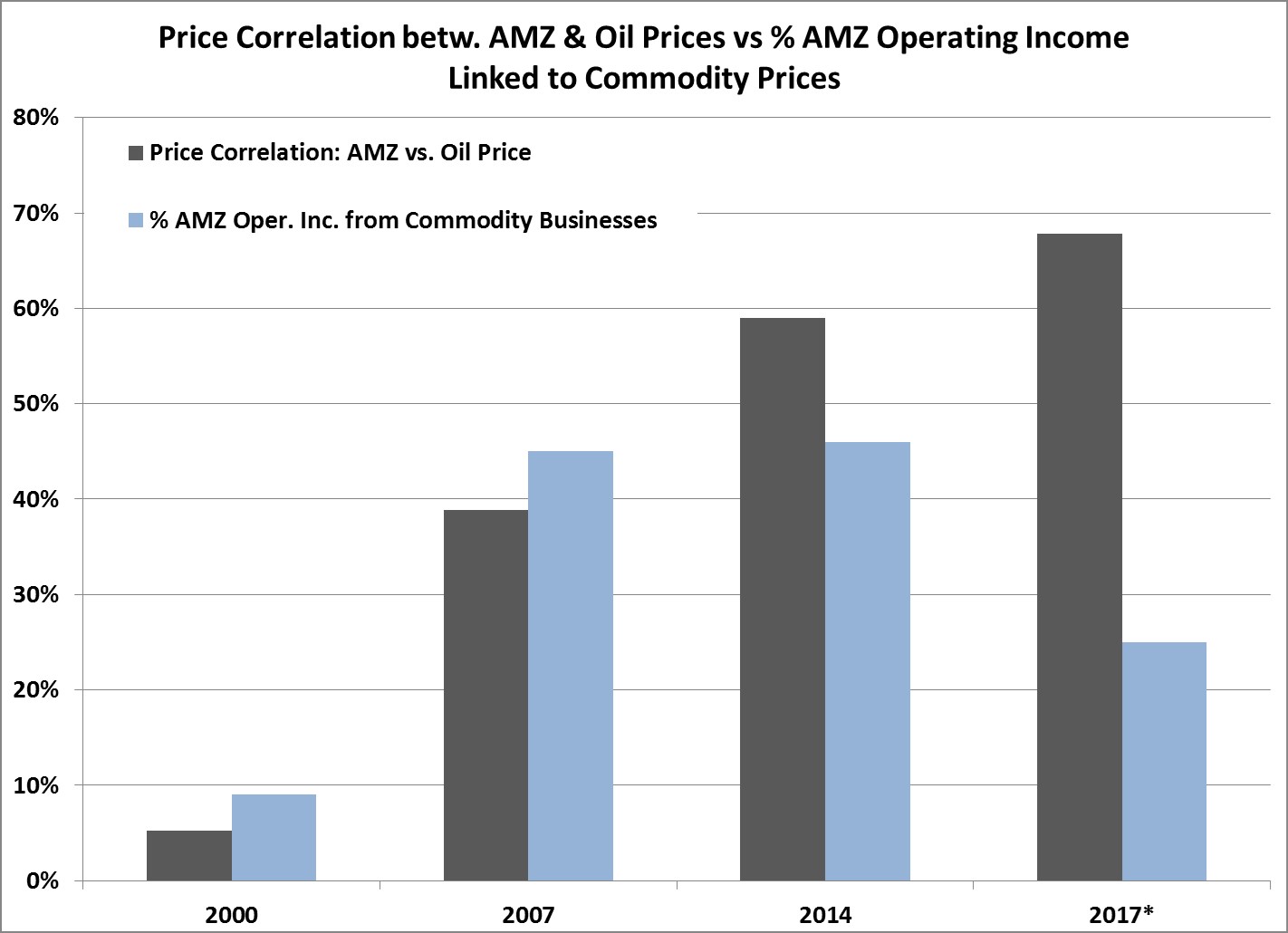

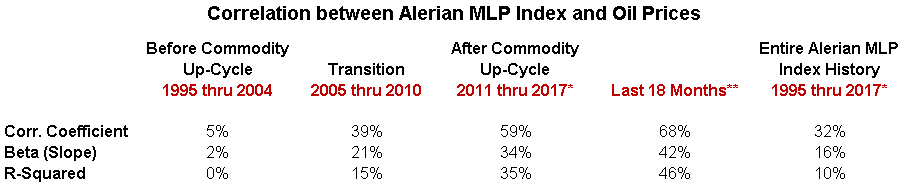

While the long-term correlation between energy-related MLPs and crude oil prices is fairly low – about 30% from 1995-2017, over the last two years it has spiked to about 70%. This increase in the correlation to oil prices has occurred while business exposure to commodity prices has declined dramatically. For the Alerian MLP Index as a whole, we estimate that the portion of operating income derived from commodity-price sensitive and variable margin businesses has declined from a peak of nearly 50% in 2013/14 to about 20-25% today. Said another way, the quality of earnings has improved dramatically. And this quality of earnings improvement has coincided with a decline in valuations of about 30-35% (more on this later).

We are not advocating buying an MLP index strategy but the short-term correlations of the MLPs in our portfolio with oil prices is affected by the short-term correlation of the MLP index (of which they are members) with oil prices. And as usual with the MLP space, in our view, the market is dead wrong – again.

The table in Exhibit 1 shows how the correlation between monthly returns for the Alerian MLP Index with oil prices has evolved.

The Alerian MLP Index data begins in 1995. Prior to that, there were only a handful of energy-related MLPs. The MLPs of the early 1990s were the survivors from the 1980s and their copycats. Remember that MLPs began as the public listing of private oil and gas drilling funds in the early 1980s at the peak of the last commodity price bubble. When that bubble popped in the mid-1980s, so did all the MLPs tied to commodity prices. We don’t have index data for that period, but we do know that every one of the 25 or so commodity-related energy MLPs failed. The survivors were pipeline MLPs. Subsequent to that disaster, the MLPs that came public in the 1990s were mostly pipeline and propane delivery companies. The memory of being burned by MLPs tied to commodity prices in the 1980s made an initial public offering (IPO) of an oil and gas producer or gas processor as an MLP in the 1990s nearly impossible.

