Energy MLP Income Fund, LP

4Q 2016 Letter to Investors

Performance

The Energy MLP Income Fund, LP (“EMIF”) was up 1.01% (net of fees) this quarter.1 This compares to the Alerian MLP Total Return Index (“AMZX”), which was up 2.04% and the Wells Fargo Midstream MLP Total Return Index (“WCHWMIDT”) which was up 3.08% over the same period. For the year, EMIF was up 19.55% vs. 18.31% and 19.87% for the AMZX and WCHWMIDT indices respectively.2

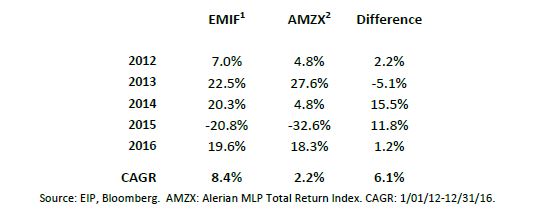

While the MLP indices caught up to the fund’s returns later in the year, our portfolio of MLPs, pipeline and power utilities and YieldCos has outperformed them by a wide margin since inception and especially over the last five years as shown in Exhibit 1 below:

Exhibit 1: Fund Performance versus MLP Index

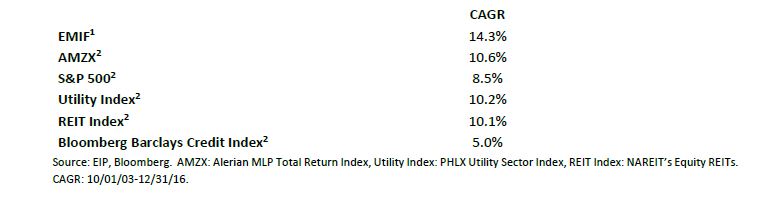

This outperformance over the last five years through up-and-down markets is above (but not inconsistent with) our out-performance of 3.7% per year since the fund’s inception in October of 2003. The fund has done well compared to other benchmarks since our inception as shown in Exhibit 2:

Exhibit 2: Performance Since Inception

1 Past performance is not indicative of future results. Results include the reinvestment of dividends, interest and other earnings and are net of fees.

2 Indices do not incur fees and expenses.

When we began in 2003, we thought the most appropriate benchmark for any fund is the remainder of an investor’s portfolio of assets. This is why we set the hurdle for our performance fee as a 50/50 mix of stocks and bonds as measured by the S&P 500 and the Lehman Credit Index. Of course, Lehman is now gone and that index is known as the Barclay’s Credit Index, but our thought was that the vast majority of people’s portfolios are made up of stocks and bonds. Hedge funds and other alternative investments make up a growing part of those portfolios, but the last 13+ years has demonstrated that those returns are not much better (many would say worse) than a 50/50 mix of stocks and bonds, especially adjusted for risk.

Back in 2003, we estimated the long-term performance of this blended index would be about 8% per year (6% for bonds and 10% for stocks) which, concurrently, was the approximate hurdle rate for most pension funds. Well, since October of 2003, the blend of these two benchmarks is about 7% (6.8% compounded and 7.2% as a straight average), slightly below our estimate. Since inception, our net returns have far exceeded our expectations, netting our investors a return that is twice the return of this hurdle. As it turned out, these returns have been additive to the returns of my own overall portfolio; we hope you have had the same experience.

What Comes Next?

At the beginning of a new year that will usher in a new administration, most of the questions we are getting relate to how things will change going forward for our portfolio companies and the industries in which they operate. While we can make some informed observations we won’t make any predictions. We resist forecasting the future because that effort does not factor into our thinking on how we actually run the portfolio. Minds greater than ours have offered up the following wisdom on forecasting:

“You make more money selling advice than following it. It’s one of the things we count on in the magazine business – along with the short memory of our readers.” – Steve Forbes

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” – Lao Tzu

So, in the spirit of Lao Tzu, what we attempt to do is have a better knowledge of the things that have already happened so we can develop a better understanding of the underlying mechanisms by which things work. This is why we get out into the field as often as we can and speak to the people who run the companies we invest in, to get as close as we can to the actual facts. But we also get out and talk to hundreds of financial advisors each year to communicate what we have learned, and also to hear how the facts as reported by others, are being perceived. Like the game of “Telephone” we played in elementary school, facts get lost, modified and downright invented between the source and the person who is hearing it fourth or fifth hand.

