-

The two-week UN Climate Change Conference known as COP-26 kicks off in Glasgow on October 31, and the participating countries are releasing in advance their energy transition plans.

-

A stand-out is France; proposing an electric system powered 80% nuclear (vs 70% now and 10% for the rest of the world) and the rest from renewables.[1]

-

Why is zero-carbon nuclear power playing such a small role elsewhere in moving to a zero-carbon energy system? Answer: public opinion. Between Chernobyl, Three-Mile Island, the movie “The China Syndrome” and the accident at Fukushima, voters are convinced that nuclear power is not safe.

-

Then there is the uncompetitive cost. The two most recent nuclear projects in the U.S. are just not economic – one was abandoned prior to completion and the other (Southern Company’s Vogtle project) will cost nearly 15 cents per kilowatt hour – about three times the cost of natural gas and renewables.[2] Both projects have had massive cost overruns.

-

France has had a better track record on costs by building the same design over and over again while each plant in the US is essentially a custom design preventing any learning curve.

-

While not in the news, there is a lot going on behind the scenes in nuclear technology that will address safety and cost issues, and if successful in gaining public support would dramatically alter the energy mix that gets the world to zero net carbon.

Some Historical Background

Here in the U.S., discussion on the future energy mix seems to be a polarized debate between fossil fuels (oil, coal, natural gas) on one side and renewables (wind & solar), batteries, hydrogen, and fuel cells on the other. Less noticed is nuclear, which plays a vital role as a zero-carbon, highly reliable, always-on power source that doesn’t gobble up land, mar scenic views, or spew anything into the air. Safety and waste disposal issues have prevented environmentalists from backing it while uneconomic costs have prevented market-oriented conservatives from backing it.

The first commercial U.S. nuclear power plant went into service in 1958 near Pittsburgh as a joint venture of the Duquesne Light Company and the Atomic Energy Commission (which preceded today’s Department of Energy). Other states and countries soon followed. Initially, the success of the industry led to discussions about free electricity being carried by poles and wires that would have a fixed monthly fee.

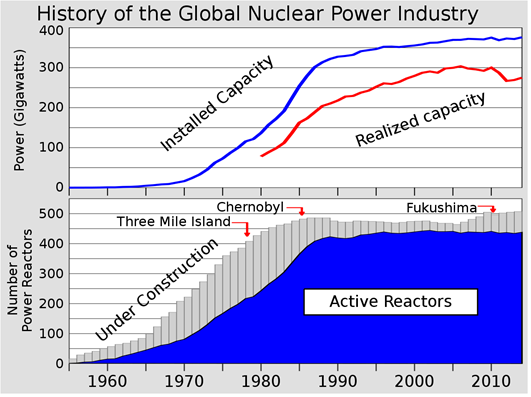

But the cost-plus reward structure of the regulated utility model eventually led to cost overruns of as much as 5x original estimates in the mid to late 1970s as construction of nuclear plants accelerated in response to the quadrupling of oil prices from the first of two supply shocks from the Middle East in 1973. In 1979, just before the second oil supply shock that would quadruple oil prices again, there was a partial meltdown of one of the units at Three Mile Island in Pennsylvania. Plans for new nuclear reactors soon came to an end on a global scale. The severe global recession that followed the second oil price shock, the eventual collapse of oil prices in late 1985 and the Chernobyl accident in 1986 pretty much ended the growth of the number of nuclear reactors in the world as shown in Figure 1.

Figure 1 History of the Global Nuclear Power Industry

Source: International Atomic Energy Commission and Dept. of Energy

France also began an aggressive push into nuclear power in the mid-1970’s. But the French nuclear program differed from the U.S. effort in several key aspects: 1) the program was carried out by a single, state-owned utility (Electricite de France), 2) they used a single standardized design and 3) fuel management and byproduct (waste) management were integrated with military applications. In contrast, U.S. utilities (investor-owned, municipal, and federal) pursued their own individual programs with several different designs and manufacturers. In simplistic terms, France built one reactor 30 at a time, while the heterogenous U.S. approach made the benefits of Wright’s Law (which measures the benefit of the learning curve) all but impossible to achieve.

Back to the Present

Given that track record, it’s easy to see why nuclear power has been left out of the energy transition. Or has it?

Currently, U.S nuclear plants supply nearly 20% of all U.S. electricity, and half of the zero-carbon power generation (source: EIA). But 25 of the 55 U.S. nuclear plants operate outside of utility rate regulation in competitive (non-regulated) states. Many of these plants can’t compete with cheaper renewable and natural gas generation. Since 2010, 11 reactors have shut, most for economic reasons, reducing the U.S. fleet from its peak of 102GW of capacity in 2012 to about 97GW of capacity today. Absent some last-minute action by the Illinois legislature that provided economic support to 4 units at two plant sites, that number would have fallen further by the end of this year.

While in theory, a new nuclear power plant should be able to produce electricity for a cost of about 8 cents per kilowatt hour, the cost overruns that always seem to happen – as with Southern Company’s Vogtle plant – drive that number higher, approaching 15 cents per kilowatt hour (Source: Southern Company, EIP estimates). This figure includes the operating costs, the cost of interest on debt and a 10% return to the equity investors, what the industry refers to as the “levelized cost of energy” or LCOE. This 15 cent LCOE compares to 4-5 cents for natural gas fired generation. Wind and solar have a similar LCOE as natural gas but that calculation ignores the significant additional costs to maintain grid reliability with backup power. This is the value that nuclear brings to the table and which competitive (i.e., nonregulated) electricity markets don’t pay for: reliability, resilience and zero greenhouse gasses.

