Energy MLP Income Fund, LP

3Q 2016 Letter to Investors

Performance

The Energy MLP Income Fund, LP (“EMIF”) was up 3.25% (net of fees) this quarter.* This compares to the Alerian MLP Total Return Index (“AMZX”) which was up 1.07% and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) which was up 1.76% over the same period.

This quarter’s letter discusses valuation, as this subject seems to dominate the incoming questions we are receiving, especially as it relates to utilities because of numerous articles in the press commenting on the strong performance of utilities and the resulting increase in their valuations.

* Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

Valuation in Context

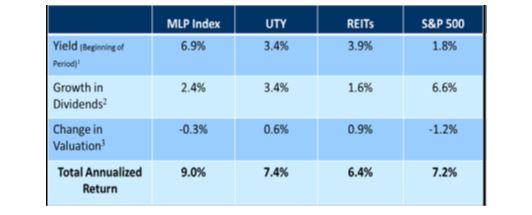

Before we discuss valuation per se, we want to frame it, once again, in the context of total return. Exhibit 1 shows a breakdown of total annualized return for the last 10 years into its three main components for four relevant indices: The Alerian MLP Index, the Philadelphia Utility Index, the NAREIT REIT Index and the S&P 500 Index.

Exhibit 1: 10-Year Total Return = Yield + Growth +/- Change in Valuation

September 30, 2006 through September 30, 2016

Source: Bloomberg.

1 Yield data for indices published by Alerian Capital Management (MLP Index), Bloomberg, Philadelphia Utility Index (UTY), and NAREIT, Equity REITs (REITs).

2 Dividend Growth for each index is calculated from published yield data by imputing a dividend for the index and calculating the compound annual growth rate (CAGR) for the time period presented.

3 Change in Valuation is calculated based on the change in yield over each time period. It also includes other expenses and rebalancing.Table is for illustrative purposes only and is not intended to represent the experience of any investor in an EIP managed account. Past performance is no guarantee of future results.

Total return for all securities is made up of the yield paid to the owner, plus or minus any change in the security price from the time it is purchased to the time it is sold. Over time, it is observable that stock prices tend to follow per share measures of value and income such as earnings per share, dividends per share, book value per share, etc. But they do not move in lockstep. So another way to think about price appreciation is to split it into two components: 1) that which is attributable to growth in per-share measures of value (earnings, dividends, book value, etc.) and 2) that which is attributable to any changes in the valuation (price-to-earnings ratio, price-to-dividend ratio, price-to-book ratio, etc.) that the market assigns to that measure of value. We like looking at dividends because they are the only thing a company ever gives to its equity holders. The table in Exhibit 1 deconstructs the total return for each of these four major indices into the initial dividend yield plus the growth in per share dividends, plus/minus the change in valuation (price-to-dividend ratio).

For long periods of time, such as 10 years or more, the change in valuation component tends to be small. And the longer the time horizon, the smaller the per-year amount tends to be. Think about a massive change in valuation of +50%, that if spread out over 20 years amounts to only a 2% change on an annual basis due to the effect of compounding. In general, much of our analysis is focused on the sustainability of the dividend and finding growth in earnings, because the vast majority of the time, the expected change in valuation is small.

Nevertheless, we do input change in valuation as a factor to total return because sometimes it is significant. In some cases, we have held positions in the portfolio where we expect to get a negative contribution from valuation, but because the overall total return (yield + growth – valuation) is still attractive and compares favorably to other opportunities. A decline in valuation is not the same as a decline in the price of a stock – this is a common misunderstanding.

If a company is experiencing a 10% rise in annual per-share earnings, dividends, book value, etc., but the stock price is rising only 5% per year, that means the valuation on these measures is falling 5% per year. A company involved in regulatory asset-based (“RAB”) businesses primarily (see last quarter’s letter for a more complete discussion of RAB businesses), with highly stable and predictable earnings that are growing 12% per year and paying a 3% yield, but which experiences a 5% per year drop in valuation, is often still attractive to us. That is because it is providing better-than-average total return ( 3% yield + 12% growth – 5% drop in valuation = 10%) with less economic and execution uncertainty than the equity markets as a whole (which currently offer a 2% yield and the prospect of growth of about 6%) (Source: Bloomberg, EIP estimates as of 9/30/16).

