Energy MLP Income Fund, LP

4Q 2017 Letter to Investors

Performance

The Energy MLP Income Fund, LP (“EMIF”) was up 0.02% (net of fees) this quarter.[1] This compares to the Alerian MLP Total Return Index (“AMZX”) which was down 0.95% and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) which was down 0.95% over the same period.[2] For the year, EMIF was up 1.50% (net of fees).[3] This compares to the AMZX which was down 6.52% and WCHWMIDT which was down 6.56% over the same period.[4]

While we use the AMZX as a benchmark when reporting our performance, bear in mind that nearly 44% of our portfolio is not in the broader Alerian MLP Index. The balance of the portfolio is in companies not formed as partnerships that are involved in the transmission and storage of hydrocarbons and the transmission and distribution of electric power. This ratio changes over time and is affected by expected returns as well as merger and acquisition activity, including companies that merge their MLP affiliates into their C-corporation (“C-corp”) parent entity. C-corps are not eligible to be members of the A lerian MLP Index (“AMZ”).

While movements in the equity markets in general, rotations between sectors, interest rate expectations and commodity prices all have the ability to move our portfolio month-to-month, the yield of the portfolio, combined with capital appreciation – ultimately, driven by earnings and dividend growth, drive the vast majority of our long-term returns.

MLP Turning Point – Now Entering Rehab

Ten years ago, I wrote an article[5] about energy-related MLPs for Monitor, the journal of the Investment Management Consultants Association (IMCA) that put the explosive growth of the MLP asset class into historical context. I described the history of MLPs as being made up of four phases. Now, the MLP space is going through a fifth phase that will most likely come to define it over the next 10 years. But to see these changes in context requires a review of how we got here.

Phase 1 was the “Pioneering Phase” that witnessed the inception of the MLP as the public listing of private drilling funds in 1981 during the previous commodity supercycle. Back then, the energy sector was all the rage, accounting for 27% of S&P 500 Index’s market cap and 47% of S&P 500 earnings. But the MLP and its high dividend payout ratio also had tax advantages in a world of high interest rates (16%) and high corporate (45%) and personal (70%) tax rates before the 1986 Tax Reform Act. Approximately 25 energy-related MLPs were formed in a few years but by 1990, only two had survived the oil price crash of 1986 that saw oil prices retreat from their $40 highs, down to $10 per barrel.

The two that survived were non-cyclical regulated petroleum pipeline companies which ushered in Phase 2 – the “Nuclear Winter Phase”. During this phase, the market was hostile to anything MLP so that any MLP IPO had to mimic the safe characteristics of the surviving pipeline MLPs. It also saw the introduction of the parent/sponsor of the MLP subordinating its shares to the public shares. This subordination promised that, if cash flows were to decline, the parent company would first cut the dividend on the subordinated MLP shares it retained before reducing the dividends on the publicly-held shares. In return, the parent/sponsor took back an incentive called incentive distribution rights (IDRs) that kicked in if the dividends grew. As I wrote in the article, the MLPs that dominated this phase had businesses that “were based on slow-growing, stable cash flows that escalated with inflation coming from pipelines and storage terminals rather than oil and gas production. The primary holders of MLPs were retail investors who saw them as bond substitutes.” In essence, the MLPs of this era were just like pipeline utilities formed as partnerships.

Phase 3 began in the mid-1990s and was kickedoff by MLPs run by successful entrepreneurs such as Rich Kinder (Kinder Morgan Energy Partners) and Dan Duncan (Enterprise Products Partners). They bought assets from major oil companies as well as from pipeline utilities that had gone “off the reservation” following the deregulation of energy markets. These utilities chose to become energy conglomerates diversifying into cyclical businesses, something in which they had no expertise managing (e.g. coal, oil and gas production, energy trading, cable, real estate, banking, etc.), preferring instead the excitement of these new businesses to the boredom of operating natural gas pipelines with steady, slow-growing cash flows. This phase added a growth element to the stable earnings/attractive yield/tax-efficient characteristics of their predecessors and so I labeled Phase 3 as – I worked overtime on this one – the “Growth MLP Phase”.

