Energy MLP Income Fund, LP

2Q 2016 Letter to Investors

Performance

The Energy MLP Income Fund, LP (“EMIF”) was up 10.38% (net of fees) this quarter.1 This compares to the Alerian MLP Total Return Index (“AMZX”) which was up 19.70% this quarter and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) which was up 21.57% this quarter. For the year, EMIF is up 14.63% (net of fees) vs. 14.71% for the AMZX. From January of 2014, (before the sell-off in energy began) through the end of June 30, 2016, EMIF is up 9.26% (net of fees) while the AMZX is down 18.96%.2

The second quarter’s performance is typical of the longer-term performance characteristics of upside capture being below 100%. EMIF’s long-term up/down capture vs. the AMZX was approximately 90/70 and vs. the Philadelphia Stock Exchange Utility Index “UTY” was approximately 75/20 (source: Bloomberg, EIP calculatons), meaning EMIF has captured approximately 90% of the upside while missing approximately 30% of the downside of the AMZX. We don’t run the portfoilio to achieve these up/down capture ratios, they are simply an artifact of how we invest. That is, we invest in quality. To paraphrase Warren Buffet, we seek to buy great businesses at a fair price, not fair (i.e. lousy) businesses at a great price.

Speaking of Warren Buffett, now that the Berkshire Hathaway energy business has grown and become one of Berkshire’s “powerhouse five” businesses and is getting its own write-up in the famous annual letters, I thought that would be a good place to hunt for other quotes to help illustrate what we do. For those of you not familiar with Berkshire Hathaway Energy (BHE), it is a collection of businesses full of poles and wires and pipes and tanks.

1 Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

2 Indices do not incur fees and expenses.

Volatility versus Risk

“Stock prices will always be far more volatile than cash-equivalent holdings. Over the long term, however, [cash equivalents] are riskier investments…That lesson has not customarily been taught in businesses schools, where volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong: Volatility is far from synonymous with risk. Popular formulas that equate the two terms lead students, investors and CEOs astray”. – 2014 Berkshire Hathaway Annual Letter

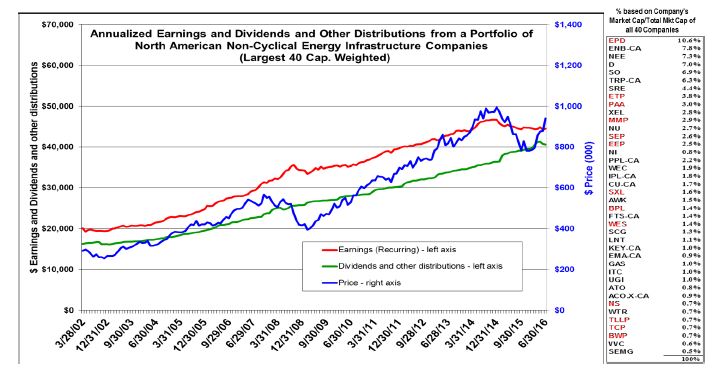

The graph below illustrates this point by comparing the composite share prices along with the composite earnings and dividends of the 40 largest non-cyclical energy infrastructure companies in North America over the last 15 years. To get into this group of 40, a company must have less than 30% variability in its earnings versus a 3- to 5-year moving average. I show this graph to illustrate that while share prices tend to follow earnings and dividends over time, they do not move in lockstep and in the short term, prices can be far more volatile than the underlying earnings and dividends. Share prices often fluctuate, even though the underlying businesses have not, because investors change their view of what will happen in the future. To us (and, we believe Buffett as well), risk would be that the earnings and dividend trend in this graph reverses its 15-year ascent and enters a rapid decline until earnings fall to zero or negative….permanently (think: Linn Energy).

While there is a lot of overlap with EMIF’s portfolio over the years with this group, this is not our portfolio but is illustrative of the earnings, dividend and share price behavior of our portfolio, which has performed better than this group of 40 companies.

Exhibit 1 – Composite Earnings, Dividend, and Prices for the 40 Largest Non-Cyclical Energy Infrastructure Companies in North America – 15-Year History

Source: EIP calculations based upon Factset data for the 40 largest non-cyclical energy infrastructure companies in North America. Portfolio based on $1 million market capitalization as of December 31, 2014. Kinder Morgan is excluded due to data discontinuity resulting from their restructuring. MLP companies are highlighted in RED. Earnings and dividends and other distributions are annualized. Past performance is no guarantee of future results. Not intended to represent the experience of any investor in any EIP managed account.