In our view, this is analogous to someone paying above $100 par value for a bond. If you pay $120 for a bond with a $6 coupon, you will receive a 5% yield, but you will realize a drop in valuation when the bond comes due because you receive only the $100 par value. When prevailing interest rates are near 0%, you can see why investors accept such a drop in valuation if they think the credit risk is worth taking. And just as in the equity example, the longer the duration of the bond, the less that $20 drop in value amounts to on a per-year basis. In this example, if there were 10 years remaining until maturity, the IRR (or “yield-to-maturity” in bond-speak) would be about 4.1%.

For an actively managed portfolio, there is a fourth component of return that comes from changes made to the portfolio. A disciplined portfolio strategy that takes a long-term view can add significantly to returns, by adding to positions when they under-perform their fundamentals and trimming them when they out-perform their fundamentals. I mention this fourth component because it adds context to the contribution to total return derived from changes in valuation for the portfolio as a whole.

Utility and MLP Valuation

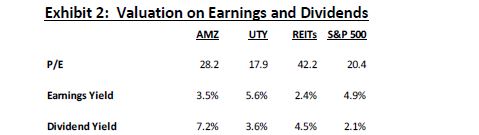

So now let’s talk about valuation of MLPs and Utilities. Bear in mind, we are not advocating owning the Philadelphia Utility Index (UTY) or the Alerian MLP Index (AMZ) – far from it, as we view about half the companies in either index as unattractive due to their exposure to cyclical businesses like merchant power generation (UTY) or gathering and processing (AMZ) or other fundamental factors. Also bear in mind that about one-third of the portfolio is invested in companies that are in neither index and that at least half of the companies in either of these indices is not in the portfolio. Therefore, the valuation of these two Indices is not indicative of the portfolio. Instead, we wanted to analyze what everyone is talking about by looking at the broad Indices to present some context. If you look at the P/E ratio for the same four groups, you will notice that the utilities have the lowest P/E. Yet everyone keeps complaining about how expensive they are.

Exhibit 2: Valuation on Earnings and Dividends

Source: Bloomberg. Data as of 9/30/16.

Bloomberg. AMZ: Alerian MLP Index, UTY: Philadelphia Utility Index; REITs: Bloomberg REITs Index.

Investor dislike for the roughly 18x multiple for utilities is not absolute; it is in the context of lower growth than the S&P 500 Index. True, but with a higher yield, nearly half of the historic growth differential (3.4% vs. 6.6% from Exhibit 1) is offset. Now, if investors hate the historic 3.4% growth rate for the UTY companies, they must really hate the 2.4% growth for the AMZ MLPs and the 1.6% growth for REITs. But if you read the newspapers, you would think that utility valuations are at unsustainably high levels and MLPs are extremely attractive.

Besides growth, another critical factor is quality of dividends. As I mentioned before, while dividends are the only thing a company ever gives you, for these payments to be sustainable (in an economic sense, not an ecological sense), they must first be Earned. I italicize, capitalize and underscore the word “earned” because I mean it (again) in the economic sense, not necessarily the accounting sense. We are not as dismissive of Generally Accepted Accounting Principles as are most people on Wall Street — to the contrary (some of my best friends are Certified Public Accountants), we recognize that GAAP earnings are a consistent method to measure true economic recurring earnings. Measures of free cash flow are equally, if not more important; it’s just that there is no established set of rules that determine how that is measured.