The success of the MLPs during Phase 3 in the late 1990s, along with the advent of shale and the next commodity supercycle in the early part of the 2000s, led to Phase 4 – which, subsequently, I named the “Recidivist Phase”. This phase saw a slow but steady deterioration of the quality of earnings in the MLP space. Here is what I wrote 10 years ago warning investors to be careful about backward-looking success bias from over a decade of MLP Growth Phase 3: “Yet in the past two years, 24 MLPs have gone public, 14 [or 58%] in oil and gas production, refining, oil service or shipping – all cyclical businesses.” As it turned out, the portion of MLP IPOs from 2005 through 2015 that were cyclical businesses was higher — about 75% — creating the same risks as the vast majority of MLPs that failed in the 1980s. We have documented this deterioration of earnings quality ad nauseum in these quarterly letters over the last 10 years as a warning to investors not to take an index approach to investing in the MLP space.

But it was not just the newly minted MLPs in cyclical businesses that caused the quality of earnings of the MLP indices to deteriorate; it was also the acquisition of cyclical businesses by many pipeline MLPs as well. These pipeline MLPs acquired or built assets in merchant businesses such as gas gathering and processing, marketing, shipping, etc. With the overbuilding of capacity that always follows a commodity price spike comes a collapse of prices and margins, necessitating reductions in leverage ratios and widespread cuts to dividends. Over the last 10 years, there have been 71 dividend cuts/eliminations within the energy MLP universe that, over this time period, averaged about 100 in number (Source: MLP Association, Bloomberg, Factset and EIP Estimates. Includes dividend cuts from merger activity). That shows the extent of the drop in quality that occurred during the “Recidivist Phase”.

So, just as the gas pipeline and electric power utilities could not resist the temptation offered by diversifying into cyclical and non-core businesses at the advent of deregulation in the early- to mid-1990s, most MLPs could not resist getting into the same kinds of supply-facing variable margin businesses during the last commodity price upcycle. These are the types of businesses that have always spelled trouble for utility companies in the pipeline and power industries, which underestimate the range of outcomes for these businesses compared to regulated monopoly businesses. Invariably, the word “strategic” was used to justify investment in these businesses, but the accretion that comes from issuing stock trading at 18x free cash flow to buy or build an asset for 8x free cash flow, meant that investors were kept happy as well. At least in the short term.

How Phase 4 Laid the Seeds for Phase 5

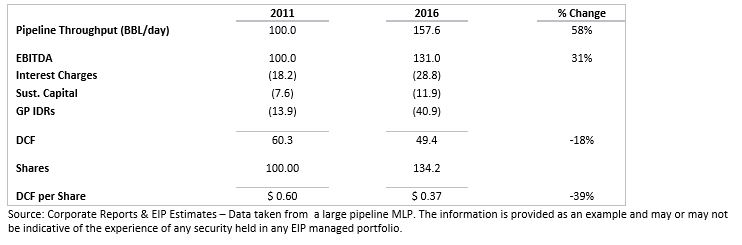

What ensued was bringing an end to the “Recidivist Phase” and ushering in Phase 5, which I call the “Rehab Phase”. Good industry fundamentals (e.g. higher volumes and revenues) were overwhelmed by the addition of new infrastructure assets financed with cheap capital. But this capital has a cost which shows up on the liability side of the balance sheet. Actually, the combination resulted in a decline in per share free cash flow as is illustrated in Exhibit 1 below. This simplified illustration is taken from a large pipeline MLP that – like most – has some degree of exposure to variable margin businesses. I have same-sized the volumes and dollar amounts to 100 in order to – as Joe Friday would say on the TV show Dragnet – “protect the innocent.”