This effect is known by just about everyone but when professionals in the investment management business are asked to interpret price changes in the market, they very often say, “the market is irrational”. I think that is an insult to irrational people everywhere. The “market” is not irrational. The market is made up of all kinds of participants and while many of those participants, in our view, are ill-informed and therefore express poor judgement on the billions of dollars they oversee, I don’t see them as lacking reason. What we try to do is have a first-hand knowledge of the facts before they get distorted, with the goal of having a better understanding of how things work so we don’t exercise bad judgement.

With all that as a backdrop, let’s get on with what has changed and what has not. The most obvious change to the industries we operate in is that we are going from a president who had a strong environmental bent (former President Obama stated in 2008 he wanted us to “be the generation that finally frees America from the tyranny

of oil.”) to a new president who thinks environmental rules, like the Clean Power Plan, have gotten to the point of – well, to put it politely, regulatory overreach.

Most will remember that TransCanada Corp.’s Keystone XL pipeline was a major lightning rod for the debate about the development of fossil fuels. The Obama administration seemed opposed to it from the start in early 2009. The reasons for not granting approval changed over the course of the various proceedings, including threats to the Ogallala Aquifer in Nebraska, “significant adverse effects to certain (i.e. Native American) cultural resources” and greenhouse gas emissions. Those arguing against the pipeline included all the “usual suspects” but it also included NASA’s chief climate scientist, James Hansen, who said if the pipeline were approved it would be “game over for the planet.”

The “game over” and “tyranny” comments are inflammatory, not to mention, grossly inaccurate. First, the entirety of the oil sands in Canada that supply the Keystone XL pipeline contributed only 0.1% of all global greenhouse gas emissions. The idea that a pipeline that would carry a portion of the Canadian Oil Sands production would constitute “game over for the planet” is just ridiculous, in our opinion. Put this in the context of the burning of rain forests in order to use the land for livestock grazing and agriculture, which constitutes between 10-15% of greenhouse gases depending on which research you read. According to the United Nations, domesticated livestock generates more CO2-equivalent greenhouse gases than the entire transportation sector, not including the effect of deforestation for the purpose of feeding cattle. According to the UN, the growth of meat consumption is one of the largest and most concerning contributors to greenhouse gases, not building pipelines.

Carbon emissions exhibit an “80-20 rule” pattern. The top 10 polluting power plants in the U.S. account for 3- 4% of U.S. CO2 and 0.5% of all CO2 emissions on the planet, five times what the oils sands produce. The top 100 plants represent about 20% of the CO2 emitted in the U.S. and over 3% globally. Is it “game over” because these plants continue to operate? Converting those 100 plants to natural gas would reduce more carbon emissions than shutting down the entire oil sands operation. In fact, if Keystone XL never gets built, the oil will still be produced and shipped through other pipeline expansions on existing rights of way, or worse, by rail.

Secondly, the idea that fossil fuels exercise tyranny over humans is, in our opinion, absurd. Before the widespread use of fossil fuels, the conversion of raw energy into mechanical energy was provided almost entirely by humans and animals, and in times past, a not insignificant portion of those humans were slaves. Citing The Rational Optimist by Matt Ridley, “It was coal that gave the Industrial Revolution its surprising second wind, that kept the mills, forges and locomotives running, and eventually, fueled the so-called second Industrial Revolution of the 1860s, when electricity, chemicals and telegraphs brought unprecedented prosperity and global power. Coal gave Britain fuel, equivalent to the output of fifteen million extra acres of forest to burn, an area the size of Scotland. By 1870, the burning of coal in Britain was generating as many calories as would have been expended by 850 million labourers. It was as if each worker had 20 at his beck and call. The capacity of the country’s steam engines alone was equivalent to six million horses or forty million men, who would otherwise have eaten three times the entire wheat harvest.” Britain had run out of forests to burn and rivers to dam for water wheels. Ridley further asserts: “It was fossil fuels that eventually made slavery – along with animal power, and wood, and water

– uneconomic”. In the twentieth century, oil replaced a large portion of coal and in the twenty-first century, natural gas is replacing both coal and oil, using a fraction of the water and a fraction of the land required to harness this energy, and generating a fraction of the pollutants of all kinds, including greenhouse gases. CO2 emissions in the U.S. have declined 15% from their peak (according to the Energy Information Administration) in 2008, primarily because of the substitution of coal with natural gas in power generation, i.e. one fossil fuel for another.