Now look at the second two rows in Exhibit 2. One measure of the quality and sustainability of dividends is to look at the earnings yield versus the dividend yield. When the earnings yield is higher than the dividend yield, it means a company is earning above what it is paying out in dividends. Notice how the earnings yield of the MLPs that make up the Alerian MLP Index (again note: majority of index we do not own) is about one-half the level of the dividend yield. Said another way, the companies that make up this index, weighted by the index weightings, are paying out two-times their earnings. This should be a red flag for investors who own portfolios linked to this Index, in our opinion.

Now I might point out, in their defense, there are companies, especially companies with very long economic asset lives, whose free cash flow well exceeds their reported or recurring GAAP earnings. This is because GAAP earnings will include a depreciation charge for the pipelines reflecting a 25-40 year life, when the economic life is more like 100 years. Said another way, the cost of maintaining these pipelines is closer to 1% of their construction cost rather than the 2.5% implied in a 40-year depreciation schedule (one divided by 40 = 2.5%). This is why “distributable cash flow per unit” or DCFPU is the most prevalent metric in the MLP world. It is very similar to Adjusted Funds from Operations (AFFO) in the REIT world. Nevertheless, we prefer that the portfolio companies earn their dividend and the ratio of DCFPU to EPS for the MLPs in the portfolio tends to be about 1.3x to 1.4x over time versus 2.0x for the Alerian MLP Index currently. This means that this ratio is even higher than 2.0x for the MLPs we do not own. In fact, in some cases it’s as high as five times.

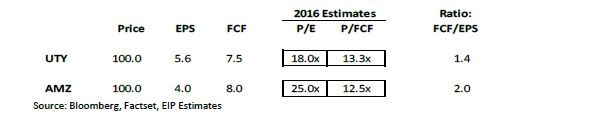

With this in mind, let’s look at these two measures for the MLP and utility indexes:

Exhibit 3: Pro forma Analysis of Free Cash Flow vs EPS for the UTY and the AMZ

FCF- Free Cash Flow, DCFPU- Distributable Cash Flow Per UnitSource: Bloomberg, Factset, EIP Estimates

Ratio of FCF to EPS for AMZ is based on weighted average of Bloomberg Consensus estimates for DCFPU and EPS for 2016 weighted by AMZ Index weighting.

1.4x ratio of FCF to EPS for UTY is based on EIP estimates as there are no consensus estimates for FCF for the utilities.

The information above is based on assumptions and/or derived from publicly available information as of September 15, 2016. The above information may change at any time and without notice. Indices are unmanaged and an investment cannot be directly made into an index. Past performance is no indication of future performance.

All the numbers in Exhibit 3 are based on consensus estimates of the Wall Street analysts who follow these companies. The only estimate that is ours is the ratio of free cash flow vs. earnings for the utilities (1.4x), because the utility analysts do not provide estimates of this measure that is consistently reported. Our 1.4x estimate matches the ratio we observe in our similarly-situated MLPs.

As you can see, utility valuations on free cash flow are only slightly higher than the MLPs. This rough parity stands in stark contrast to what you read in the press. Again, I would stress that we have no interest in owning either index as the bulk of each index includes low-quality companies we would not own at any valuation. Instead, the purpose of the exercise is to cut through the misinformation that is out there on this subject.