Exhibit 1 – Before-and-After P&L of an Illustrative MLP

Notice how much the pipeline throughput went up – 58%. But EBITDA increased by only 31% as margins compressed due to investments made by competitors. Now look at how the increased cost of debt financing and IDR obligations to the general partner actually reduced the amount of distributable cash flow (DCF) available for the limited partners – down 18%. Throw in the effect of 34.2% more shares and the per share DCF declines 39%, even though volumes rose 58%!Source: Corporate Reports & EIP Estimates – Data taken from a large pipeline MLP. The information is provided as an example and may or may not be indicative of the experience of any security held in any EIP managed portfolio.

That folks, in a nutshell, is what happened to the typical energy MLP over the last six years. It is the numbers behind the “Recidivist Phase”. And as buyers of the MLP indices know, the prices of the MLPs followed this collapse in earnings.

MLP valuations are now so low that the free cash flow yields of the MLPs – on average – are about the same as the free cash flow yields of what they are investing in. Some are higher, some are lower. So for half the MLPs, their cost of equity financing is too high. The promise of steady dividends, which was intended to result in a free cash flow yield lower than the projects the compay invested in, was broken. The market reacted and now these MLPs need to completely rethink their business models–which resulted in the breaking of those promises. In short, it is the liability side of the balance sheet that needs to be addressed now.

The hallmarks of the liability side of the balance sheet of the typical MLP over the last 10 years were as follows:

- Paying out nearly 100% of free cash flow, in spite of the fact that some portion of those cash flows were cyclical.

- Paying incentives (IDRs) to the general partner in return for the GP subordinating its shares to the public’s shares, even though the subordination had long expired.

- Funding half of all new projects with debt and the other half with newly issued shares.

- Giving the general partner super majority voting control, preventing any shareholder initiatives that might improve corporate governance in favor of the limited partners.

As we begin 2018, industry fundamentals continue to improve, with production, exports and domestic demand for oil, natural gas and gas liquids continuing to hit new highs. The problem has been that too much stuff was built and too much debt and equity was issued to build it. And too much in the way of incentives went to the general partners.

The saying “the market usually gets what it wants” applies here. As we have said in the past, MLPs are created when they lower the cost of financing and they are destroyed (and converted to some other form of financing) when they don’t.

But the low valuations of MLPs (10-12x free cash flow on average) have been compounded for many MLPs by a “tax” in the form of incentives to the general partner. Our 1Q 2017 letter wrote extensively about this, but the punchline is that for MLPs with general partners, the yield paid to limited partners on new shares is not the only cost of issuing new equity. For many MLPs, there is an additional 25-40% paid to the general partner. For Oneok, before it consolidated its MLP with the C-corp parent on July 3, 2017, that cost paid to the general partner was an additional 36%. That means if the limited partner units are trading at an 8% yield, the total cash cost of issuing new equity is about 12.5%. That’s not cheap capital. When Kinder Morgan Energy Partners (KMP) executed its consolidation, 46% of every dollar of free cash flow went to the general partner. At the time, KMP was trading at about a 7% yield so the cash cost of issuing new equity was about 13%.

In short, when MLPs are trading at low yields (high valuations), they can “afford” this “tax” going to the general partner. Now that “MLP” has become a four-letter word, this “tax” can no longer be borne and we expect that virtually all IDRs will be eliminated over the next few years. IDRs are now also a four-letter word that is viewed as an undesirable characteristic of an asset class that broke its promise to investors.

But the elimination of IDRs is only part of the story; shareholders looking to invest in this space would also like to see the elimination of the general partner so as to have a one-share-one-vote corporate governance, and the elimination of the K-1, state tax filings and UBTI for qualified investors and institutions.

