As we wrap up 2022 and look forward to 2023, talk of an oncoming recession is all around us. This would normally be a concerning outlook for the cyclical energy industry, but this energy up-cycle is not driven by strong demand. It is instead driven by a lack of supply.

In the past, geopolitical events have caused the supply shocks. The Arab oil embargo in 1973, Iranian revolt in 1979 and the Iraqi invasion of Kuwait in 1990. This time it’s a shareholder revolt.

Historically, oil prices and global capital spending have moved in tandem as producers reinvested most of their free cash flow. They spend what they make and don’t spend what they don’t make. However, a rebound in capital spending has failed to materialize in 2022 despite a 40% year-over-year oil price rebound[1]. Why? Because shareholders are tired of wasteful capital allocation and have taken the credit card away. While global oil and gas capital spending is up off its 2020 lows, it has not outpaced cost inflation and sits well below levels needed to sustain production.

People outside the industry are generally unaware that oil and gas production will decline 6-8% per year if there is no drilling. No other industry has rates of decline/depreciation like that. This means that capital spending–which has been below sustaining levels since 2016–must rise 50% to 80% just to stop declining production[2]. This is why OPEC has nearly run out of spare capacity. And while demand may suffer in a weak economy, it must suffer more than the declines in production to put downward pressure on prices. This doesn’t even factor in the how much natural gas supply Western Europe lost following the Russian invasion of Ukraine.

Now it would seem the world’s conventional energy supply is so tight that it may also be a contributing factor to a weaker global economy. In a recent interview with the Wall Street Journal, Darren Woods, CEO of Exxon Mobil, responded to a question regarding the world’s energy supply:

“What we were seeing even before the Russian invasion of Ukraine is a policy approach dominated by ideology, aspiration and hope collide with the realities of a global energy system that’s complicated, multidimensional and critically important to economic growth and prosperity.”