Yet, over the seven years that the Keystone debate raged on, it acted like a black hole that sucked in all angry disagreements between the anti-fossil fuel crowd and the drill-baby-drill crowd, allowing thousands of miles of pipelines to be constructed without attracting national attention. Former President Obama helped fan the environmental flames during the back-and-forth between regulators, Congress, Nebraska, TransCanada. The debate dragged on for nearly seven of the eight-year Obama Administration until the president denied approval of the pipeline in November of 2015. However, ultimately, Obama took the middle road: “For years, the Keystone pipeline has occupied what I, frankly, consider an overinflated role in our political discourse. It became a symbol too often used as a campaign cudgel by both parties rather than a serious policy matter. And all of this obscured the fact that this pipeline would neither be a silver bullet for the economy, as was promised by some, nor the express lane to climate disaster proclaimed by others.”

Actually, despite the outward environmental rhetoric, during the Obama Administration, the oil and gas industry increased production over the past eight years at a historic rate, and installed thousands of miles of new pipe. Anecdotally, we later found out that in 2014, while the Keystone XL debate was reaching a fever pitch, the management of another large pipeline company in the country told us that it had been invited to the West Wing to meet with senior White House officials. These officials, who reported directly to the president, wanted to know what they could do to assist in getting one of their proposed pipelines permitted and built. Yes, assist. The reason was that farm-state senators wanted a new oil pipeline to get built because they were getting too many complaints about how the rail system was clogged with railcars carrying crude oil.

I am not arguing that Obama was “pro” fossil fuels, merely that as a politician who wanted to get his friends elected and have a legacy in the history books, he needed the cooperation of other constituencies. No one would accuse him of having been easy on polluters any more than one would accuse Richard Nixon of being soft on Communism, yet Nixon initiated détente with the Russians and opened diplomatic channels with Communist China. And history would hardly characterize Nixon as an environmentalist, but it was under his administration that the Environmental Protection Agency was established, not the Democratic administrations that book-ended his truncated two-term presidency. The Republican Nixon also imposed wage and price controls to stem inflation. It was the Republican George W. Bush who oversaw the largest reductions to sulfur emissions from coal-fired power plants as his administration’s revisions to Title IV of the Clean Air Act imposed more stringent rules that cost the industry billions of dollars to comply. “W” also signed into law the Energy Independence & Security Act of 2007 that literally outlawed most incandescent light bulbs. Gotta love those free-market Republicans.

Now we now have an incoming president who positions himself as the exact opposite of Obama in terms of his disposition toward the fossil fuels industry. Many in the industry look upon this as a positive as it might result in looser regulations and a more aggressive stance with those protesting and delaying pipeline construction. But let’s look at another two anecdotes as a window into the dynamics behind the headlines.

The first is what happened when Energy Transfer (one of the largest pipeline operators in the U.S.) took an aggressive stance in dealing with protesters of the nearly-completed Dakota Access Pipeline (DAPL). DAPL runs over 1000 miles from the Bakken oil formation in North Dakota to the junction of other crude pipelines in Patoka, Illinois. While Energy Transfer followed all the rules, obtained permission from all the state, regional, special district and Federal Government agencies, the Standing Rock Sioux tribe remained opposed, saying it threatened their water supply. While both sides can argue the merits of their cases and how those merits have been presented, Energy Transfer’s bone-headed use of guard dogs and pepper spray on protesters while the cameras were running, has helped the #NoDAPL protests go viral by attracting celebrity protesters and crowdfunding. They have created a lightning rod that has been a significant setback not only for their project but for the entire pipeline industry.