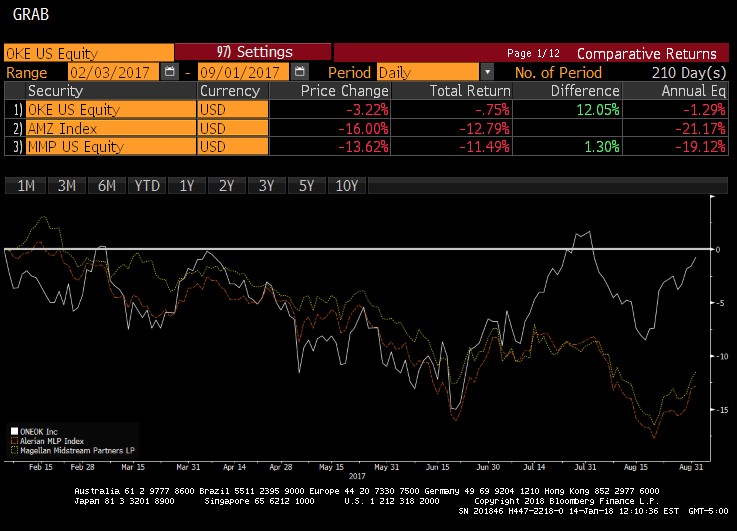

The case of Oneok, which completed its restructuring on July 3, 2017, is interesting. On February 1, 2017, Oneok, Inc. (OKE), the parent corporation and general partner of Oneok Partners (OKS), announced a share exchange effectively buying out the partnership at a 22% premium. From that point until June 30, OKS and OKE traded in lockstep, experiencing daily volatility that mimicked the other MLPs.

The Graph in Exhibit 2 shows what happened in July as soon as Oneok became a single C-corp rather than a C-corp that owned an LP and GP interest in an MLP. In about three months, a performance differential of about 12% versus other MLPs opened up. We compare Oneok to both the AMZ and Magellan Midstream Partners (MMP), which has a similar size in our portfolio to Oneok.

Exhibit 2 – Oneok Gets Rewarded for Exiting the MLP Space

Source: Bloomberg

Oneok is the same company with the same assets, same balance sheet and same management team in August as it was in June. The only thing that is different is that it no longer has a connection to the MLP indices.

An even greater relative performance divergence was experienced by Kinder Morgan Inc. (KMI) in the months after its consolidation with Kinder Morgan Energy Partners (KMP), announced on August 10, 2014, and completed on November 28, 2014, and also by Targa Resources Corp. (TRGP) after its consolidation with Targa Resource Partners (NGLS), announced on October 13, 2015, and completed on February 2, 2016.

It is only in hindsight that one can say these represent a pattern. And these transactions were not executed in order to escape from the MLP space per se. They were executed because the high level of IDRs being paid to the general partner/parent corporation got so high, they even exceeded the 35% corporate tax rate.

Oh, but wait, the corporate tax rate isn’t 35% anymore, it’s 21%. That lowers the hurdle for any consolidation transaction similar to Oneok where the MLP is paying IDRs up to a C-corp parent. But does it mean companies like Enterprise, Magellan, Buckeye or Plains All American that have already eliminated their IDRs should consider converting to a C-corp? We think the answer is a resounding yes, even though the MLP community of investment bankers, sell-side analysts, the MLP Association lobbying group and MLP fund managers (the group we like to call the “MLP Cheerleading Squad”) think nothing has changed. The analysis below illustrates why we think things have changed.

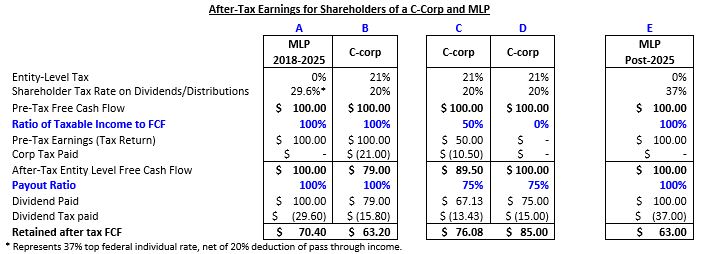

The table in Exhibit 3 below (apologies to Simon & Garfunkel) compares the profit retained by the shareholder of $100 of free cash flow earned at the entity level after paying entity-level tax and tax on dividends or distributions (even though the latter tax may be deferred until the shares are sold).

