On December 13, 2021, California’s utility regulator (CPUC) proposed changes that would reduce the price retail customers receive for rooftop solar generated power they sell to the grid by at least 70%[1]. California has power reliability problems and (nearly) the most expensive retail electricity prices in the country. This proposed order addresses not only costs but who bears them. It also begins to address system reliability. While this proposal will surely evolve as public comments pour in, we view it as a step in the right direction because a sustainable energy system cannot be based on unsustainable economics.

Hidden Subsidies for the Wealthy

While solar panels are attached to your roof, they cannot power your house without also connecting to the grid because the power must be synchronized to the 60 Hertz AC frequency used by all U.S. appliances and to balance their inherently variable power output. Most customers didn’t realize this until recent blackouts shut off power to their homes just like those with no solar panels. In effect these rooftop panels represent thousands of small suppliers to the grid.

Commercial power generators sell their power into the grid at wholesale prices that have averaged about 5 cents per kilowatt hour (kWh), but California residential customers with solar panels sell their excess power at the full retail price, which currently averages over 21 cents per kWh[2]. The difference between wholesale and retail prices reflects the high cost of building and maintaining the grid and every wire hooked up to every house. Since allowing Californians with large homes, large roofs and large bank accounts to sell a wholesale product at retail prices sounds um, well, kind of bad, this practice was instead called “net metering” (abbreviated as NEM), so-called because the customer pays for the “net” difference between the power they need and the power they sell.

Consumer advocates–who show up at every public utility commission hearing–have long argued that this subsidy is a highly regressive form of taxation and that if states want to subsidize renewable energy, they should do so in a more transparent and fair way. The subsidy is not small: 1.3 million customers have installed about 10 gigawatts of rooftop generation, over 10% of the state’s installed power generation capacity generating close to 18 billion kilowatt hours of electricity[3]. At a 15-cent subsidy, that amounts to about $2.6 billion dollars per year or about 1.4% of California’s tax revenues. Even the California PUC calculates that customers benefitting from net metering are paying only about 10- 20% of the cost to serve them[4].

One positive development of the proposed order—already getting howls of protest–is for NEM customers to pay a fixed fee for the use of the grid. We have argued long and hard that connectivity to the grid has enormous value and that legacy poles-and-wires utilities will not be made obsolete or be dis-intermediated. Quite the opposite. Their infrastructure creates a shared network of diverse energy sources that will always be cheaper than a system of millions of disconnected “island” households generating and storing their own electricity. The CPUC proposed order is a big step forward in having customers pay for the services they receive and not pay for those they don’t.

System Reliability Needs to Catch Up

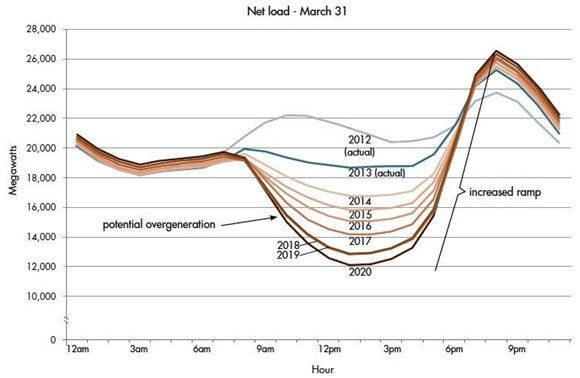

California’s solar boom—and the attendant problems—are illustrated in Figure 1, often referred to as the “duck curve,” which depicts the demand for dispatchable (always available) power. The duck’s belly reflects growing solar generation during the sunniest hours of the day, which can exceed demand in some parts of the state. The NEM subsidy did what it was designed to do—add solar capacity—to the extent that it’s often oversupplied. The increased solar penetration also sharply steepened the duck’s “neck,” the need for dispatchable generation to take up the considerable shortfall in supply that happens when the sun sets.

Exhibit 1: The Solar “Duck Curve”

Source: https://www.energy.gov/eere/articles/confronting-duck-curve-how-address-over-generation-solar-energy

As we’ve written about previously, California’s most pressing need today is for dispatchable power generation that’s available around the clock, regardless of weather or location. The proposed NEM changes address that in part by introducing a new payment that encourages customers to add solar paired with on-site storage, or to add storage to existing solar installations.

What Happens Next?

The CPUC has opened a 20-day comment period and has indicated that the proposed rule could be on the agenda for its January 27, 2022, meeting. Energy and climate are fighting words in California and the “spin” on removing this subsidy is gathering steam. We expect an extended, vitriolic, and highly litigious process will follow this proposed decision—the show’s just getting started. The solar industry is already claiming that the proposed rule changes will drive increased utility profits, which is absurd because as regulated monopolies, utilities earn an allowed return on invested capital, not a profit on sales.

The proposed changes to California’s NEM rules are intended to not only remove incentives that exacerbate an already saturated solar market, but also to more equitably share costs and benefits of distributed generation and provide economic support for badly-needed energy storage with solar to help address the end-of-day shortfall. It’s a move in the right direction.

From an investment standpoint, this development, and the attendant drop in upstream solar stocks and indices highlights the risk of investing in supply-end energy providers like small-scale residential solar panel companies whose costs are not competitive without subsidies.

[1] Source: J.P. Morgan Equity Research, EIP Estimates.

[2] Source: U.S. Department of Energy, Energy Information Administration, Electric Power Monthly, September 2021.

[3] Source: California Public Utilities Commission Proposed Decision R.20-08-020, EIP Estimates.

[4] Source: California Public Utilities Commission Proposed Decision Factsheet.

The above is Energy Income Partner LLC’s (EIP) opinion and such opinions may change without notice or duty to update. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. Discussions of companies are not for investment purposes but to describe those companies involved in new nuclear technologies. Any investment may lose money, including investment principal.