Energy Transfer’s position is that the law should be followed and adhered to regardless of whether one agrees with those laws. But protestors seek to change those laws because they feel, rightly or wrongly, that they, or those for whom they are protesting, have been wronged. If you want to get every idealistic college student in America out of the classroom protesting fossil fuel development, a president who is insensitive to their concerns and energy companies pressing their rights with water cannons, would be a good first step.

Now consider an anecdote not in the national news that involves a pipeline project that is moving forward in the eastern part of the U.S., transporting natural gas from the growing production coming out of the Marcellus/Utica fields in Pennsylvania and Ohio. The new pipeline is being built by one of the largest midstream companies in North America with a management team that is, in our view, more mature, thoughtful and effective than the team building DAPL. In an effort to address all local concerns over the construction of nearly 200 miles of new pipe in Pennsylvania, the management reached out to all Native American tribes that might have any historical connection to the region. The company even paid for the tribes to hire experts to assist in their efforts. Over the course of many months, neither the tribes nor their experts could find any evidence of sacred lands that would be disturbed by the new right-of-way. Never to take Yes for an answer, the Sierra Club initiated a hunt for a tribe who would object. The nearest it could find was a tribe in Rhode Island. Because of the honest effort by the company to listen to the concerns of those who might be affected by the new pipeline, it was clear the Sierra Club’s efforts were a cynical and futile attempt to use Native American concerns to further its environmental agenda.. As a result, this pipeline has received its critical Final Environmental Impact Statement and quietly moves forward toward final certificate approval.

We relay these stories to make a couple of points. The first is that what happens in the headlines often obscures the boring and meticulous work that goes on in the background–leading to a misunderstanding of the mechanism by which these industries work with their regulators, their customers and their potential opponents. What happens on the 6 o’clock news is important too, and effective politicians have used that to their advantage for decades. When I was in graduate school, I was a research assistant on a book about the history of U.S. natural resource strategy. I learned that the relationship between the petroleum industry and the U.S. government, going back decades, is one of flogging the major oil companies like Exxon in the public square, while helping the smaller independent petroleum companies with tax incentives, exemptions from regulations and quotas. We even had oil import quotas from 1957-1973 to protect the independent oil producers. After all, Texas represents a lot of electoral votes.

The second point is that regardless of the political environment and public sentiment, which poorly-managed companies blame for their own failures and well-managed companies always seem to get things done. It’s another important reason why we focus so much on a company’s management teams to assess their capabilities, because we know the business and political environment, unpredictable though they may be, will sometimes be hostile.

All Things Re-NEW-able Again

Another area of our portfolio that some think will be affected by the new administration is the area of renewable power generation. Some in the press have opined that the growth of renewables is bad for power utilities across the board. It’s true that excess power generation, regardless of the source, is bad for merchant power generators, but not for the regulated utilities we invest in, whose earnings grow with the investment of new capital in their regulatory asset base. Public sentiment favors renewable energy, and that has driven 38 states to use their own authority to initiate renewable power mandates or goals, many of which date back to the 1990s (source: DSIRE, August, 2016). Remember, Mitt Romney boasted that one of his accomplishments as a

Republican governor of Massachusetts was presiding over the demise of coal-fired power generation in that state, including the Salem Harbor coal plant which closed in 2003 because Massachusetts (not the Federal Government) had passed new rules to reduce power plant emissions of nitrogen oxide, sulfur dioxide, carbon dioxide and mercury.

Most of the regulated utility management teams that we speak with recognize that investing in their networks to expand the use of renewable energy not only aligns their business with public policy and sentiment, it also drives growth through new capital investment. The new administration’s focus on fossil energy has “triggered” concerns that tax incentives for wind and solar are threatened, but these are already being phased out over the next three years. While federal policy uncertainty may slow the pace of renewable energy growth, wind and solar aren’t likely going away for two main reasons. One, technological improvments mean that in the windier and sunnier parts of the country, wind and solar are emerging as competitive new sources of electricity, even without incentives. Two, regardless of the pendulum swings in Washington, state governments have enacted laws that address the environmental concerns of their constituents, and that is likely to continue moving forward.