Exhibit 3 – “I’d Rather be a C-corp. than an MLP – Yes , I would…”

Source: EIP estimates based on Tax Cuts and Jobs Act of 2017 (TCJA) and discussions with management teams and corporate reports. For illustrative purposes only and should not be regarded as tax advice. Investors should consult with their tax professionals for more complete information with regard to their specific tax situation.* Represents 37% top federal individual rate, net of 20% deduction of pass through income.

The first two columns show a simplified comparison of a C-corp and an MLP each earning a $100 of pre-tax free cash flow at the entity level, paying out to shareholders 100% of that free cash flow after entity-level tax (which is zero for a partnership like an MLP) as a dividend or distribution and then paying tax at the shareholder level on that distribution (even if such taxes are deferred). In this example, the MLP investor keeps $70.40 of that original $100 of pretax free cash flow while the C-corp shareholder keeps only $63.20. This apparent 7 percentage point advantage for the MLP is similar to the advantage before the new tax law, because the MLP investor pays only 80% of the top marginal rate of 37% on pass-through income. The apparent retention of the “MLP advantage” is being touted by the “MLP Cheerleading Squad” as an enormous win for the asset class they so depend on for their living.

Hold on, not so fast. While it is good news for MLP investors that the tax rate on pass-through income went down, the ability to deduct 20% of pass-through income from personal income (making the effective rate 80% x 37% = 29.6%) lasts only through 2025, absent further legislative action. But even if it were extended, our view is that the “MLP advantage” is gone and that most midstream companies are better off forming as a C-corp corporation. Here’s why:

There are two flaws to the analysis being presented by the “MLP Cheerleading Squad” in columns A and B. The first is that corporations don’t pay tax on free cash flow; they pay tax on taxable income, which is much lower. The second is that the payout ratios are lower than 100% for the higher quality investable MLPs. Columns C & D illustrate these corrections.

Both examples in C and D assume the company pays out 75% of its free cash flow. This is the level targeted by Enterprise Products Partners (EPD) when it surprised the market last quarter by announcing a slowing of its dividend growth in order to achieve self-funding of its capital program. In Column C, we assume taxable income is about half the level of free cash flow. Since MLPs do not currently pay tax, we don’t know the ratio of taxable income to free cash flow, but we do know that the ratio of recurring GAAP earnings to free cash flow averages about 60% (source: Alerian, Factset, Bloomberg and EIP estimates). Taxable income would be lower than GAAP income because of accelerated depreciation. In the example in Column C, the C-corp shareholder retains $76.08, which is higher than if the company were formed as an MLP.

But wait, it gets better. The new tax law allows companies to actually expense capital expenditures in the year they are incurred. For the energy MLP group as a whole, capital expenditures over the last year were nearly twice the level of GAAP income (Source: Factset and EIP estimates). Even assuming a recovery in earnings and a continued decline in capital spending in the future, the ability to expense capital would still result in virtually no taxable income – on average – for energy related MLPs, even if they all switched to C-corporations. Each company is different and expensing of capital is not available for gas transmission as electric and gas utilities were exempted from this provision. But as shown in column D, the elimination of tax at the corporate level would allow a shareholder to retain 85% of every dollar of free cash flow, much better than the 70% available for an MLP investor (column A).

While it is true that the tax on the MLP distribution is deferred until the sale of the shares, so, too, would be the tax on the portion of dividends from a taxable C-corporation that exceed the company’s profits. But unlike an MLP unitholder who pays ordinary income tax rates on this “recapture” income, the C-corp shareholders pay the capital gains tax rate. And while there may be some small tax liability to limited partner unitholders on the conversion from a partnership to a C-corp, so long as 80% of the units convert (a so-called “351 transfer”), we believe the conversion could be largely tax free.

