This deep dive is for readers who want more background to our Insights post on Friday, August 20, 2021, regarding the drivers of electric vehicle adoption across the on-road fleet and the glacially slow impact we expect it to have on oil demand over the next ten years. In our opinion, the four factors that drive this result are:

- The portion of new vehicle sales that are EV (or powered by any non-petroleum-based fuel);

- How quickly the on-road fleet turns over (e.g. the scrap rate of existing vehicles);

- Growth in miles driven and the need for new vehicles to meet that demand; and

- Demand growth for non-transport uses of crude oil (e.g. petrochemicals and fibers, lubricants, asphalt, space heating and industrial energy usage).

Since there are already a host of oil demand forecasts out there from organizations that do forecasting for a living, we took a different approach and simply modeled the on-road vehicle fleet and set inputs at extreme levels that would drive EV adoption faster than anyone is forecasting. While we maintained the current scrap rates, we used the following three input parameters, which, in our view, no responsible forecaster would sign off on:

- That 50% of ALL global on-road vehicle sales, not just passenger cars, would be EV or fuel cell powered by 2030, and that 100% would be reached by 2035;

- That off-road transport (shipping, rail, aviation) would follow a similar path away from petroleum-based fuel;

- That the annual growth in the on-road fleet going forward would be 2% rather than its historic rate of 4% in the five years prior to COVID.

The result of our inputs was lower oil demand in ten years compared to all the other forecasts but still at or above what it was in 2019 prior to COVID. Between 2030 and 2035, our model has oil demand declining about 2% per year. It’s only after 2035 that our model, with these aggressive assumptions, starts predicting faster declines in worldwide oil demand.

The math behind the model is relatively simple but proves curiously difficult to overcome. New vehicle sales are important, but what matters most are the rate of growth in the on-road fleet (which is still mostly ICE) and the scrap rate. Simply stated, it will take time to replace today’s global fleet of nearly 1.5 billion[1] internal combustion engine vehicles (ICEs) that continues to grow every year.

Changing the result offered by our model would require a higher scrap rate that would in turn drive more EV sales which would ultimately require converting most of global vehicle manufacturing from ICEs to EVs at a record pace. The scale of meeting such a challenge, in our view, is proportional to the manufacturing mobilization efforts seen during World War II.

What follows is a walk-through of the math behind our model to illustrate the impact these inputs have on the resulting demand for crude oil.

We’ve left two other important topics surrounding rapid EV penetration for future Deep Dives: 1) implications for and the investment opportunities surrounding upgraded global power grids to handle all the charging needs associated with these additional EVs, and 2) implications for oil industry capital spending.

But first a word about why we did this analysis.

Why We did This Analysis

The headlines that global crude oil demand is not likely to fall – and may even rise – over the next ten years is the source of endless questions from our investors, yet it has no practical impact on our portfolio. Why? Because crude oil logistics is a very small part of our portfolio, and the profitability of those assets are driven by the cost position of the oil fields at the supply end of the system and the refineries at the demand end of the system combined with competition from other logistic assets. Natural gas and electric power logistics make up the bulk of our portfolio because the investments there are less exposed to merchant competition and are experiencing higher growth rates due to cost and performance advantages.

It has long been our view that EV adoption will happen for the same reasons that drive adoption of all new technology: cost and performance. Thomas Edison and Henry Ford formed an electric vehicle joint venture about 100 years ago[2] but neither performance nor cost has been able to beat that of the ICE vehicle, primarily due to the battery.

But batteries are improving rapidly in both cost and performance. The lines are converging, and it is easy to see them crossing in just a few years, especially when governments subsidize EVs. Betting against the engineers and the breakthroughs in technology they exploit is never a good wager. Instead, there will likely be numerous opportunities for our regulated monopoly gas and electric network operators to invest in EV related projects like charging facilities as well as grid and generation assets needed to support growing demand.

From a policy perspective, decarbonization should happen first where it is cheapest and where it will have the least negative impact on performance (and if done right, an improvement in performance). Decarbonizing the power sector is happening first and, in our opinion, electrifying the transport system likely follows on its heels. Together these sectors account for 70%[3] of global carbon emissions and both have a material impact on our investment universe of energy infrastructure companies.