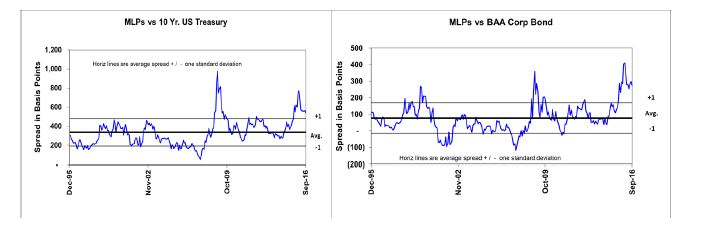

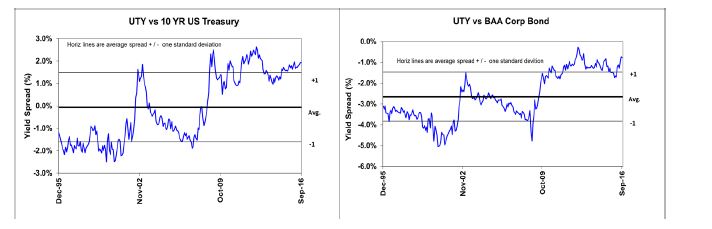

The other objection to comparing utility versus MLP valuations on earnings, is that MLPs trade on yield and utilities trade on earnings. Don’t you love it when advocates for a group choose to turn a blind eye to metrics that do not fit with their narrative? I understand how this happens in politics, but in investing it is just self- destructive. So let’s look at the valuations on yield for the MLPs and the utilities versus bonds. Exhibits 4 and 5 show a 20-year history of these yield differentials.

Exhibit 4: Yield Differential: MLPs vs Bonds through September 2016

Source: Alerian Capital Management and Bloomberg

MLP: Alerian MLP Total Return Index (AMZX); BAA Corp Bond: Moody’s Bond Indices Corporate BAA

The chart is for illustrative purposes only and is not intended to represent the experience of any investor in an EIP managed account. Past performance is no guarantee of future results.

Exhibit 5: Yield Differential: UTY vs Bonds through September 2016

Source: Bloomberg.

UTY: Philadelphia Utility Index; BAA Corp Bond: Moody’s Bond Indices Corporate BAA

This chart is for illustrative purposes only and is not intended to represent the experience of any investor in an EIP managed account. Past performance is no guarantee of future results.

While not at their highs, the MLP yield spreads are still wide, indicating – at least based on history – better than attractive valuation. And in fact, we have added significantly to the portfolio’s MLP weightings (one company at a time) because of this. But consider two things. The first is that bond yields are unsustainably low in our view (not a contrarian view). Second, for people investing in the AMZ, the market’s view of dividend growth and consistency has – rightfully in our opinion – declined dramatically since the correction in oil and gas prices. For much of the 20-year history of this graph, investors could still believe that MLPs were “essentially non-cyclical energy infrastructure”. But the deterioration in the quality of MLPs since 2005 (from which point about three- quarters of the MLP IPOs were cyclical businesses) was revealed when oil and gas prices corrected in 2014-2015.

Exhibit 5 shows the same yield spreads for the utilities making up the Philadelphia Utility Index. For utilities, this measure of valuation shows them at the cheap-end of their 20-year range. How can it be that the utilities are expensive on earnings and cheap on yield? The dichotomy is that we are comparing yields to fixed-income and P/Es to the S&P 500. It is true that the P/E on utilities has increased, but so too have all valuations since the 2008/2009 trough in the market. But for the utility space there is another factor at work, and to understand that we need to look not at interest rates (which affect all securities) but at the stability and growth rates of the earnings within the utility space. As more and more utilities have abandoned their variable margin businesses (such as energy trading and marketing and merchant power generation), the earnings quality of the UTY is actually improving, while in the AMZ, earnings quality has been deteriorating with the proliferation of cyclical MLPs.

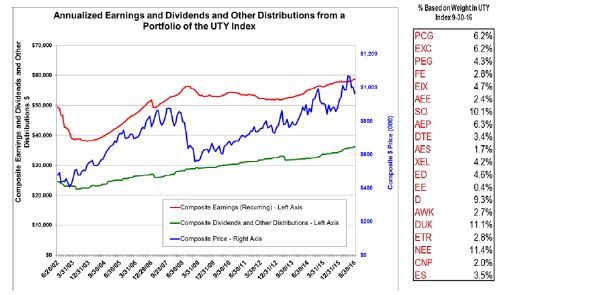

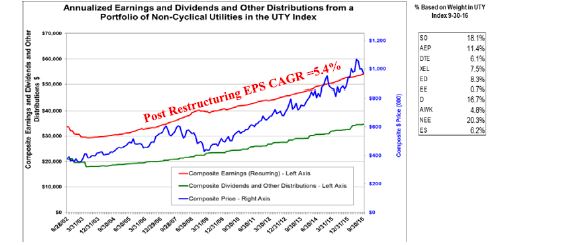

Faithful readers of our work will recognize the next three graphs that trace out the earnings, dividends and price for a group of companies. This time we are looking at the 20 companies in the Philadelphia Utility Index. The first is the entire index, the second are the 10 diversified utilities that have a significant portion of their assets still involved in variable margin businesses – primarily merchant power generation. The third graph is of the 10 utilities that either never had or were early to exit businesses with variable, cyclical earnings.