Utility and RAB Businesses

“..utilities [are] usually the sole supplier of a needed product and [are] allowed to price their product at a level that [gives] them a prescribed return upon the capital they employed. The joke in the industry [has been] that a utility was the only business that would automatically earn more money by redecorating the boss’s office”. – 2015 Berkshire Hathaway Annual Letter

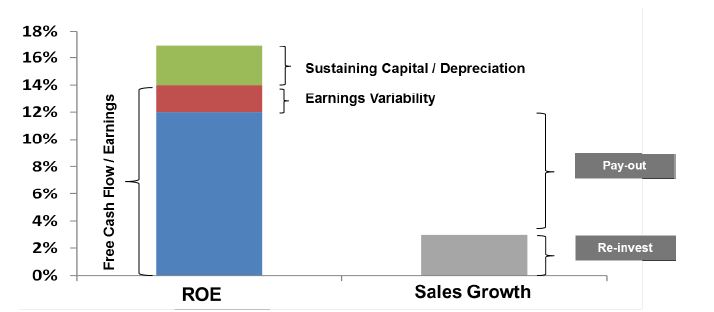

The reason these earnings have had a fairly smooth and upward ascent is that the operating businesses of these companies are dominated by Regulatory Asset Base (RAB) businesses. We (and Berkshire) have often referred to these businesses as “utility” businesses, but just as the “MLP” label is misleading, so too can be the “utility” label. 3 So RAB is really a better adjective that includes both poles and wires, regulated power generation and certain components of the pipeline industry as well. As shown in Exhibit 2, a RAB business starts with an allowed return on capital to derive the price that should be charged, while the return on investment of most businesses is dependent on sales volume, pricing, expense control, and capital investment discipline. The economy, commodity prices, and labor costs all affect the profitability of most businesses (which is why investors can’t stop talking about these factors).

3 2015 Berkshire Hathaway Annual Letter.

Exhibit 2 – RAB Illustration

The examples shown above represent EIP’s view of the basic differences between a RAB Business and a Typical Business and are presented for illustrative purposes. It is not meant to reflect any particular company or companies held by EIP in the portfolios it manages.

RAB businesses are legal monopolies operating pipelines, power transmission and distribution, water systems, etc. They trace their origins to the beginnings of the electric and gas lighting industries in the late nineteenth century. As the industry expanded, it became apparent that monopoly regulation at the state and federal level was a better alternative to capricious municipal corruption, overlapping of duplicate infrastructure, or government ownership of private enterprise. The regulated model was championed by the early Edison Electric companies and is found in similar forms around the world. In North America, RAB businesses today are primarily water utilities, electricity transmission and distribution (poles & wires) and petroleum and natural gas transmission, storage and distribution (pipes & tanks). Power generation is mixed; while many states deregulated that part of the business in the 1990s, generation remains a RAB business in other states.

A RAB business is granted an “allowed” rate of return that is based in part on interest rates and prevailing equity returns. As interest rates have declined, so too have allowed rates of return. Twenty years ago, allowed rates of return on equity for state-regulated utilities were over 13%; today the average is about 10%. (So much for rising interest rates being a threat to these businesses). The company’s profit is essentially this allowed rate of return multiplied by the invested capital. The revenue required to achieve the allowed return is then added to the cost of operating the business, which is why it is also referred to as a “cost of service” pricing scheme. This revenue requirement divided by the units sold determines the rates that customers pay for their water, electricity or gas. This is why these businesses are less subject to the vagaries of the economy, labor costs or commodity prices.

The key word in the above paragraph is “allowed” rate of return. It’s not a “guaranteed” rate of return. In fact, history has demonstrated numerous examples of gas, power or water utilities earning less than their allowed rate of return, frequently due to mistakes made by the management of the utility company. This is primarily where the risk lies in these businesses, in our opinion. It’s not with the business cycle or inflation or commodity prices; it’s with how management teams execute their responsibility to safely and reliably deliver their products while earning the trust of regulators, policy makers, and the communities they serve. Those that do this well tend to earn good returns for their shareholders.