Energy policies in the U.S. have thus far encouraged and benefitted from technology and innovation resulting in lower, not higher, costs for natural gas and electricity. A modeling exercise like ours is doubly useful in that it identifies the levers policy makers will have to pull if they want to drive a faster transition but also the ones that will have little to no effect. Perhaps a cash-for-clunkers program paired with incentives for manufacturers could accelerate fleet turnover. But extending incentives beyond passenger vehicles to commercial vehicles and off-road transport would also have a significant impact because, combined, they represent just as much of global oil demand as passenger cars.

If policy makers were to pull these levers, the EV industry would need to make massive investments in manufacturing capacity to meet the extra demand and electric utilities would need to accelerate their growth in grid capacity to produce and deliver the extra electricity needed.

A Walk Through the Modeling Exercise

In making our first major assumption regarding EV sales as a percent of all vehicle sales (50% by 2030 and 100% by 2035), we set aside any issues of costs, range anxiety, and EV charging infrastructure constraints that could impact market demand for EVs. In short, the assumption we made implies that regulatory policies will be sufficient to incent both demand and what’s needed to deliver it. This represents a faster rate of growth than anyone, to our knowledge, is forecasting.

An even more aggressive element of this model input is to assume the 50% of new sales in 2030 and 100% in 2035 will apply to ALL on-road vehicles, including heavy trucks. While some manufacturers like Tesla are researching electric tractor-trailers, others are looking at hydrogen fuel cells. Either way, unlike passenger vehicles that already have over 3 million of EV sales per year[4], heavy trucks are still in the prototype phase. This assumption is significant because while passenger vehicles represent 27% of world crude oil demand, commercial vehicles represent an additional 17%[5]. So, while the discussion that follows analyzes the passenger vehicle fleet, in our model we simply applied this math to the 17% of oil demand represented by commercial vehicles.

Today, there are ~1.2 billion passenger cars on the road globally[6]. Less than 1% of these are EVs. The U.S., Europe, and Asia (excluding China and India) make up 54% of the fleet. The remainder is spread across China, India, and the rest of the world, where we are forecasting ~80% of fleet growth to occur over the next decade (similar to the last five years).

In our scenario, we first assume an annual growth rate of 2% in the global vehicle fleet. This is about half of the average rate in the five years that preceded COVID (2015 – 2019) and translates into demand for 25 – 30 million cars to be added each year to the global fleet. A 4% growth rate would require 50 – 60 million cars.

In addition to the cars demanded from fleet growth, we also need to replace the cars that are retired or scrapped each year. The scrape rate averaged ~4% of the current global fleet size or ~45 million cars each year in the four years prior to COVID[7].

Therefore, to meet annual demand of 2% growth as well as typical ICE scrap rates of ~4% of the global fleet size with EVs instead of ICEs, we would need an EV production capacity of 70 – 75 million cars per year. Today, global EV production is a small fraction of global vehicle production, amounting to 4% in 2020 and forecast to be 6% this year[8].