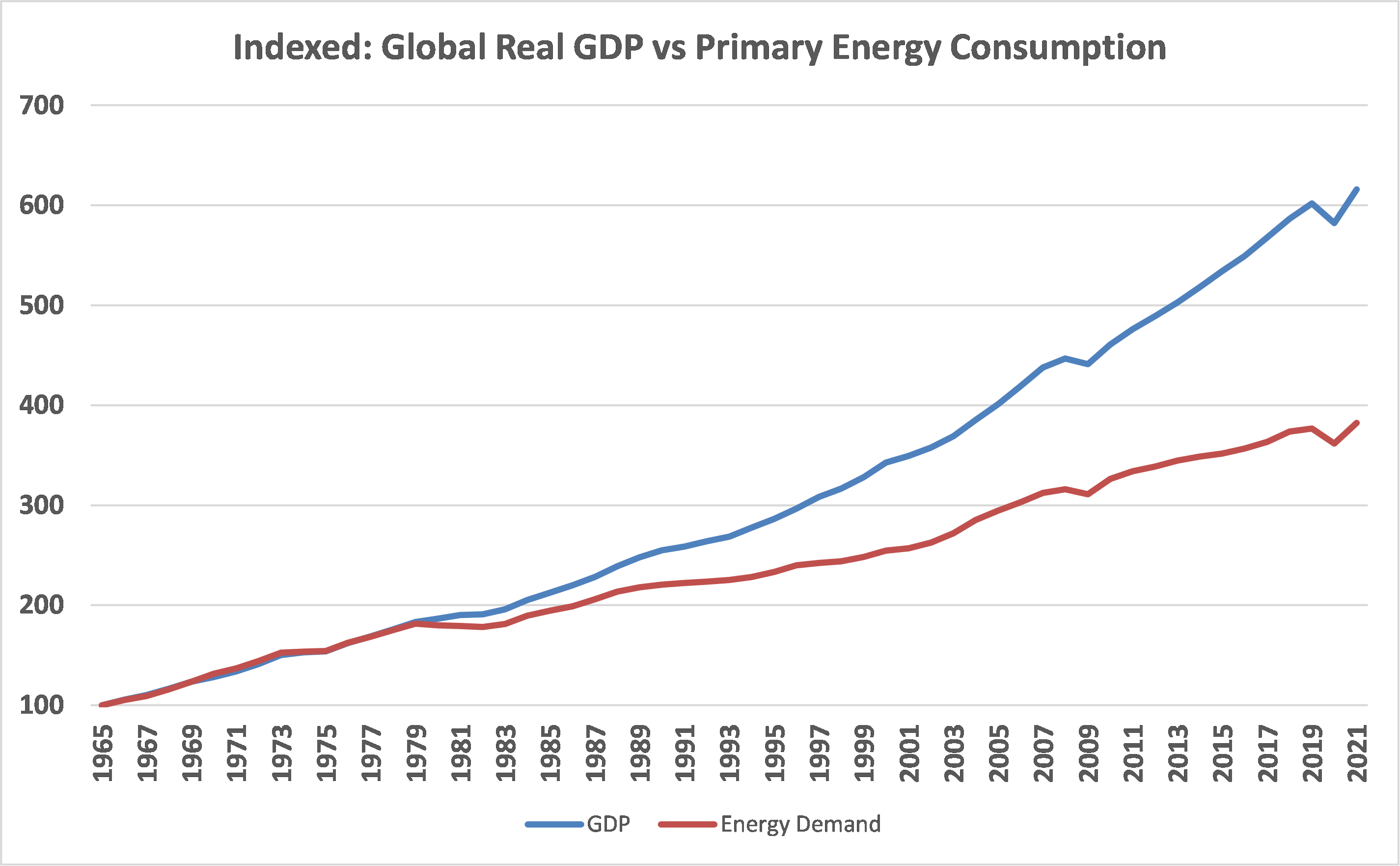

This is an understatement. The economy shuts down without energy. This can be seen in the relationship between global primary energy demand and global real GDP. If energy production capacity is shrinking, it is not physically possible to grow GDP in the near to medium term. So, it begs the question of causality and turns the concern about a recession on its head.