Risks in RAB Businesses

“Our confidence [that this RAB arrangement will continue] is justified by our past experience and by the knowledge that society will forever need massive investments in both transportation and energy. It is in the self- interest of governments to treat capital providers in a manner that will insure the continued flow of funds to essential projects. It is concomitantly in our self-interest to conduct our operation in a way that earns the approval of our regulators and the people they represent”. – 2015 Berkshire Hathaway Annual Letter

When management teams lose the approval of the regulators and the customers, it’s usually because costs are not controlled and/or reliability is poor. When there were massive cost overruns for newly constructed nuclear plants in the late 1970s and early 1980s (in some cases over 3x the original estimate), regulators forced the utility shareholders to absorb much of the excess costs. In some cases, costs are simply disallowed but there are a myriad of variables to this process that can allow various parties (regulatory staff, consumer groups, utilities) to claim victory for their particular constituency. These variables can include the mechanics of how additions to the regulatory asset base are measured, as well as the mechanics of how long the company needs to wait to start earning on those assets, and the rewards and penalties to encourage exceptional performance. Add to this, the public’s desire to have every industry operate in a more environmentally-friendly manner and the process gets even more nuanced. Understanding all these nuances is a research-intensive exercise, but one that EIP believes is rewarded in better portfolio performance for those who understand these details.

Management, Management, Management

“All of this adds up to a huge responsibility. We are a major and essential part of the American economy’s circulatory system…[that] places a huge responsibility on us…[which] requires us to have ample financial resources under all economic scenarios and to have the human talent that can instantly and effectively deal with the vicissitudes of nature…Fulfilling our societal obligation…we participate in a ..”social contract”. We are expected to put up ever increasing sums to satisfy the future needs of our customers. If we meanwhile operate reliably and efficiently, we know we will obtain a fair return on these investments”. – 2011 Berkshire Hathaway Annual Letter

Good management teams always seem to navigate this complexity well and take their obligation to the public

– not just the shareholders – seriously. Poor management teams tend to blame regulators for not earning their allowed rates of return (we disagree). So while the management team of a regulated monopoly may not have to deal with competition, they still face the challenges of simultaneously meeting these obligations. We have seen financial owners try to manage a utility business and fail because they oversimplify the task of managing the social contract. For example, one company (managed by former investment bankers) tried to grow its asset base too quickly which translated into a big price spike for customers. The customers complained. The state regulator called the company in for a rate case, which may result in cutting the rate increase which would effectively cut the return on the utility’s investment. We believe that a more experienced management team would not have made this mistake. Such differences create a wide performance spread between those that do it well and those that don’t. We believe that understanding these complexities and having a long history with the industry and the management teams give us an advantage in constructing a portfolio of companies with management teams “who get it”.

Diversification

“At BHE….two factors ensure the company’s ability to service its debt under all circumstances. The first is common to all utilities: recession-resistant earnings, which result from these companies offering an essential service on an exclusive basis. The second is enjoyed by few other utilities: a great diversity of earnings streams, which shield us from being seriously harmed by any single regulatory body. ….This multitude of profit streams, supplemented by the inherent advantage of being owned by a strong parent, has enabled BHE and its utility subsidiaries to significantly lower their cost of debt.” – 2014 Berkshire Hathaway Annual Letter

Diversification is a primary consideration in our portfolio construction for the same reasons. We are exposed to many different regulatory jurisdictions for our RAB businesses and a wide diversity of mostly investment-grade counterparties for our contracted businesses. Of course, our portfolio companies cannot reduce their cost of borrowing because they are part of EIP’s diversified portfolio, but the cost of capital for our portfolio companies is an important consideration to us. This is one of the reasons the portfolio is dominated by companies of substantial size as critical mass and business diversification does lower the cost of capital. In addition, the MLP portion of the portfolio is dominated by MLPs that are merely a sleeve of capital of a much larger company, enjoying the strong backing of that company when capital markets seize up.

Finally, in addition to having diversification across geography, regulatory agencies and businesses, we have diversification across asset classes owning MLPs, YieldCos, and RAB utilities. This may not be a consideration for BHE since its businesses are privately and directly held. But when owning publicly traded equities whose prices tend to move in the short term depending on which category they belong to, this diversification enhances our ability to achieve rebalancing profits.