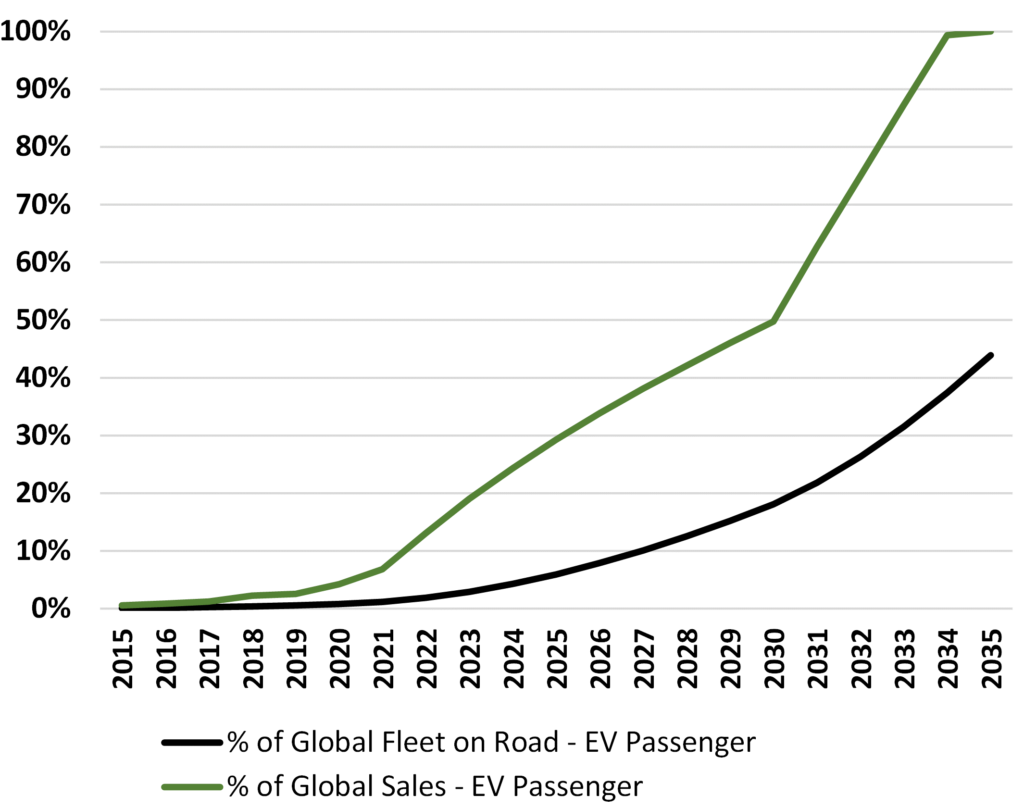

We then applied our EV market share targets: 50% of all new sales are EV by 2030 and 100% by 2035. Exhibit 1 illustrates how even under such an aggressive EV adoption curve, fleet turnover from ICEs to EVs takes much longer as it’s limited by the scrap rate and fleet growth while, in our model, we allowed EV production capacity to grow at 28% per year[9].