Exhibit 1: Indexed Global Real GDP vs. Global Primary Energy Consumption

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

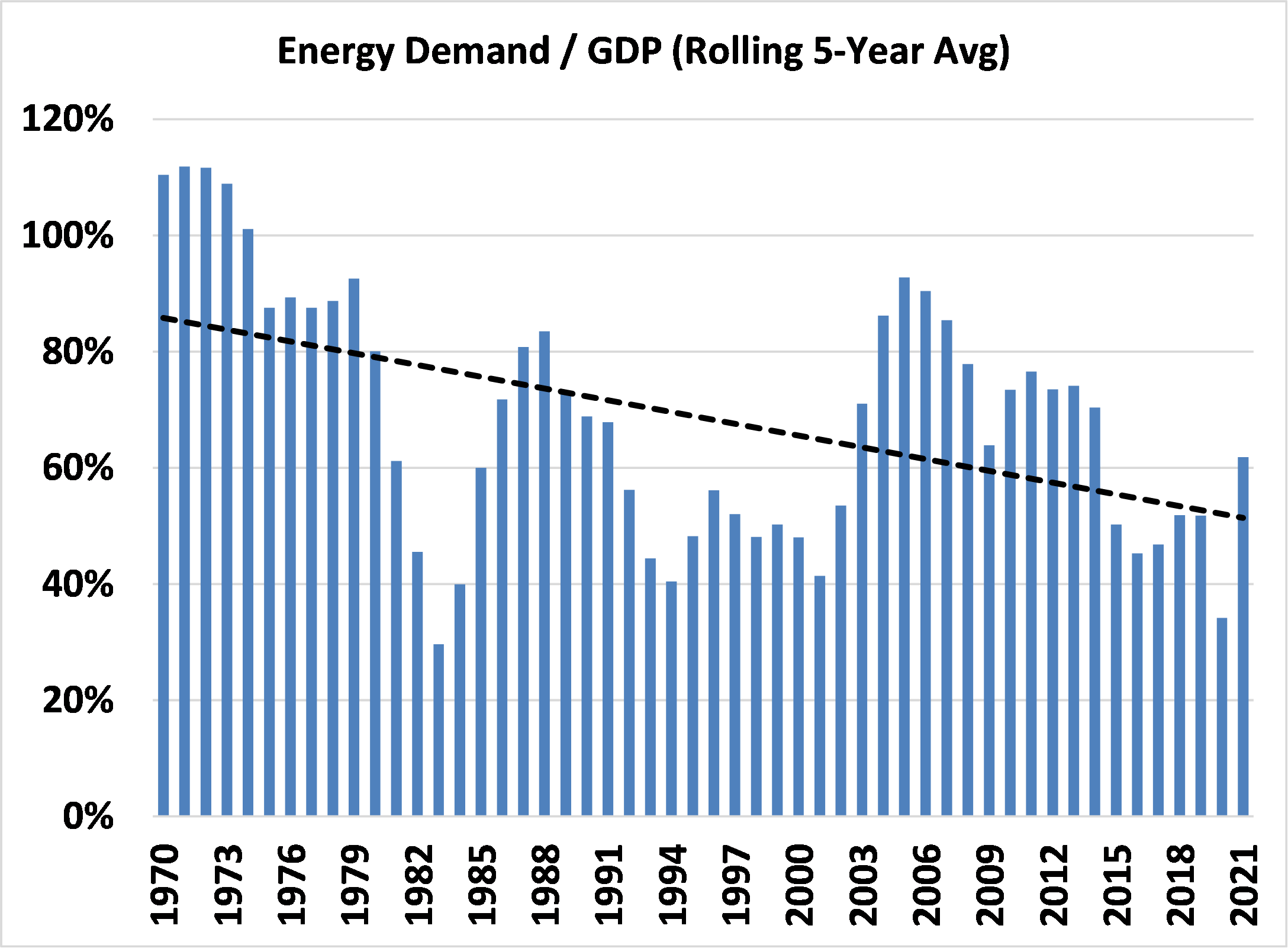

The very long term, of course, is different as energy efficiency grinds along and global economies become more service oriented. Exhibit 2 shows that global GDP has become less energy intensive. In the 1970’s, global GDP and primary energy demand grew one-for-one. In recent years this ratio is closer to 50%. This is why the GDP index outpaces the energy demand index in Exhibit 1.