Exhibit 6: Long-Term Performance of UTY Index

Source: EIP calculations based upon Factset data for the 20 UTY members in the Philadelphia Utility Index (UTY). Portfolio based on $1 million at market capitalization as of September 30, 2016. Earnings and dividends and other distributions are annualized. Past performance is no guarantee of future results. Not intended to represent the experience of any investor in any EIP managed account.

Exhibit 7: Long-Term Performance of Cyclical UTY Members

Source: EIP calculations based upon Factset data for the Cyclical UTY members in the Philadelphia Utility Index (UTY) as determined by EIP. Portfolio based on $1 million at market capitalization as of September 30, 2016. Earnings and dividends and other distributions are annualized. Past performance is no guarantee of future results. Not intended to represent the experience of any investor in any EIP managed account. Weightings based on ratio of each company’s weighting in the index to the total for this subgroup.

Exhibit 8: Long-Term Performance of Non-Cyclical UTY Members

Source: EIP calculations based upon Factset data for the non-Cyclical UTY members in the Philadelphia Utility Index (UTY) as determined by EIP . Portfolio based on $1 million at market capitalization as of September 30, 2016. Earnings and dividends and other distributions are annualized. Past performance is no guarantee of future results. Not intended to represent the experience of any investor in any EIP managed account. Post Restructuring EPS CAGR encompasses period following exit from unregulated operations between 9/06 and 9/16. Weightings based on ratio of each company’s weighting in the index to the total for this subgroup. Past performance is no indication of future performance.

The first observation is that the UTY graph in Exhibit 6 looks like a composite of the other two graphs as this Index is split roughly evenly between the two groups in Exhibit 7 and Exhibit 8. Notice that the earnings pattern in Exhibit 8 shows the non-cyclical utilities exhibit a steady history of growth, despite some declines and cyclicality in the first few years of the graph, as some of these companies still had variable margin businesses left over from the 1990s. As time passed, more and more diversified utilities have become purely regulated utilities made up of poles and wires and regulated (i.e. non-merchant and therefore non-cyclical) power generation. Over the last 10 years or so, this group of companies has grown its earnings about 5% to 6% annually. For the utilities in the portfolio, the growth is closer to 7% on average, higher than all four Indices we compare in Exhibit 1—including the S&P 500.

So when you read about utility valuations or growth rates in the press or from Wall Street pundits, keep in mind the writer probably has no ability to parse the universe into its two main groups like we did above, much less a company-by-company analysis. People who index their money may find these observations about “MLPs” or “utilities” useful. We find them extremely misinformed and therefore misleading.

Wrapping Up

So, when valuation is viewed in the context of the rest of the capital markets, earnings stability and growth, the dividend payout ratio and current yields, the observation that “utilities are expensive” is not really helpful. What is helpful is understanding the underlying businesses of each company so that a decent assessment can be made about expected returns made up of yield, growth and changes in valuation. When those expected returns change, so too, do our portfolio weightings. This is why MLPs had a falling share of the portfolio between 2011 and 2014 and utilities had a rising share. Those trends began reversing in late 2015 due to the large changes in valuation and expected return. Going forward, we will continue to stick with great companies that offer attractive yields and growth, and we will continue to adjust their position sizes as their expected returns change. Usually, these changes are in reaction to changes in valuation not in anticipation of such changes. As Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

Best Regards,

James J Murchie

Past performance is not indicative of future results. Performance information provided for the Energy MLP Income Fund (EMIF or the “Fund”) assumes the reinvestment of interest, dividends and other earnings and is net of fees. There is no assurance that the Fund’s investment objective will be achieved.