Exhibit 1: EV Adoption: New Passenger Vehicles Sold vs On-Road Fleet

Source: EIP, Bloomberg NEF

Source: EIP, Bloomberg NEF

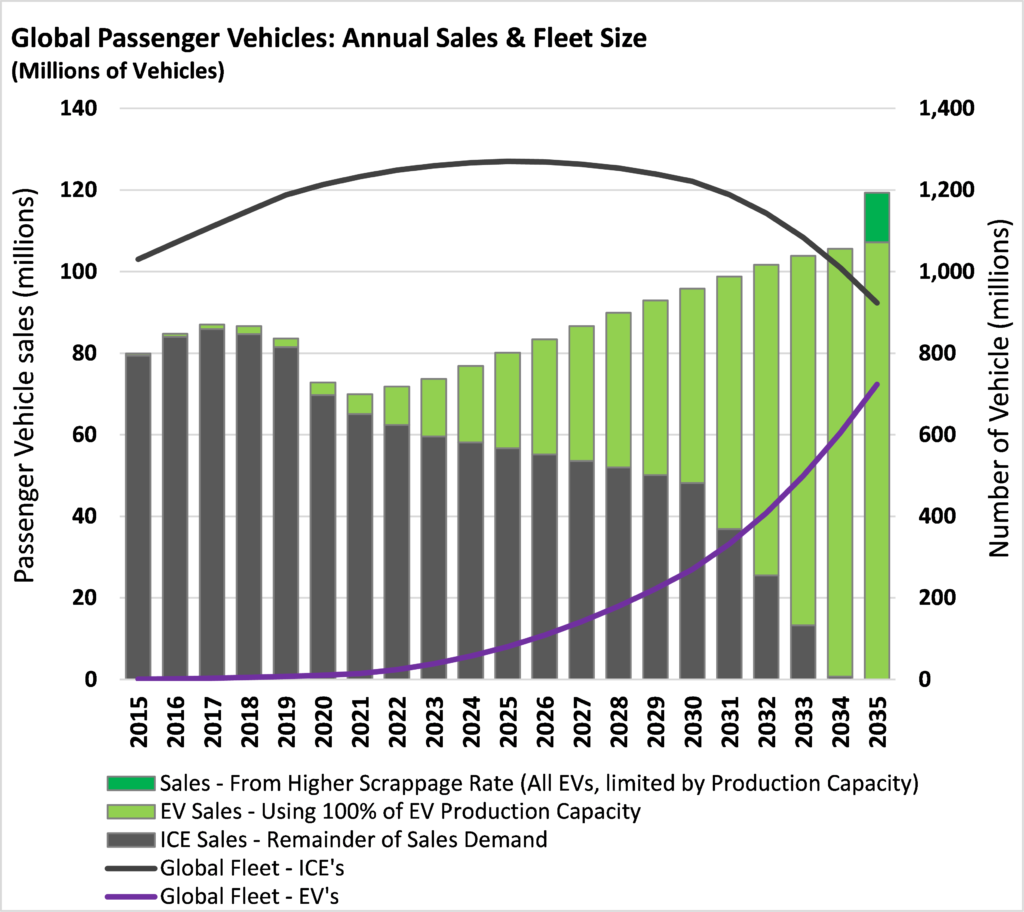

Exhibit 2 illustrates the progression of the primary model outputs. The grey-shaded bars represent sales of ICEs, and the green-shaded bars are sales of EVs. We first allocate all assumed EV production to new sales and then to the base ICE scrap rate. Only when there’s enough EV production capacity to cover both growth and the base scrap rate can we increase to a higher scrap rate (dark green bar in 2035).

The black and purple lines in Exhibit 2 (right-hand axis) really drive home the point: even with EVs representing 100% of sales in the early part of the 2030’s, the remaining number of ICEs on the road is nearly 1 billion.

Exhibit 2: Annual Global Passenger Vehicle Sales & Fleet Size Mix Over Forecast Period

Source: EIP, Bloomberg NEF.

Source: EIP, Bloomberg NEF.

The pace of the ramp-up in EV production capacity is therefore an important model input because the number of ICEs on the road will continue to increase until EV production is capable of meeting both new fleet demand as well as the annual scrap rate.

Simply put, there are physical limits to producing/selling that many EVs in such short order. For some perspective: Volkswagen Group is the largest automaker in the world, producing nearly 11mm vehicles[10]. It took over 80 years for that company to get to today’s scale. Tesla has been around since 2003, released its first car in 2008, has an enterprise value of $670 billion[11] but is only just approaching a run-rate of 1mm vehicles/yr sold[12]. Getting to 100 million EVs by 2035 would amount to a CAGR of nearly 30% from today and would require a massive infusion of capital and, in our view, significant additional regulatory policies and incentives.