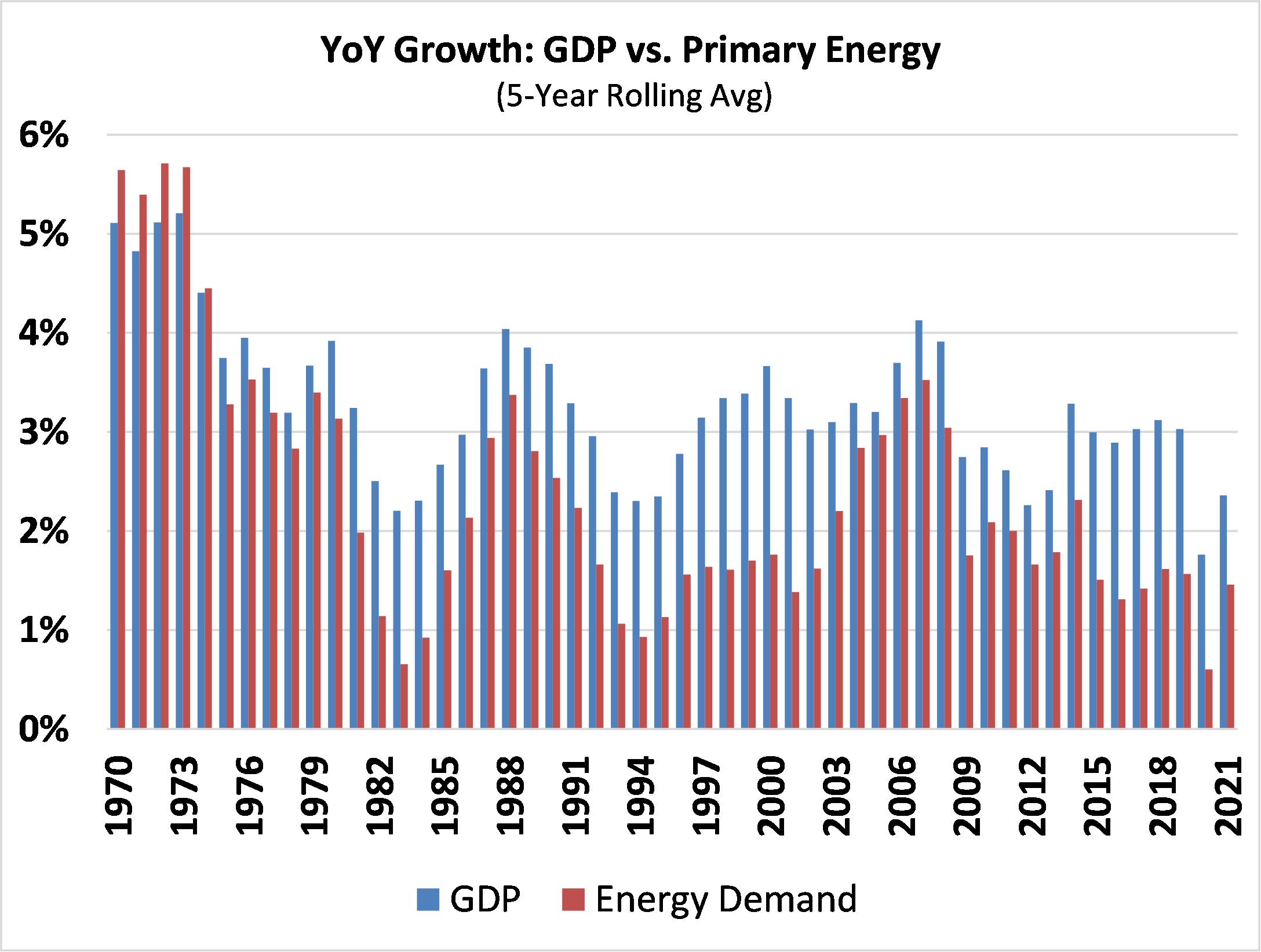

And while a recession in one year is a negative for demand for any product, even a fairly short investment horizon of five years would say to ignore it. Going back as far as 1965 there has never been a five-year period where average global GDP and primary energy demand has been negative (Exhibit 3). Yes, there have been times when both GDP and energy demand slipped negative year-over-year but five years later both were higher compared to the previous five-year period.

Exhibit 2: Global Primary Energy Demand Growth vs. Real GDP Growth

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

Exhibit 3: Global Primary Energy Demand Growth and Real GDP Growth

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

Source: World Bank, bp Statistical Review of World Energy – June 2022, EIP Estimates. This information is based on assumptions made by EIP, changes to the assumptions will affect the information provided.