Exhibit 1 – Correlation between MLPs and Oil Prices

Source: Alerian, Bloomberg, EIP estimates. *Data through 6/30/17. **Last 18 months is from 1/31/16-6/30/17. Data is NYMEX WTI and monthly total returns for the Alerian MLP Index. Beta measures the slope of the best fit regression line between the Alerian MLP Index and oil prices. The Correlation Coefficient must be between -1 and +1 and so normalizes for differences in volatility of one variable versus the other. Crude oil prices are more volatile than the Alerian MLP Index and so the Beta is less than the Correlation Coefficient. Beta and Correlation Coefficient are equal when the volatility of the two variables (as measured by standard deviation) are equal. R-Squared indicates the probability that the correlation will hold in any given observation which in this case is monthly. The higher the R-Squared the more predictive the correlation is.

Source: Alerian, Bloomberg, EIP estimates. *Data through 6/30/17. **Last 18 months is from 1/31/16-6/30/17. Data is NYMEX WTI and monthly total returns for the Alerian MLP Index. Beta measures the slope of the best fit regression line between the Alerian MLP Index and oil prices. The Correlation Coefficient must be between -1 and +1 and so normalizes for differences in volatility of one variable versus the other. Crude oil prices are more volatile than the Alerian MLP Index and so the Beta is less than the Correlation Coefficient. Beta and Correlation Coefficient are equal when the volatility of the two variables (as measured by standard deviation) are equal. R-Squared indicates the probability that the correlation will hold in any given observation which in this case is monthly. The higher the R-Squared the more predictive the correlation is.