The EMIF portfolio information regarding dividends and portfolio company prices is provided as an example of EIP’s investment philosophy and strategy and not an offer or sale of any security. Information in this letter regarding specific MLP instruments and other companies, including any information pertaining to the performance of such instruments and other companies, is provided solely as a tool for general industry analysis. Under no circumstances should it be assumed that the Fund or any other account managed by Energy Income Partners, LLC derived any benefit from the performance of any MLP or company referenced herein. Information provided is believed to be accurate as of the date on the materials. EIP reserves the right to update, modify or change information without notice. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. This Document is not an offer or solicitation with respect to the purchase or sale of any security. This Document is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person under any circumstances. This Document is not intended to constitute legal, tax, or accounting advice or investment recommendations of any particular security or industry. Investors are encouraged to conduct their own analysis before investing.

CIRCULAR 230 NOTICE. THE FOLLOWING NOTICE IS BASED ON U.S.TREASURY REGULATIONS GOVERNING PRACTICE BEFORE THE U.S. INTERNAL REVENUE SERVICE: (1) ANY U.S. FEDERAL TAX ADVICE CONTAINED HEREIN, INCLUDING ANY OPINION OF COUNSEL

REFERRED TO HEREIN, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES THAT MAY BE IMPOSED ON THE TAXPAYER; (2) ANY SUCH ADVICE IS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS DESCRIBED HEREIN (OR IN ANY SUCH OPINION OF COUNSEL); AND (3) EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

These materials do not constitute an offer of securities. Such an offer will only be made by means of the Confidential Memorandum to be furnished to prospective investors at a later date. This document is confidential and is intended solely for the information of the person to whom it has been delivered. It is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior written consent of the Fund. Notwithstanding anything to the contrary herein or in the Confidential Memorandum, the recipient (and each employee, representative or other agent of such recipient) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of (i) the Fund and (ii) any transactions described herein, and all materials of any kind (including opinions or other tax analyses) that are provided to the recipient relating to such tax treatment and tax structure.

A description of the Alerian MLP Total Return Index may be found at http://www.alerian.com/indices/amz-index/. The index performance is provided for information purposes only.

The Wells Fargo Midstream MLP Total Return Index consists of 35 energy MLPs and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology.

Philadelphia Utility Index (UTY): Market capitalization weighted index composed of geographically diverse public utility stocks.

NAREIT Equity REIT Index: An index of all publicly-traded, tax-qualified real estate investment trusts that are Equity REITs as determined and compiled by the National Association of Real Estate Investment Trusts. (NAREIT).

Bloomberg NA REITs Index – Bloomberg NA REITs (BBREIT) Index is a capitalization-weighted index of Real Estate Investment Trusts having a market capitalization of $15 million or greater. The BBREIT index was developed with a base value of 100 as of December 31, 1993.

S&P 500 Index: A capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incure fees or expenses and an investment cannot be made directly in an Index.

Portfolio of UTY Companies: Includes the 20 members of the Philadelphia Utility Index (UTY). Portfolio based on $1 million at market capitalization as of September 30, 2016. Each company percentage is calculated by company’s market capitalization divided by total market capitalization for all 20 companies as of September 30, 2016.

Portfolio of Cyclical UTY Companies: Includes the cyclical companies in the Philadelphia Utility Index (UTY) as identified by EIP. Portfolio based on $1 million at market capitalization as of September 30, 2016. Each company percentage is calculated by company’s market capitalization divided by total market capitalization for all 10 companies as of September 30, 2016.

Portfolio of Non-Cyclical UTY Companies: Includes the non-cyclical companies in the Philadelphia Utility Index (UTY) as identified by EIP. Portfolio based on $1 million at market capitalization as of September 30, 2016. Each company percentage is calculated by company’s market capitalization divided by total market capitalization for all 10 companies as of September 30, 2016.