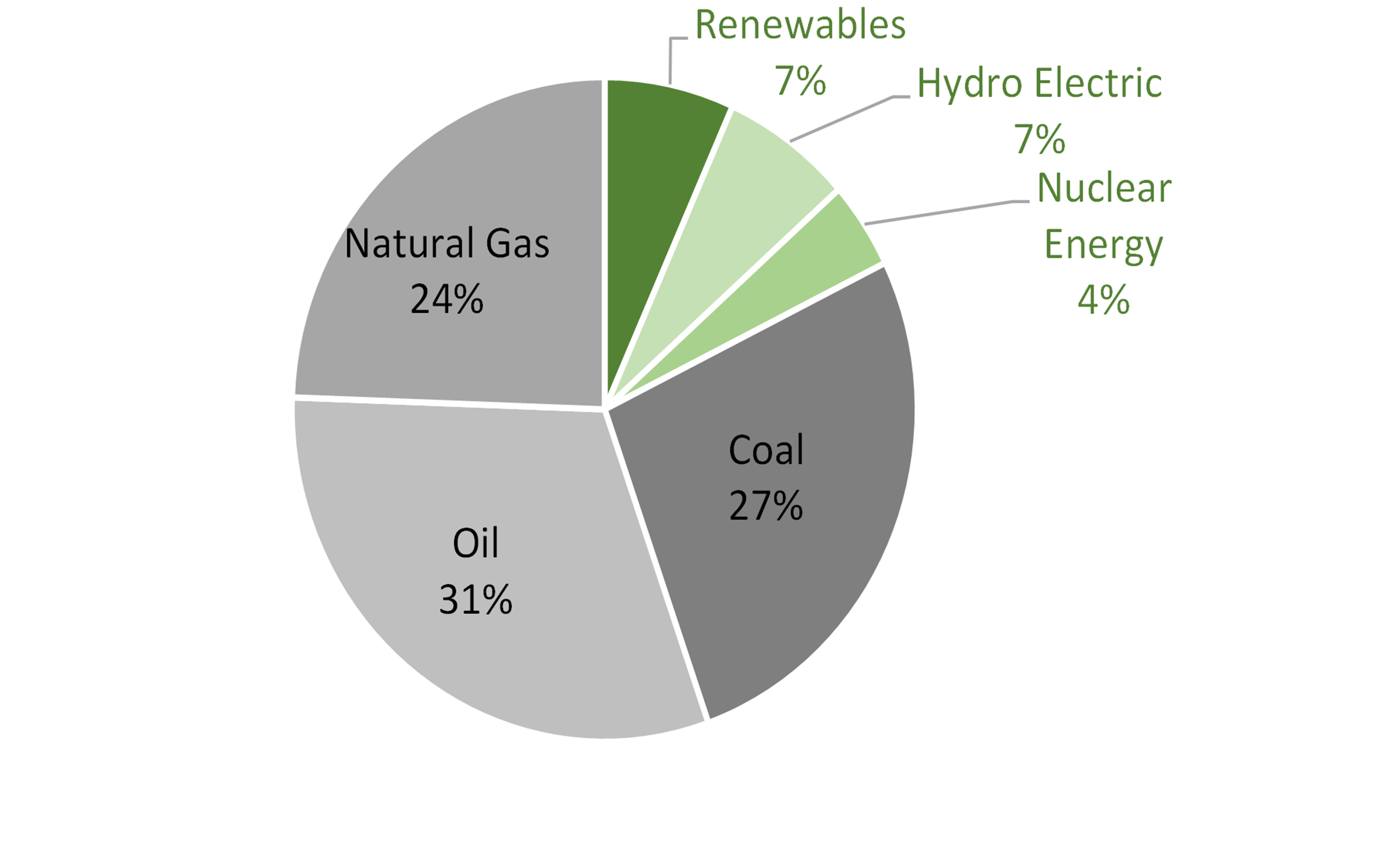

As shown in Exhibit 4, 82% of global primary energy demand is from fossil fuels. If the oil and gas companies are not investing enough capital to grow production, then, in our opinion, the economy will find it difficult to grow. This is where pundits point to a rapidly growing renewables sector filling the gap. The problem is that wind and solar only make up 7% of total primary energy supply and even growth rates as high as 15% are not enough to offset even marginal declines in conventional energy supply.

Exhibit 4: Global Primary Energy Sources

Source: EIA, IEA 2020 Key World Energy Statistics, Statista, Enterprise Products 2022 Analyst Day Deck, bp Statistical Review of World Energy – June 2022, EIP Estimates. This is based EIP’s analysis and assumptions, any changes to either could affect the information presented above.

Source: EIA, IEA 2020 Key World Energy Statistics, Statista, Enterprise Products 2022 Analyst Day Deck, bp Statistical Review of World Energy – June 2022, EIP Estimates. This is based EIP’s analysis and assumptions, any changes to either could affect the information presented above.

The solution is not found in D.C., as the President does not possess the power to mandate how energy companies reinvest their earnings. In large part, oil and gas assets are owned by publicly traded companies with boards and shareholders to answer to. So, until it becomes more attractive to drill incremental wells rather than buying back stock and paying dividends, in our opinion, supply is not likely to ramp back up in any meaningful way. When this might occur is uncertain, but it probably won’t happen if the stock prices and valuations of these companies slip any lower because current valuation levels make share repurchases accretive to earnings. That supports the price of energy company shares even if government policies don’t. In the meantime, the industry is busy cutting costs and paying down debt which significantly raises their long-term earnings power for any given commodity price. This is what equity investors watching the daily changes in oil price are missing.

[1] Source: Bloomberg.

[2] Sources: Evercore ISI Research (using a compilation of Company Data, Salomon Brothers, Salomon Smith Barney, Lehman Brothers, Barclays Capital, and Evercore ISI Research estimates), U.S. Bureau of Economic Analysis, EIA, EIP estimates.

The information provided above is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. In providing the information, EIP has made several assumptions that if changed, materially affect the information and conclusions provided. This information presented contains EIP’s opinion which may change at any time and without notice.