So when we observe the correlations to oil prices between 1995 and 2004 before the most recent commodity price bubble began, the correlations are nearly zero (as shown in the first column of Exhibit 1).

But as the world economy recovered after the 2000-2002 economic slowdown, demand for commodities in India and China triggered the next commodity boom. From 2005 through 2014, about three-quarters of the MLP IPOs were of companies directly tied to commodity prices or variable margin businesses (Source: Bloomberg, Alerian and EIP estimates). As these companies became a larger percentage of the index between 2005 and 2010, the portion of Index operating income tied to commodities rose, and so, too, did the correlation between the price of MLPs and the price of oil.

Existing MLPs also added to their commodity exposure and between 2011 and today, the correlation to oil prices rose further (as shown in the third column of Exhibit 1).

The collapse in oil prices back below the cost of production in 2014 and 2015 and the bounce in 2016 drove the correlation between MLPs and oil prices even higher, as investors learned the hard way how much of their investment in MLP funds was tied to commodity prices. The drumbeat of “MLPs are non-cyclical infrastructure” from the MLP cheerleading squad of investment bankers, sell-side analysts and MLP fund managers, sucked in a lot of investors who decided not to get fooled twice.

For most of the history of the Alerian MLP Index, the correlation between energy MLPs thus followed the fundamentals. As operating income became more dependent on commodity prices, the correlation between commodity prices rose. However, during the last 18 months, the two trends have diverged significantly, creating a rare opportunity to acquire companies that have a significantly higher quality of earnings at a much lower valuation than 3-4 years ago.

Recent Changes in Earnings Composition

While the commodity price boom brought with it a decline in the quality of the earnings of all the major MLP indices, the commodity bust has coincided with a dramatic improvement in the earnings composition of the Index. For example, at their peak weighting by market cap in 2012, companies that produce oil and gas made up about 9% of the Alerian MLP Index. That percent now is exactly zero. In 2014, gas-processing MLPs made up 24% of the market cap of the Index. Today, it’s 18% but approximately 5 of the 18 percentage points are entirely fee-based earnings and not exposed to commodities. The reason for this is that the portion of processing MLPs’ operating income derived from the fee-based areas of Ohio and Pennsylvania has risen. Source: Alerian, Corporate Reports and EIP calculations.

But exposure to gas processing and other variable margin businesses within companies that are categorized as “pipeline transportation,” has also declined dramatically. For example, in 2011, one of the top-5 MLPs (in terms of its size in the Alerian MLP Index) derived about $1.2 billion of its $3.5 billion in operating income from commodity price-related variable margin businesses. In 2017, this company expects about $7 billion of operating income but only about $150-200 million, or about 3%, will come from those variable margin businesses. Contract restructuring toward fee-based pricing, asset sales and declines in earnings associated with commodity prices, have all contributed to reducing commodity-related earnings’ share of total earnings. This type of transformation, albeit in varying degrees, has happened to a number of larger MLPs, some of which we have in the portfolio.

For the Alerian MLP Index as a whole, the removal of commodity exposed companies from the Index due to their dividend cuts and price declines, combined with mix changes in the business segments of the companies still in the Index, has resulted in a significant reduction in commodity exposure. By our estimates, that commodity exposure peaked at nearly 50% in 2013/14 and has now fallen to about 20-25%. This, just as the correlations between oil prices are at all-time highs.

Combine the changes in the portion of operating income linked to commodity prices and variable margin businesses and the price correlation between the Alerian MLP Index and oil prices, and we have the bar chart shown in Exhibit 2.

Exhibit 2 – Price Correlation of MLPs vs % of Operating Income linked to Commodity Prices.

*Data through 6/30/2017

Source: FactSet, Alerian, SEC Filings, and EIP Estimates

While the exposure to commodity businesses looks roughly the same in 2007 and 2014, this is the result of two large changes that offset each other. Between 2007 and 2014 crude oil prices declined 19% and the price of natural gas and its associated gas liquids (far more important to MLPs than crude oil) declined about 50%. These price declines were offset by a 54% increase in the portion of the Alerian MLP Index in commodity-related MLPs.