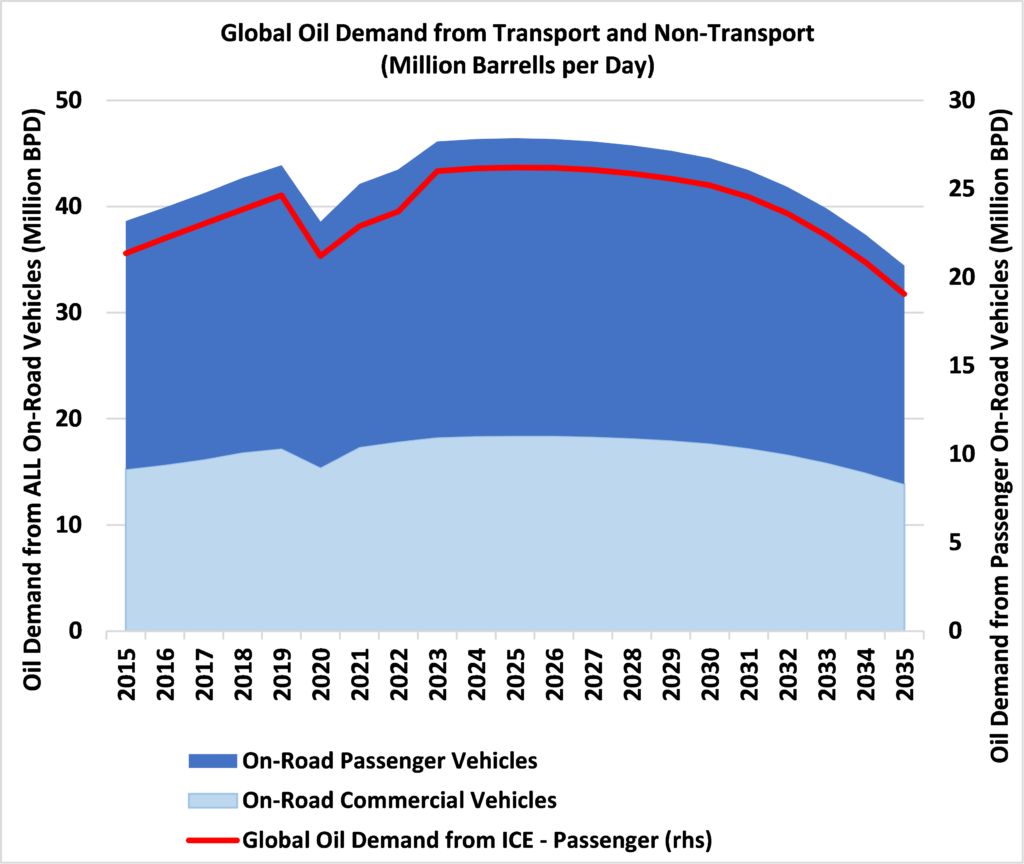

The result of our model inputs is shown in Exhibit 3. The model results in demand for motor fuel of about 45 million barrels per day(MM BPD) in 2030 vs about 44MM BPD in 2019 pre COVID.

Exhibit 3: Projected Oil Demand from On-Road Transportation Sources

Source: EIP, Bloomberg NEF.

Source: EIP, Bloomberg NEF.

Another way to illustrate the results of the model is the waterfall graph in Exhibit 4 where the increased demand for the current fleet of 2% per year is not quite offset by the adoption of EVs. As you can see in this illustration, if demand growth for the on-road fleet were to stay at pre-covid levels of 4% annually, there would be significant growth in motor fuel demand by 2030, in spite of the aggressive EV sales assumptions we plugged into the model.

Exhibit 4: Forecast Changes in Demand from 2019- 2030

Source: EIP, Bloomberg NEF.

Source: EIP, Bloomberg NEF.

How Transportation Fuel fits into Global Oil Demand

Global oil demand (including natural gas liquids, or NGLs) was just shy of 100MM BPD in 2019 (see Exhibit 7).

Exhibit 5 illustrates the breakdown across transport and non-transport applications. About 43MM BPD of 2019 oil demand came from non-transportation uses such as plastics, space heating, and other industrial applications that generally trend with global GDP growth. The remaining ~57MM BPD of demand came from transportation fuels, split across passenger and commercial transport.

Exhibit 5: Sources of Demand for Global Oil and NGLs, 2019

Source: EIP, BP’s Statistical Review of World Energy 2020, Bloomberg NEF. Note EIP used 2019 as a base to remove the near-term impacts of COVID.

Commercial transportation includes light/medium/heavy duty on-road trucks as well as other modes such as rail, aviation and marine. Electrifying these applications will be much more difficult due to the weight and energy density of lithium batteries. Therefore, alternative fuels, such as hydrogen, are seen as a more likely solution, but at adoption rates that, in our opinion, will likely lag passenger car conversion to EVs. It appears, therefore, that the passenger vehicle portion of oil demand, or about a quarter of total global oil demand, will be most influenced by electrification trends.

Exhibit 6 illustrates various oil demand forecasts according to sources ranging from major oil companies to international agencies. In all cases, oil demand isn’t expected to fall below pre-Covid levels of ~100MM BPD until at least the mid-2030’s. Of course, like most oil demand forecasts that came before, all these forecasts are likely to be wrong. But we thought it would be interesting to test how an oil demand forecast would hold up against our rapid EV penetration example.

Exhibit 6: Oil Demand Forecasted to Grow

Source: Morgan Stanley Research’s June 1 2021 Report: “Oil, OPEC and ESG – Raising Long-Term Oil Price Forecasts”, by Martijn Rats, CFA and Amy Sergeant, CFA.. Note: Oil intensity model line is Morgan Stanley’s forecast.

If we assume essentially no growth in the non-transport demand portion of the barrel and a -1% decline in off-road transport (marine, rail, aviation, etc.), the result is shown in Exhibit 7 which combines these forecasts with the model output for the on-road transport sector in Exhibit 3. This result (~100MM BPD in 2030 and ~90MM BPD in 2035) represents dramatically lower oil demand in 2035 than any of the Exhibit 6 forecasts.