Into the Unknown

Because the future is unpredictable, we run the portfolio accordingly. That means we invest in the best assets run by the best management teams. It means we seek non-cyclical energy infrastructure companies that have a high-dividend payout ratio because that dividend is a bird in the hand. We like growth in dividends as much as the next guy, but understand that growth is delivered by competent management teams and great assets, not macro and industry factors. The boom in oil and gas production led to a boom in midstream asset construction which, in turn, led to dramatically lower margins for those unregulated assets with variable margins. The average MLP did better for its investors before that shale boom than after it. Temporal industry, company and macro factors and the market’s misunderstanding of them has, and will, probably continue to give us rebalancing opportunities.

I’ll finish with one last quote about predicting the future:

“With high hope for the future, no prediction in regard to it is ventured.” – Abraham Lincoln

This last quote is one of my all-time favorites because it is the last sentence in the first paragraph of Lincoln’s second inaugural address delivered on March 4, 1865, a mere 36 days before the end of the Civil War on April 9th at Appomattox Courthouse. It follows a phrase stating that the efforts of the army are “…reasonably satisfactory and encouraging to all.”. Talk about an abundance of caution.

That sums it up for us, as well. We do hope our past track record is viewed as “reasonably satisfactory” by others. And while we, too, “have high hope for the future,” we will make no predictions other than a forecast that we will continue to work hard doing the same thing we have been doing for the last 13 years.

Best Regards,

James J Murchie

Past performance is not indicative of future results. Performance information provided for the Energy MLP Income Fund (EMIF or the “Fund”) assumes the reinvestment of interest, dividends and other earnings and is net of fees. There is no assurance that the Fund’s investment objective will be achieved.

The EMIF portfolio information regarding dividends and portfolio company prices is provided as an example of EIP’s investment philosophy and strategy and not an offer or sale of any security. Information in this letter regarding specific MLP instruments and other companies, including any information pertaining to the performance of such instruments and other companies, is provided solely as a tool for general industry analysis. Under no circumstances should it be assumed that the Fund or any other account managed by Energy Income Partners, LLC derived any benefit from the performance of any MLP or company referenced herein. Information provided is believed to be accurate as of the date on the materials. EIP reserves the right to update, modify or change information without notice. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. This Document is not an offer or solicitation with respect to the purchase or sale of any security. This Document is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person under any circumstances. This Document is not intended to constitute legal, tax, or accounting advice or investment recommendations of any particular security or industry. Investors are encouraged to conduct their own analysis before investing.

CIRCULAR 230 NOTICE. THE FOLLOWING NOTICE IS BASED ON U.S.TREASURY REGULATIONS GOVERNING PRACTICE BEFORE THE U.S. INTERNAL REVENUE SERVICE: (1) ANY U.S. FEDERAL TAX ADVICE CONTAINED HEREIN, INCLUDING ANY OPINION OF COUNSEL REFERRED TO HEREIN, IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES THAT MAY BE IMPOSED ON THE TAXPAYER; (2) ANY SUCH ADVICE IS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS DESCRIBED HEREIN (OR IN ANY SUCH OPINION OF COUNSEL); AND (3) EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

These materials do not constitute an offer of securities. Such an offer will only be made by means of the Confidential Memorandum to be furnished to prospective investors at a later date. This document is confidential and is intended solely for the information of the person to whom it has been delivered. It is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior written consent of the Fund. Notwithstanding anything to the contrary herein or in the Confidential Memorandum, the recipient (and each employee, representative or other agent of such recipient) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of (i) the Fund and (ii) any transactions described herein, and all materials of any kind (including opinions or other tax analyses) that are provided to the recipient relating to such tax treatment and tax structure.

A description of the Alerian MLP Total Return Index may be found at http://www.alerian.com/indices/amz-index/. The index performance is provided for information purposes only.

The Wells Fargo Midstream MLP Total Return Index consists of 35 energy MLPs and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology.

PHLX Utility Sector Index (UTY): Market capitalization weighted index composed of geographically diverse public utility stocks.

NAREIT Equity REIT Index: An index of all publicly-traded, tax-qualified real estate investment trusts that are Equity REITs as determined and compiled by the National Association of Real Estate Investment Trusts. (NAREIT).

S&P 500 Index: A capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incur fees or expenses and an investment cannot be made directly in an Index.