The post-2014 decline in commodity prices, the removal of commodity-related MLPs from the Alerian MLP Index and business mix changes to the MLPs categorized as “Pipeline Transportation” have resulted in an enormous decline in commodity exposure of the underlying businesses to about 25%. The response of the stock market to this change has been an increase (to an all-time high) in the price correlation between oil prices and the Alerian MLP Index.

To those who still believe in the Efficient Market Hypothesis, I say this: You are worshipping a false god. Cast away your golden calf and come into the light!

Valuation

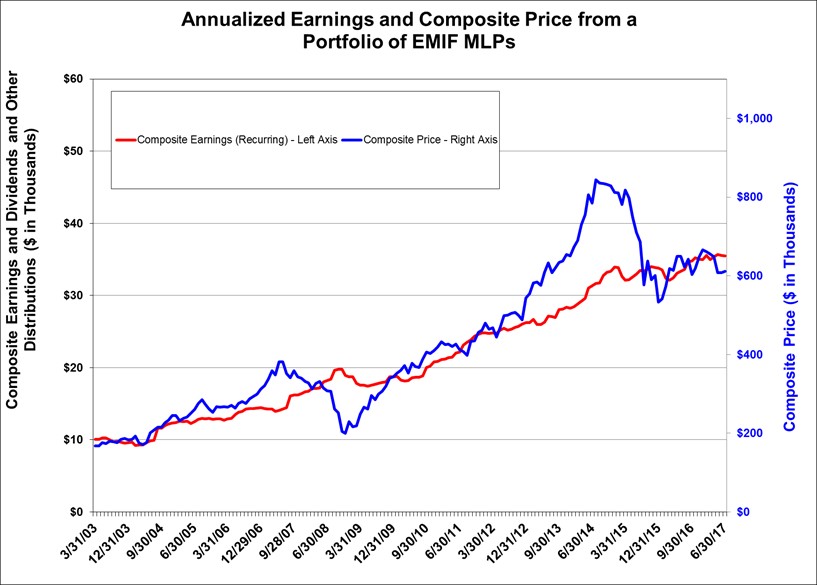

The graph in Exhibit 3 shows a simple time series of the composite earnings (red line) and composite price (blue line) of the MLPs currently in the EMIF portfolio, thusly weighted as of June 30, 2017.

Exhibit 3 – Annualized Composite Earnings and Composite Price of MLPs Currently in the EMIF Portfolio

Source: EIP Calculations based upon Factset data for MLPs held by EMIF as of June 30, 2017. To the extent that the company did not exist during the time period, the weighting for that particular company is 0. This chart is provided for informational purposes only and should not be construed as an offer to sell, or a solicitation of an offer to buy, any investment and/or investment-related services. The performance information provided in this exhibit represents the MLPs currently held by the EMIF portfolio. Actual EMIF holdings during the historical periods covered by the chart above deviated significantly from the model portfolio noted above, both in terms of the names held in accounts and the respective weightings of those names as percentages of assets under management. This EMIF MLP model performance was created with the benefit of hindsight and does not represent the actual performance of clients, which may be materially less favorable during portions and/or the entirety of the period noted above. The return data noted above does not reflect the deduction of fees and expenses that would have been paid if the EMIF model portfolio was held in actual client accounts, including, but not necessarily limited to, advisory fees, brokerage expenses, and custody charges. Earnings, dividends and other distributions are annualized. Past performance of the individual securities in the model or the model performance noted above should not be construed as any guarantee of future results.