Reinvestment and Growth

“BHE can make these investments because it retains all of its earnings. In fact last year the company retained more dollars of earnings – by far – than any other American electric utility. We and our regulators see this 100% retention policy as an important advantage – one almost certain to distinguish BHE from other utilities for many years to come.” – 2014 Berkshire Hathaway Annual Letter

This is where we part ways with Berkshire. Because Berkshire controls all the cash flow of its subsidiary companies, it can review the economics of all its investments. As investors in public companies, we don’t have that control so we need some assurances that capital is being deployed carefully.

We have used the graphic in Exhibit 3 below before to talk about how the reinvestment rate of a company needs to fit with its returns and its growth rate. For example, a company earning 10% returns on its invested capital that reinvests 100% of its profits would grow its capital base 10% per year. If the underlying business is only growing 2% per year, then either pricing needs to rise 8% per year, or that company’s volume needs to grow 8 percentage points faster than the industry or all of its investments need to be lowering costs by 8% per year…or some combination of the three. But with a legal monopoly, prices can only rise with regulatory approval and there is no business to steal from competitors because there are no competitors. A high payout is our primary assurance that a monopoly company in a slow growth industry does not waste capital by reinvesting too much of its profits.

Exhibit 3 – Reinvestment Equilibrium for Companies in Mature Industries

Example for illustrative purposes only.

Source: EIP calculations

Note: ROE (Return on Equity) and Sales Growth Data are for illustration only and not meant to represent or be indicative of the EIP Portfolios or any company invested in by EIP.

Past performance is no guarantee of future results.

Some companies do in fact have growth opportunities well in excess of industry growth rates that make sense. BHE can simply fund those opportunities from retained earnings. Our portfolio companies – which have an average payout ratio between 60-90% of free cash flow, need to come to market and issue more equity and/or more debt if they want to grow faster than their retained cash would allow. That need to raise capital introduces a level of capital discipline from the market that is usually a pretty good substitute for the discipline that comes with two highly astute old curmudgeons from the Midwest (i.e. Warren Buffett and Charlie Munger). Of course, when markets convulse as they did in 2008/9 and more recently for MLPs, the need to raise capital when share prices have been halved introduces its own problems. But on balance, over time, we like the symmetry of the relationship in Exhibit 3. And as mentioned above, the bulk of the companies in our portfolio with the highest payout ratios – the MLPs and YieldCos – have strong parent organizations that can bridge the gap when capital markets are not cooperating.

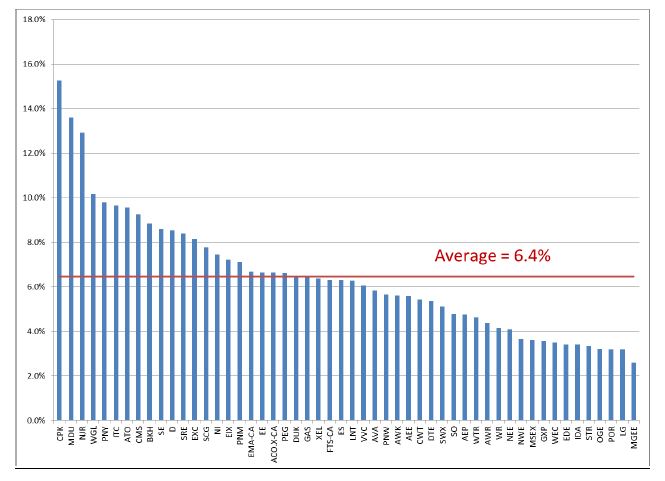

As shown in Exhibit 4, there is quite a range in the rate of capital investment growth among utilities in our investable universe from 2%-15% growth with the average around 6.4%. These growth rates may surprise a lot of people because electric power demand is essentially not growing. Some of these companies also operate gas utilities and growth there is about 2% per year, but in any event, the capital growth exceeds the volume growth. The capital investment is needed to replace old pipe, improve grid efficiency and reliability, and connect new sources of electricity like wind, solar, and natural gas generation that are replacing coal, etc.