When we started EIP in 2003, many believed that the primary benefit of the MLP asset class was the tax efficiency that comes from being a passthrough entity. As we have written about numerous times in these letters, EIP is mostly agnostic as to whether a company finances the equity sleeve of its capital with a normal “C”-corporation, a Canadian Income Trust structure, a REIT, a YieldCo or an MLP. What we are not agnostic about is the assets, the management team, the payout ratio, the balance sheet, etc. Owning great assets, run by a solid management team with a conservative payout ratio and a conservative balance sheet that pays less tax as a C-corp than as an MLP, is a win all around, especially for the huge pool of investors who cannot own publicly-traded partnerships due to their tax complexities.

There is Opportunity During Phase 5

As we state every quarter at the top of our letters: While movements in the equity markets in general, rotations between sectors, interest-rate expectations and commodity prices all have the ability to move our portfolio month-to-month, the yield of the portfolio combined with capital appreciation – ultimately, driven by earnings and dividend growth, drive the vast majority of our long-term returns.

In essence, we are saying that in the long run, changes in valuation are the smallest contributor to our total returns while yield and growth make up the bulk of our returns. Occasionally, however, valuation plays a much bigger role in total return. I think now is one of those times as high quality MLPs are trading for about 12x free cash flow and comparable C-corps are trading for about 17x. (Source: FactSet, EIP estimates)

So, what is the catalyst that closes the valuation gap between solid energy infrastructure companies and utilities? Short answer: I don’t know. But history tells us what kinds of changes have occurred in these situations. The return to a simple C-corp structure like Oneok, Kinder Morgan and Targa Resources could be one such catalyst. I suspect some MLPs will just be bought by another publicly-listed company and be delisted while the assets are absorbed into a much larger company. This is what happened to Columbia Pipeline Partners (CPPL) after it was spun out of NiSource (NI). Private equity buyers are also a possibility. The amount of uninvested capital sitting with the private equity managers is reportedly over $1.5 trillion, an all-time high according to a recent study by Bain. (Source: Global Private Equity Report 2017, Bain & Company).

Self-help is always a catalyst in situtations like this. The self-help “fixes” now being openly discussed among the “MLP community” at venues such as MLP investment conferences, are mostly on the liability side of the balance sheet. The to-do list here looks as if it was mailed-in by the institutional investors discussed above: lower payout ratio, less leverage, elimination of IDRs and normal corporate governance. At a large annual MLP conference during the second week of December, these principles were widely discussed, and there seemed to be widespread agreement that they were necessary changes.

Our Portfolio

The vast majority of MLPs we own are sponsored entities (SEs) which we described in the 1Q 2017 letter. Briefly, a sponsored entity is an MLP or a YieldCo spun out of a larger company such as Royal Dutch Shell, Phillips 66 or NextEra Corporation in order to lower their overall cost of financing. Equity valuations are a function of stability and growth of earnings as well as the dividend payout ratio. A sponsored entity earning stable income, paying out most of its free cash flow that is growing (due to both organic investments and drop-down acquisitions from the parent) and is modestly leveraged, will trade at a higher valuation (lower cost of financing) than a cyclical energy company with a necessarily lower payout ratio. Our large ownership in SEs is a significant contributor to our out-performance relative to the MLP indices over the last 3 to 4 years. The sponsored entities we own currently have grown their dividends about 40-45% over the last three-and-a-half years since the MLP Index peaked. Over this time, the dividends for the companies in the AMZ are down over 25%. (Source: Alerian, corporate reports and EIP estimates).

The sponsored entities tend to get a lot of support from their parent organizations so that they continue to be a cheaper source of financing. Nonetheless, the mistakes made by other MLPs that are weighing on the group have prompted an examination of the IDRs paid to the sponsor. As with the MLP group as a whole, there is widespread agreement that the IDRs of sponsored entities need to go. In fact, it is already happening as HollyFrontier Corp., Andeavor, Inc. and Marathon Petroleum Corp. recently announced IDR elimination transactions with their sponsored entities. And with the new tax law, some sponsored entities are looking hard at converting to the C-corp structure as a way of lowering the overall tax bite and accessing a much larger pool of institutional capital.