Source: EIP Calculations based upon Factset data for MLPs held by EMIF as of June 30, 2017. To the extent that the company did not exist during the time period, the weighting for that particular company is 0. This chart is provided for informational purposes only and should not be construed as an offer to sell, or a solicitation of an offer to buy, any investment and/or investment-related services. The performance information provided in this exhibit represents the MLPs currently held by the EMIF portfolio. Actual EMIF holdings during the historical periods covered by the chart above deviated significantly from the model portfolio noted above, both in terms of the names held in accounts and the respective weightings of those names as percentages of assets under management. This EMIF MLP model performance was created with the benefit of hindsight and does not represent the actual performance of clients, which may be materially less favorable during portions and/or the entirety of the period noted above. The return data noted above does not reflect the deduction of fees and expenses that would have been paid if the EMIF model portfolio was held in actual client accounts, including, but not necessarily limited to, advisory fees, brokerage expenses, and custody charges. Earnings, dividends and other distributions are annualized. Past performance of the individual securities in the model or the model performance noted above should not be construed as any guarantee of future results.

As you can see, this group of companies was much more expensive back in 2014. Of course, in 2014, our portfolio was dramatically different in a couple of ways. The first is that we had lowered our exposure to MLPs to about 50% of the portfolio while now they represent closer to 60-65%. The second is that the weightings within the MLP portion of the portfolio are dramatically different than they were back then. In fact, we now hold a few very high-growth MLPs at significant weightings that were absent from the portfolio in 2014, because they were just too expensive.

Nonetheless, it is clear the valuation has come down. In the case of the current portfolio, the valuation on expected earnings is down about 34% from 2014, and is cheaper now than at any time in the last 15 years except during the financial crisis.

What is also evident from the graph in Exhibit 3 is that earnings for these companies, on average, continue to rise. While we have sustained a few dividend cuts, we anticipated their likelihood and felt that the expected internal rates of return (IRRs) were still attractive. As in the past, the performance of the portfolio will be driven by the portfolio yield and capital appreciation, which itself, is driven by growth in earnings and dividends.

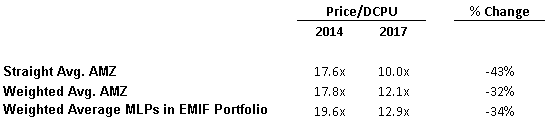

Another way to look at valuation is versus free cash flow rather than earnings. Here, we use a table because we do not get continuous monthly data on that metric the way we get earnings. The table in Exhibit 4 shows the valuation on expected free cash flow available for distribution for 2014 and today. Again, the decline is significant, especially in light of the improvement in the quality of earnings that transpired over the last 3 years.

Exhibit 4 – Valuation on Distributable Cash Flow

Source: Bloomberg, Factset, Alerian and EIP estimates. DCPU: distributable cash available per unit shares issued. 2014 and 2017 averages for the Alerian MLP Index (AMZ) are based on the members and weightings in their respective years. Weighted Average EMIF MLPs refers to the MLPs in the EMIF Portfolio and weighted according to the portfolio held as of June 30, 2017. To the extent that the member was not in existence in 2014, then the weighting is “0”. DCPU for the EMIF Portfolio as a whole may be substantially different than shown above.

