Key Takeaways:

- Biden budget proposal would raise tax credits for carbon capture and sequestration (CCUS).

- Bipartisan efforts on an infrastructure and clean energy bill are gaining momentum with a tailwind of job preservation and creation.

- We think incentives for incumbent energy companies to capture and store greenhouse gas emissions are key to passing a bipartisan bill.

- The real goal of eliminating carbon and methane emissions in the cheapest most reliable way possible is often drowned out by “kill fossil fuels” narrative.

What’s New

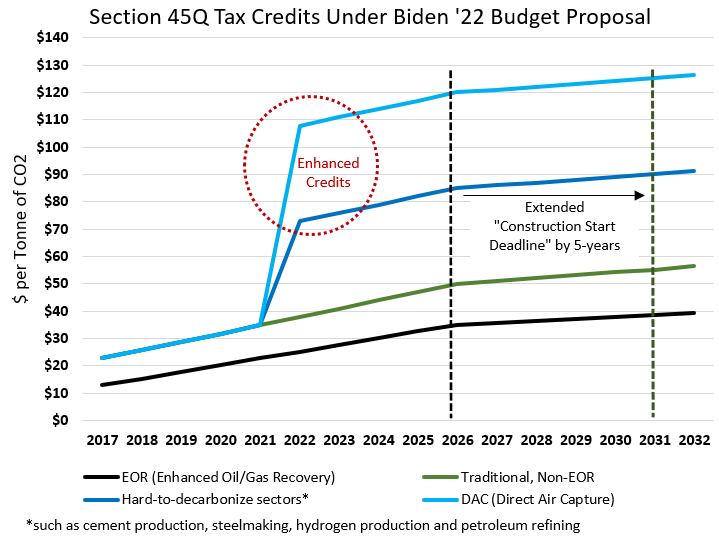

Two weeks ago, the Biden Administration trotted out a proposed budget that would enhance tax credits for “hard-to-decarbonize” sectors like cement, steel and petroleum refining. We believe that the bump to this tax credit (often referred to as “45-Q” for its defining section of the Internal Revenue Code) could be $35/ton, raising the total tax credit from $50 to $85 per ton of CO2 captured and sequestered in the ground or beneficially re-used in a product like cement[1].

US Treasury, General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals (“Green Book”) https://home.treasury.gov/system/files/131/General-Explanations-FY2022.pdf, EIP estimates.

Joe Manchin, Democratic Senator from West Virginia, and THE swing vote in the Senate, has introduced his own legislation supporting CCUS, and passage of any energy bill will require his vote. For that matter, so would a Democrat-led path through the budget reconciliation process such as could sidestep a filibuster. Preserving jobs and the economy of his state are important to Senator Manchin—and are issues woven throughout President Biden’s narrative. Biden’s energy plan, the Energy Act of 2020 (embedded in the Consolidated Appropriations Act signed on December 27, 2020), the draft House Bill Clean Future Act from 2020 and all of the discussions we are hearing about contemplate a very large role for CCUS.

In our view, CCUS has always been essential to bipartisan support for any energy legislation because it garners needed votes from those representing fossil fuel and farmer interests. Since the advent of shale, states with large fossil fuel interests have expanded from Texas, Louisiana and Oklahoma to include North Dakota, Montana, New Mexico, Pennsylvania, Ohio and West Virginia.

The clean energy debate is also maturing beyond just carbon emissions to include methane, which is 80x more potent in its near-term climate impact than CO2. Since agricultural waste and landfills are among the largest source of methane emissions, the geographic interest in creating new sources of revenue from methane abatement is quite broad. And geography, not population, is the arithmetic of the Senate.

Why it Matters

Based on equity valuations, investor sentiment indicates exuberance for clean energy and pessimism for conventional energy. But, in our opinion, the arithmetic of decarbonizing the world economy by 2050 must include economic incentives to drive carbon and methane emission abatement. By our calculations, the agriculture and conventional energy industries combined can drive gigaton-scale reductions of GHG emissions if they can realize a new source of revenue for doing it. Our view is that finding a way to make that happen is exactly what’s being discussed in Washington right now.

Biden wants to decarbonize the power grid 15 years earlier – by 2035. In our view, the only way that happens without California-style blackouts is by CCUS enabling continued use of gas-fired generation as the cheapest and most reliable means of balancing the inherent intermittency of renewables. The costs we have seen for this indicate it will be a large part of achieving the 2035 goal[2]. How can the Administration offer an $85 CO2 credit to refiners who produce gasoline and not provide that same $85 to a power generator that will be needed to electrify the transportation system?

Since the 1970s, the Clean Air Act and the Clean Water Act have reduced untold levels of pollution not by shutting down industry but by requiring those industries to abate or dispose of their waste in places other than the nearby river or into the air. Over time newer, cleaner and more efficient factories replaced older ones. Why will reducing methane and carbon emissions be any different?

CCUS is a Big Opportunity for Pipeline Companies

In our view, pipeline infrastructure companies are particularly well positioned to create entirely new business platforms that could benefit from an emerging CCUS industry given their valuable rights-of-way, knowledge of moving gases, and potential to repurpose overbuilt pipelines. Consequently, we believe that moving and storing captured CO2 could be a multi-billion-dollar investment opportunity for the pipeline industry.

[1] US Treasury, General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals (“Green Book”) https://home.treasury.gov/system/files/131/General-Explanations-FY2022.pdf

[2] IEA (2020), CCUS in Clean Energy Transitions, IEA, (page 103 Box 3.3), Paris https://www.iea.org/reports/ccus-in-clean-energy-transitions.

The Information provided in this article is believed to be accurate as of the date above. EIP reserves the right to update, modify or change information without notice. Any statements of opinion are EIP’s opinion and should not be relied upon as a prediction of any future event. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. Investors are encouraged to seek their own legal, tax, or other advice before investing. EIP is not responsible for any information provided in third party links.