Exhibit 4 – Capital Base Growth Rates for the Largest North American Utilities

Source: Factset, EIP Calculations for average 2015 and 2016. 2016 figures are based upon EIP estimates. The graph above shows the 50 largest utilities ranked by annual capital expenditures. The graph above contains information with respect to specific utility companies and is provided solely as a tool for industry analysis. It should not be assumed that EIP invests in any of the companies shown above.

Over the last 8-10 years, natural gas prices have fallen from about $6-8 per mcf to about $2-3 per mcf (denotes a thousand cubic feet of gas) because of the whole shale thing. They cannot fall to zero. This has allowed a capital base growth rate in excess of unit demand growth without any real increase in customer bills. But this tailwind for retail electricity and gas costs will eventually come to an end and utilities will increasingly have to direct their capital spending in ways that improve efficiency and lower operating costs that are passed on to customers. These can include grid automation (e.g. remote meter reading that reduces labor costs and improves system reliability) or energy storage and distributed generation to mitigate price spikes or investing alongside their customers in energy-saving capital such as more efficient lighting. Again, determining these factors is a research-intensive exercise.

Wrapping Up

Whether the company we invest in is classified as a utility, an MLP, a YieldCo, a REIT or any other category is of less importance to us than the character of their businesses. For EIP those businesses need to be predominantly RAB businesses or merchant businesses with stable margins and long-term contracts based on similar principles

as RAB businesses with able counterparties. Again, to paraphrase the Chairman of Berkshire Hathaway, pipelines and utilities may not make you rich, but they can sure help you stay that way.

Our past letters have used a lot of ink identifying, countering and correcting the inaccuracies of the Wall Street consensus about the areas we invest in such as MLPs and utilities. It’s nice for a change to write a letter centered around a view we largely agree with. Quoting a sage or classic piece of literature always lends the appearance of credibility to one’s efforts – and we here at EIP are all about appearances! So with that in mind, expect future letters to quote from classics such as Shakespeare, Yogi Berra, Casablanca and Caddy Shack.

Best Regards,

James J Murchie

Past performance is not indicative of future results. Performance information provided for the Energy MLP Income Fund (EMIF or the “Fund”) assumes the reinvestment of interest, dividends and other earnings and is net of fees. There is no assurance that the Fund’s investment objective will be achieved.

The EMIF portfolio information regarding dividends and portfolio company prices is provided as an example of EIP’s investment philosophy and strategy and not an offer or sale of any security. Information in this letter regarding specific MLP instruments and other companies, including any information pertaining to the performance of such instruments and other companies, is provided solely as a tool for general industry analysis. Under no circumstances should it be assumed that the Fund or any other account managed by Energy Income Partners, LLC derived any benefit from the performance of any MLP or company referenced herein.

CIRCULAR 230 NOTICE. THE FOLLOWING NOTICE IS BASED ON U.S.TREASURY REGULATIONS GOVERNING PRACTICE BEFORE THE U.S. INTERNAL REVENUE SERVICE: (1) ANY U.S. FEDERAL TAX ADVICE CONTAINED HEREIN, INCLUDING ANY OPINION OF COUNSEL REFERRED TO HEREIN, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES THAT MAY BE IMPOSED ON THE TAXPAYER; (2) ANY SUCH ADVICE IS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS DESCRIBED HEREIN (OR IN ANY SUCH OPINION OF COUNSEL); AND (3) EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

These materials do not constitute an offer of securities. Such an offer will only be made by means of the Confidential Memorandum to be furnished to prospective investors at a later date. This document is confidential and is intended solely for the information of the person to whom it has been delivered. It is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior written consent of the Fund. Notwithstanding anything to the contrary herein or in the Confidential Memorandum, the recipient (and each employee, representative or other agent of such recipient) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of (i) the Fund and (ii) any transactions described herein, and all materials of any kind (including opinions or other tax analyses) that are provided to the recipient relating to such tax treatment and tax structure.

A description of the Alerian MLP Total Return Index may be found at http://www.alerian.com/indices/amz-index/. The index performance is provided for information purposes only.

The Wells Fargo Midstream MLP Total Return Index consists of 35 energy MLPs and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology.

The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incure fees or expenses and an investment cannot be made directly in an Index.