High net worth investors have long included both consumer staples and pipeline and power utilities in their portfolios to capture higher dividend yields and growth that acts as a hedge against inflation. Since food and energy are daily essentials, investors figure that rising costs have to be passed through in end-user prices because consumers cannot defer their purchase as they can with durable goods like appliances and vehicles.

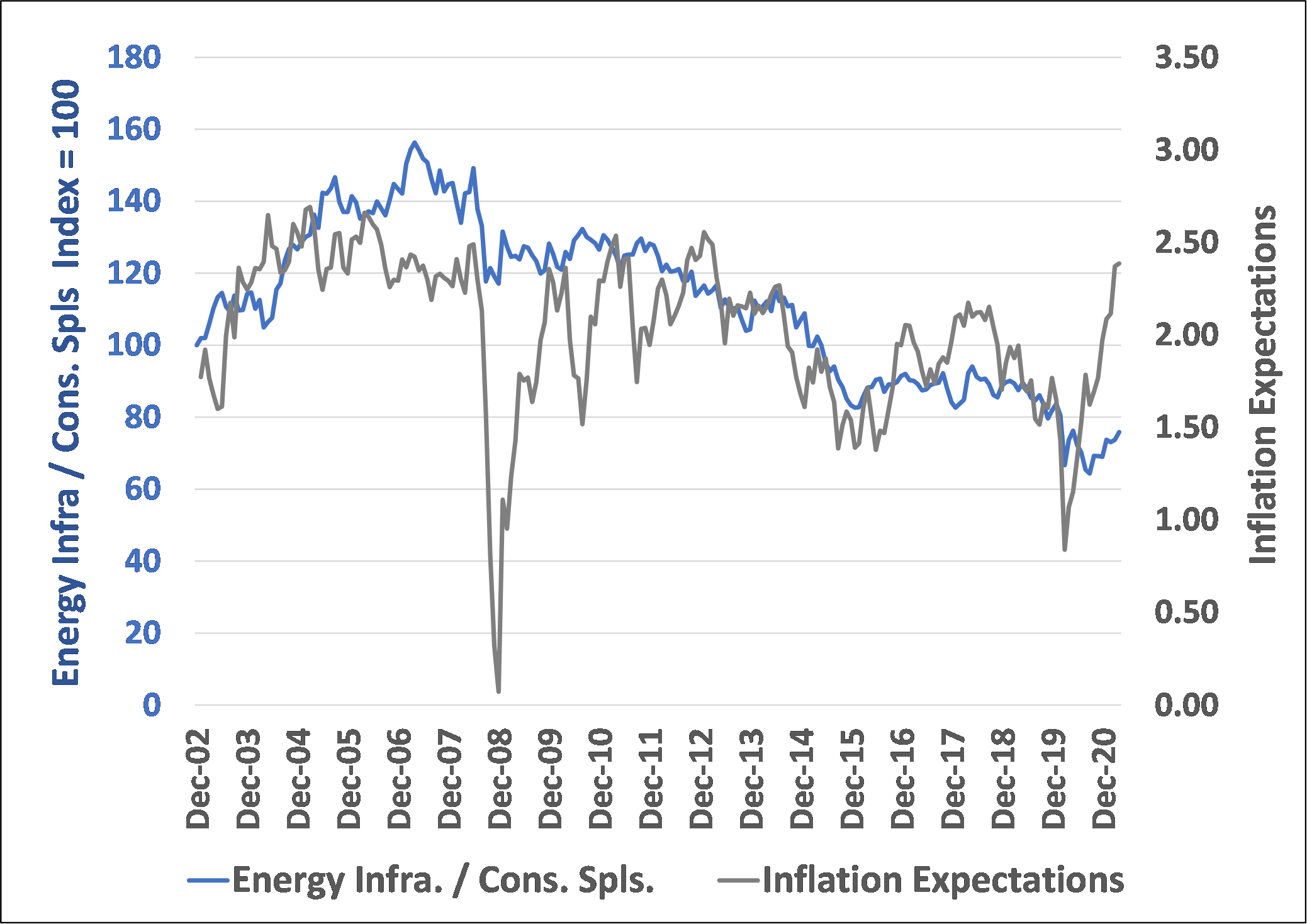

But when we compare the relative performance of energy infrastructure to consumer staples, the former is the clear winner in inflationary environments like we are currently experiencing. The graphs below compare the relative performance of energy infrastructure[1] to the S&P Consumer Staples Index (blue line) with two measures of inflation: the Bloomberg Commodity Index (orange line) and the 10-year breakeven inflation rate-the gap between the 10-year Treasury Bond and Treasury Inflation Protected Securities (TIPS) (gray line).

In fact, based on past patterns, the relative performance of energy infrastructure has a long way to go to catch up to moves in commodity prices and inflation expectations. Valuation supports this as well.

Today energy infrastructure has a dividend yield of 4.7%[2] compared to 2.7% for consumer staples. Valuation is also more attractive with a P/E of 16.8x for energy infrastructure versus 22.9x for consumer staples.[3] While historic growth for consumer staples has done better than an index of energy infrastructure, our portfolios have had substantially higher growth over the last 17+ years than either the consumer staples sector or the S&P 500.

[1] Energy infrastructure is a 2/3, 1/3 weighting of the PHLX Utility Sector Index (UTY) and the Alerian MLP Index (AMZ).

[2] IBID

[3] IBID

The above is Energy Income Partner LLC’s (EIP) opinion and such opinions may change without notice or duty to update. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. Past performance is not indicative of future results, which may vary significantly due to changing conditions. Any investment may lose money, including investment principal. Accounts managed for partial periods may have experienced materially less favorable results than those portrayed over the highlighted time horizon. The indices have not been selected to represent an appropriate benchmark with which to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well-known and widely recognized indices. An index is unmanaged, does not incur fees or expenses and an investment cannot be made directly in an Index.