Differentiation

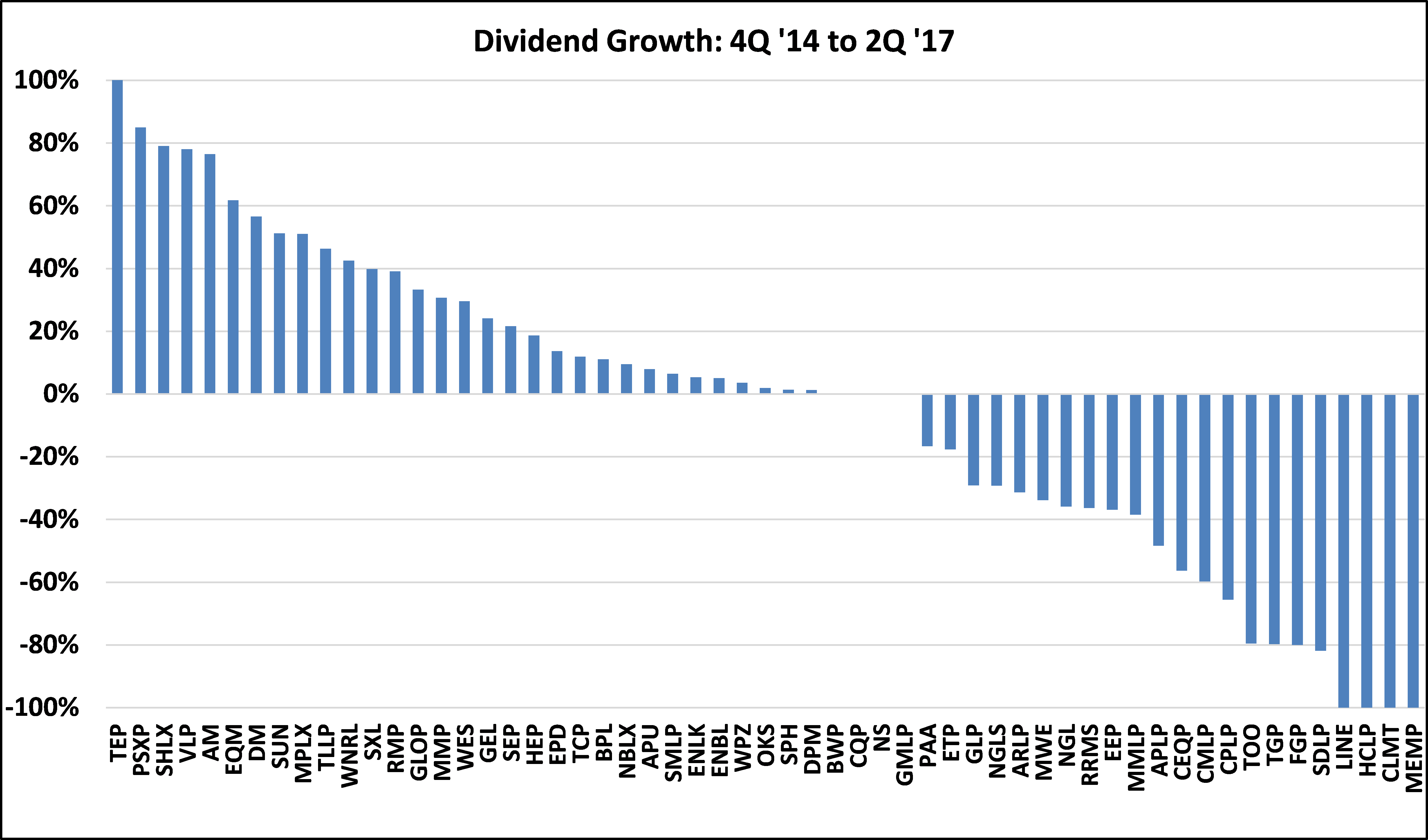

While this discussion has focused on the improvements to earnings quality and declines in valuation for MLPs as a whole or the MLPs in our portfolio as a whole, it’s important to not gloss over the drastic differences between companies formed as MLPs. The graph in Exhibit 5 is a reminder of how divergent the outcomes are between these companies. This is the change in dividends over the last 2 ½ years for every MLP that has been in the Alerian MLP Index since the fourth quarter of 2014.

Exhibit 5 – Changes to Dividends for MLPs 4Q 2014 through 2Q 2017

Source: Factset, Alerian, & EIP Estimates. The MLPs shown are all the MLPs in the Alerian MLP Index from 4Q 2014 to 2Q 2017. Seven MLPs were acquired or have been delisted from the Alerian MLP Index from 4Q 2014 through 2Q 2017. The MLPs named in this graph may or may not be in any EIP managed portfolio. There is no assurance that these companies will be able to sustain this dividend level in the future.