Where Do We Go From Here?

It took about a decade for the power utility space to clean up its act after the carnage of deregulation and subsequent “diversification”. One by one, each company slowly shed its energy trading, marketing and other merchant businesses, adjusted their dividends and repaired their balance sheets. Similarly, it will likely take years for the MLP space to clean up its own mess. This is not to say that one should wait to participate in this rehabilitation phase. It was very profitable to own the utilities during its rehab phase as the earnings growth, earnings stability and valuations all improved over the course of the last 10+ years. Ten years may sound like a long time, but to the old folks at EIP who have been involved in this space our whole careers, it’s just another phase.

Another Year

In closing, please accept our good wishes for 2018, and our thanks to our investors for your confidence in us.

Best regards,

James J Murchie

Past performance is not indicative of future results. Performance information provided for the Energy MLP Income Fund (EMIF or the “Fund”) assumes the reinvestment of interest, dividends and other earnings and is net of fees. There is no assurance that the Fund’s investment objective will be achieved.

The EMIF portfolio information regarding dividends and portfolio company prices is provided as an example of EIP’s investment philosophy and strategy and not an offer or sale of any security. Information in this letter regarding specific MLP instruments and other companies, including any information pertaining to the performance of such instruments and other companies, is provided solely as a tool for general industry analysis. Under no circumstances should it be assumed that the Fund or any other account managed by Energy Income Partners, LLC derived any benefit from the performance of any MLP or company referenced herein. Information provided is believed to be accurate as of the date on the materials. EIP reserves the right to update, modify or change information without notice. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. This Document is not an offer or solicitation with respect to the purchase or sale of any security. This Document is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person under any circumstances. This Document is not intended to constitute legal, tax, or accounting advice or investment recommendations of any particular security or industry. Investors are encouraged to conduct their own analysis before investing. CIRCULAR 230 NOTICE. THE FOLLOWING NOTICE IS BASED ON U.S.TREASURY REGULATIONS GOVERNING PRACTICE BEFORE THE U.S. INTERNAL REVENUE SERVICE: (1) ANY U.S. FEDERAL TAX ADVICE CONTAINED HEREIN, INCLUDING ANY OPINION OF COUNSEL REFERRED TO HEREIN, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES THAT MAY BE IMPOSED ON THE TAXPAYER; (2) ANY SUCH ADVICE IS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS DESCRIBED HEREIN (OR IN ANY SUCH OPINION OF COUNSEL); AND (3) EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

These materials do not constitute an offer of securities. Such an offer will only be made by means of the Confidential Memorandum to be furnished to prospective investors at a later date. This document is confidential and is intended solely for the information of the person to whom it has been delivered. It is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior written consent of the Fund. Notwithstanding anything to the contrary herein or in the Confidential Memorandum, the recipient (and each employee, representative or other agent of such recipient) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of (i) the Fund and (ii) any transactions described herein, and all materials of any kind (including opinions or other tax analyses) that are provided to the recipient relating to such tax treatment and tax structure.

A description of the Alerian MLP Total Return Index may be found at http://www.alerian.com/indices/amz-index/. The index performance is provided for information purposes only.

The Wells Fargo Midstream MLP Total Return Index consists of 45 energy MLPs as of 12/31/17 and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology.

S&P 500 Index: A capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incur fees or expenses and an investment cannot be made directly in an Index.

[1] Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

[2] Indices do not incur fees and expenses.

[3] Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

[4] Indices do not incur fees and expenses.

[5] Jim Murchie, “Master Limited Partnerships—Lessons from History,” Investments and Wealth Monitor, March/April 2008, 7-10.