Again, the grey area in Exhibit 7 is global oil demand from non-transportation sources which is likely to remain resilient over the next decade+ as gradual declines in demand from Space Heating and Electric Power (~14MM BPD in 2019) are likely to be offset by growing demand for harder to displace Plastics & Fibers and Industrial & Other sources (~28MM BPD in 2019)[13]. This ~40-45% of oil demand serves to dampen the overall impact from reductions in transport-fuel uses.

Exhibit 7: Global Oil & NGL Demand Forecast by Type

Source: EIP, BP’s Statistical Review of World Energy 2021, Bloomberg NEF.

Exhibit 8 rolls the analysis on transport fuels shown in Exhibit 4 forward another five years to 2035 to show that the aggressive inputs into our model really start to take hold after 2030. When we add the ~34MM BPD from on-road transport to the 11MM BPD of other transport (which we declined at the same rate as commercial on-road vehicles) and the 45MM BPD of non-transport demand for oil the total demand is about 90MM BPD. This represents a demand that, while substantially below any other forecast, is still only a 10% reduction from 2019 levels, or a CAGR of minus 0.6%.

Exhibit 8: Forecast Changes in Demand from 2019- 2035

Source: EIP, Bloomberg NEF.

Exhibit 9 extrapolates oil demand for five additional years to 2040, where oil demand falls to 75MM BPD. The average annual growth rate in the 2030’s falls to about -3%. Since worldwide oil depletion rates are somewhere between 4-7%[14], this decline rate would still require the industry to drill new wells to meet demand, albeit at a lower rate than today. But the impact of depletion, ESG constraints and demand growth on capital spending is a subject for another deep dive later in the year.

Exhibit 9: Forecast Changes in Demand from 2019- 2040

Source: EIP, Bloomberg NEF.

Taking Stock of Emerging EV Regulatory Policies

The degrees of regulatory policies around the globe have varying implications for the rise of EVs and the demise of ICEs. Among these policies, the emerging trend is for EV sales goals of 40 – 50% total vehicle sales by 2030.

In addition, there are some countries (about 14 at last count) that have some form of regulation in place calling for zero sales of ICEs past a certain date. Collectively, these countries only make up about 7% of global sales of ICEs, and most are European countries with deadlines in the 2030 – 2040 timeframe[15].

China, with by far the largest market share at ~25% of global sales, has set a policy whereby 40% of new vehicles sold in 2030 will be EVs[16].

The U.S. accounts for ~20% of global market share, both in new sales and fleet size. Regulations aimed at reducing emissions and electrifying US sales were initially set out by President Obama but were rolled back under the Trump Administration[17]. The Biden Administration has since reversed course, calling on automakers to increase the market share of EV sales to 40 – 50% by 2030. On August 5th, Biden put a bit more bite into that request when he unveiled an Executive Order (EO) that aims to hasten the ramp in U.S. production of EVs by increasing Corporate Average Fuel Economy (CAFE) targets.

These standards build on what’s referred to as the California Framework Agreement, an agreement struck in 2019 between the State of California and five automakers (BMW, Ford, Honda, Volkswagen Group, and Volvo). The automakers voluntarily agreed to clean up their cars and light truck fleets through 2026 at about the same rate as the former Obama-era program. At the time, GM chose not to participate. However, on June 9th, 2021, GM did an about-face and not only joined the California standard but proposed to the U.S. Environmental Protection Agency (US EPA) that automakers move even faster to clean up/electrify their fleets under a single national standard.

Biden is proposing 8% annual increases to CAFE targets for model years 2024 through 2026, with further increases through 2030. According to an analysis by Bloomberg’s New Energy Finance group (BNEF), if the 8% growth rate to CAFE targets is extended post-2026, it would raise their projection of EV sales in U.S. to 52% by 2030[18].