Conclusions

The horrible dividend and earnings performance of about half the MLPs in the Alerian MLP Index explain why this group of companies has been orphaned. It is also a reminder of the limited usefulness of discussing MLPs as some kind of industry sector that is homogeneous in its makeup. The market has moved on to the growth offered by tech stocks, and cannot be bothered to learn about how some MLPs are great, while most are disasters, in our opinion. This is why there has been a significant drop in valuation in spite of a dramatic improvement in earnings quality.

The resulting improvement in the expected risk-adjusted IRRs of the MLP portion of our portfolio over the last three years is why we have increased our weightings in these companies, and in some cases, added new companies. This is not to advocate buying an MLP Index strategy as it still includes too many MLPs with poor business models, over-leveraged balance sheets, exposure to businesses we do not want to own and above all else, management teams we think, to put it politely, are not good enough. There are over 100 energy-related MLPs in total and about 40 in the Alerian MLP Index. Eighty percent of our portfolio’s MLP exposure is in 10 companies… Ten.

Best regards,

James J Murchie

Past performance is not indicative of future results. Performance information provided for the Energy MLP Income Fund (EMIF or the “Fund”) assumes the reinvestment of interest, dividends and other earnings and is net of fees. There is no assurance that the Fund’s investment objective will be achieved.

The EMIF portfolio information regarding dividends and portfolio company prices is provided as an example of EIP’s investment philosophy and strategy and not an offer or sale of any security. Information in this letter regarding specific MLP instruments and other companies, including any information pertaining to the performance of such instruments and other companies, is provided solely as a tool for general industry analysis. Under no circumstances should it be assumed that the Fund or any other account managed by Energy Income Partners, LLC derived any benefit from the performance of any MLP or company referenced herein. Information provided is believed to be accurate as of the date on the materials. EIP reserves the right to update, modify or change information without notice. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. This Document is not an offer or solicitation with respect to the purchase or sale of any security. This Document is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person under any circumstances. This Document is not intended to constitute legal, tax, or accounting advice or investment recommendations of any particular security or industry. Investors are encouraged to conduct their own analysis before investing.

CIRCULAR 230 NOTICE. THE FOLLOWING NOTICE IS BASED ON U.S.TREASURY REGULATIONS GOVERNING PRACTICE BEFORE THE U.S. INTERNAL REVENUE SERVICE: (1) ANY U.S. FEDERAL TAX ADVICE CONTAINED HEREIN, INCLUDING ANY OPINION OF COUNSEL REFERRED TO HEREIN, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES THAT MAY BE IMPOSED ON THE TAXPAYER; (2) ANY SUCH ADVICE IS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS DESCRIBED HEREIN (OR IN ANY SUCH OPINION OF COUNSEL); AND (3) EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

These materials do not constitute an offer of securities. Such an offer will only be made by means of the Confidential Memorandum to be furnished to prospective investors at a later date. This document is confidential and is intended solely for the information of the person to whom it has been delivered. It is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior written consent of the Fund. Notwithstanding anything to the contrary herein or in the Confidential Memorandum, the recipient (and each employee, representative or other agent of such recipient) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of (i) the Fund and (ii) any transactions described herein, and all materials of any kind (including opinions or other tax analyses) that are provided to the recipient relating to such tax treatment and tax structure.

A description of the Alerian MLP Total Return Index may be found at http://www.alerian.com/indices/amz-index/. The index performance is provided for information purposes only. The Wells Fargo Midstream MLP Total Return Index consists of 53 energy MLPs and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology. The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incur fees or expenses and an investment cannot be made directly in an Index.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, EIP is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA and the Internal Revenue Code. EIP has no knowledge of and has not been provided any information regarding any investor. Financial Advisors must determine whether particular investments are appropriate for their clients. EIP believes the financial advisor is a fiduciary, is capable of evaluating investment risks independently and is responsible for exercising independent judgment with respect to its retirement plan clients.