Reliability. We’ve discussed this concept in our July 8, 2021 blog post Nuclear plants are designed to run at full power 24/7/365 except for periodic outages to refuel and perform routine maintenance. And run they do; in 2020 they provided power 92.5% of the time – what the industry calls “capacity factor”. That compares to 24.9% for photovoltaic solar (the sun sets every day, and some days are cloudy), and 35.4% for wind (which doesn’t always blow). As intermittent resources have increased their share of generation supply, the value of this reliability has risen. Just ask the folks in California.

Resilience. Nuclear supplies big blocks of power that lend stability to the transmission grids that move power from production to consumption. As more of that power becomes intermittent, the need to stabilize grid voltage and frequency grow. Nuclear is well-suited to this task.

Zero GHG. This is the biggest reason for renewed interest in nuclear today, and a key driver behind state and federal subsidies for existing nuclear plants so they stay economically viable. Nuclear plants generate no carbon, methane, or nitrous oxide.

Future Shock[3]: Small is Beautiful

Nonetheless, it is difficult to imagine public opinion changing unless costs come down and perceptions of safety improve. Enter the “Small Modular Reactor” or SMR whose size and design address these two main shortcomings of conventional nuclear and as the name implies, these reactors are much smaller (about 60-200 megawatts) than the 1000 megawatts of a typical reactor.

A key advantage of SMR technology is it’s “passive design” which means the flow of water through the reactor relies on convection, conduction, and gravity rather than mechanical pumps for heat transfer and cooling. This feature essentially eliminates the risk of what happened at Three Mile Island or Fukushima.

Another is that these units will be assembled in a factory and shipped to the site. This allows for the learning curve to reduce costs as more units are built as each is identical. If more generation is needed, more units are installed right next to each other in the field.

Finally, some are being designed to support intermittent renewables by storing the heat used to make steam on site so the reactor can run steadily, and the turbine can ramp up and down.

Commercial delivery of the first SMR in the U.S. is planned for 2029 at the Idaho National Lab serving municipal utilities in Utah and will be built by NuScale. NuScale is a public / private joint venture between engineering company Fluor and the U.S. Department of Energy and is the first SMR technology to seek design approval from the U.S. Nuclear Regulatory Commission. The NuScale design is a single integrated unit using conventional water as a coolant in a passive design. The vast majority of the world’s nuclear reactors use conventional or “light” water as the coolant. The remaining reactors use “heavy” water.

Natrium, another SMR technology backed by Bill Gates, pairs a nuclear reactor with thermal storage via molten salt. A third technology known as Xe-100 uses helium gas as the coolant instead of water or molten salt. Both these designs are moving forward with US Department of Energy support.

We have studied what is available on the costs of the NuScale technology, including an independent academic review, and it is encouraging. The capital costs per kilowatt for the NuScale reactors are about half of a conventional plant and the operating costs will match the best 25% of existing reactors. From our perspective the ability to assemble these units in a factory and deliver them to the site on a truck will allow for costs to decline the more units are fabricated, taking advantage of the learning curve and scale that benefitted shale drilling, wind, solar and batteries. Field construction of a massive, custom designed unit will likely become a thing of the past. Even the French are now moving on SMR technology to exploit its advantages over conventional technology.

Final Word

Keep your eye out for nuclear to gain momentum in the policy discussion and maybe generate some headlines from Glasgow. Recently a 10-member alliance of European countries issued a declaration that said “If Europe is to win the climate war, it needs nuclear energy. It is a vital and reliable resource for all to secure a low-carbon future.” The alliance then called on the European Commission to classify nuclear power as a “sustainable activity” under a proposed set of finance regulations dealing with the environment. (Source: Dow Jones).

Perhaps the recent price volatility of oil, natural gas and coal combined with showcasing the French experience in Glasgow, support from the European Union and the promise of a new smaller-is-better approach to nuclear design will begin to change U.S. public opinion about nuclear power.3

[1] Sources: https://www.rte-france.com/en/eco2mix/power-generation-energy-source, https://cnpp.iaea.org/countryprofiles/France/France.htm

[2] Source: EIP estimate of LOCE based upon $27bn capital cost, 10% equity return, 3% cost of debt.

[3] Sorry, we couldn’t resist

Sources:

Capacity factors

https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_6_07_b

Nuclear units in operation and capacity:

https://www.eia.gov/energyexplained/nuclear/us-nuclear-industry.php

Lazard LCOE:

https://www.lazard.com/media/451419/lazards-levelized-cost-of-energy-version-140.pdf

Deregulated / regulated states:

https://www.nei.org/resources/statistics/nuclear-plants-in-regulated-and-deregulated-states

The above is Energy Income Partner LLC’s (EIP) opinion and such opinions may change without notice or duty to update. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable, but EIP has not independently verified and cannot warrant the accuracy of such information. References to a particular company or funds are for informational purposes only and are not an offer to purchase or sell or a solicitation to purchase or sell a particular security, company or fund.