The reason U.S. policymakers prefer the CAFE targets, in our view, is that they’re technology agnostic: automakers are free to manufacture their ICE’s to be more fuel-efficient to meet these new targets. The reality, however, is that ICE technology is over 100 years-old and these auto manufacturers have wrung out most of the easy-to-find efficiency gains. We believe that automakers also are less keen to allocate their R&D budgets to older ICE tech versus newer EV and battery tech. Therefore, in our opinion, the result of President Biden’s ratcheting up CAFE targets is that over time automakers will be nudged (almost forced) into producing EVs to ensure their total fleet sales meet the more stringent standards.

This approach is not unprecedented. The Energy Independence and National Security Act of 2007[19] (which was originally named the Clean Energy Act) signed into law by President Bush (43) mandated a 25% increase in light bulb efficiency. So, while not mandating a conversion to LED bulbs, the result was the same.

A Final Note

Declines in oil demand from EVs will occur, it’s just highly unlikely in the 2020’s in our view. At the crux of the issue is the existing base of ~1.5 billion existing ICE vehicles (1.25 billion cars and 0.25 billion trucks)[20] plus demand from global growth and limitations on how fast the world can scrap the existing fleet and convert the vehicle manufacturing base from ICEs to EVs. A “War Powers Act”[21] type of manufacturing mobilization on a global scale would likely be required to make a meaningful dent in global oil demand and emissions from ICEs in the next 10 to 15 years.

It’s important to note that the above is simply a mathematical exercise to illustrate the potential impact on global oil demand under an aggressive scenario of EV market penetration (~50% of all vehicle sales in 2030 and 100% by 2035) to see if we can bend the bullish oil demand forecasts that are out there. We are in the business of managing investor capital, we are not in the forecasting business. Instead, we aim to understand the underlying mechanisms that drive the industry so we can make better investment decisions. Our strategy remains unchanged: we seek to invest in companies run by strong management teams with a track record and propensity for capital discipline that own regulated or regulated-like infrastructure that is the low-cost form of transport for the lowest-cost sources of energy, and that have stable, predictable earnings and dividends that grow over time.

[1] Source: Bloomberg NEF.

[2] https://www.energy.gov/articles/history-electric-car

[3] Source: U.S. Energy Information Administration (EIS), 2019 data used to exclude transitory impacts from COVID.

[4] Source: Bloomberg

[5] Source: BP’s Statistical Review of World Energy 2020, Bloomberg NEF.

[6] Source: All references to vehicle fleet size and market share are from calculations by EIP with data from Bloomberg NEF.

[7] By fleet turnover, we are referring to the scrap rate. This is calculated as the annual sales of new vehicles minus the Y-o-Y change in vehicle fleet size. For the past five years, we used Bloomberg NEF data to calculate an average of approximately 4% per year or ~6% of the fleet size from 15 years ago.

[8] EV’s in 2020 represented just 4% of sales and 1% of fleet size globally for passenger and commercial vehicles, per Bloomberg NEF.

[9] CAGR of 28% from 2019 to 2035.

[10] Source: Bloomberg.

[11] Source: Bloomberg, as of 8/19/2021.

[12] Source: Tesla’s Form 10-Q, June 30, 2021.

[13] EIP, BP’s Statistical Review of World Energy 2021, Bloomberg NEF.

[14] This range is based upon various estimates and depends upon various assumptions, such as OPEC vs. Non-OPEC.

[15] Source: Bloomberg NEF.

[16] Source: https://news.mit.edu/2021/chinas-transition-electric-vehicles-0429

[17] Source; https://www.epa.gov/newsreleases/us-dot-and-epa-put-safety-and-american-families-first-final-rule-fuel-economy-standards

[18] BNEF Insights, “Biden’s Goal of a 50% EV Market Share Gets a CAFE Boost”. Corey Cantor, August 12, 2021.

[19] Source: https://www.epa.gov/laws-regulations/summary-energy-independence-and-security-act

[20] Source; Bloomberg NEF.

[21] US passenger vehicle production was at a roughly 4 million annual rate in 1941 in the months preceding the Pearl harbor attack. Eight weeks later, in early February of 1942, it was effectively zero, making room for production of military vehicles and aircraft. Source: National Bureau of Economic Research.

The Information provided in this article is believed to be accurate as of the date above. EIP reserves the right to update, modify or change information without notice. Any statements of opinion are EIP’s opinion and should not be relied upon as a prediction of any future event. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. Investors are encouraged to seek their own legal, tax, or other advice before investing.