Key Takeaways

- Our recent posts looked at growth in electric vehicles (EV) and their potential impact on global oil demand (2030 demand likely higher than 2019). We now turn to EV’s impact on electricity demand and investment in electric utility infrastructure.

- 100% EV penetration of on-road passenger vehicles would nearly double U.S. residential electricity usage which is 40% of all electric demand. In the aggregate, residential electricity consumes slightly less energy than passenger vehicles, and two EVs consume roughly the same amount of electricity per year as an average U.S. home.

- But growth depends on EV adoption rate. EVs currently represent <1% of passenger vehicles, and our prior post noted that the fleet turnover rate remains low at ~4% per year, meaning that growth in electricity demand is likely to be incremental and back-end loaded.

- Utility EPS growth is driven by investment, and incremental EV charging load will require electricity infrastructure capex, with the potential to add a percentage point or more to the sector’s current 5-7% annual earnings growth rate[1], a 15-20% increase.

Converting from Conventional ICE (internal combustion engine) to EVs – how big is the potential change in electricity demand?

Primary energy consumption in the U.S. totaled 93 quadrillion British thermal units (Quad Btu) in 2020, according to U.S. Department of Energy (DOE) data. Table 1 estimates the breakdown of energy usage between electricity, transportation, and other uses.

Table 1 – Total U.S. Energy Usage

Sources: EIA, EIP

* Current Residential Electricity is ~40% of total U.S. Electricity consumed.

** Current Passenger Car Transportation is estimated at ~60% of total energy consumed by the Transportation sector.

Converting the on-road passenger car fleet from Conventional ICE to EV means substituting electricity for petroleum as a transportation fuel. As shown above, passenger cars consume slightly more energy than total U.S. residential electricity usage, making this a potential game-changer for utilities, driving not only increased electricity use, but also incremental grid investment.

Energy geeks may object to using Table 1 for that purpose on the basis that there is higher EV energy conversion efficiency or losses incurred in generating and transporting electricity.[2] So let’s come at this from another angle.

Similar to Conventional ICE, EV energy consumption depends on vehicle size, weight, power, and how it’s driven (e.g. highway vs city). Gasoline comes in gallons, and electricity is measured in kilowatt-hours (kWh); one kWh is simply 1,000 watts of electricity consumed for one hour.

To compare EV fuel efficiency to Conventional ICE, the U.S. Environmental Protection Agency (EPA) estimates electricity consumption in kWh per 100 miles of travel, which ranges from about 25-35 kWh/100 miles for a typical passenger car to over 50kWh / 100 miles for a high-performance car or sport utility vehicle (SUV)[3].

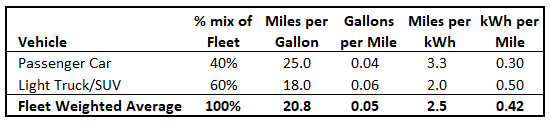

Table 2 below compares gasoline and electricity consumption and cost per mile driven based on national averages for two typical U.S. vehicle classes.

Table 2 – EV and Conventional Vehicle Fuel Consumption and Cost

Source: EIP Estimates using data from U.S. EPA, AAA’s average cost of gasoline, and U.S. EIA’s average cost of residential electricity.

Americans drive their passenger cars 2.9 trillion miles each year[4]. Assuming 60% of those are in an SUV, full electrification would consume about 1.2 trillion kWh (0.42 KWh per mile x 2.9 trillion = 1.2 trillion kWh). For context, last year U.S. residential users consumed 1.46 trillion kWh, meaning EVs could nearly double residential electricity demand.

And finally, here is another way to look at it. Driving our sample passenger vehicle in Table 2 for 12,100 miles – the average annual miles driven per vehicle in the U.S. pre-COVID[5] – would consume ~5,075 kWh (12,100 miles x 0.42 kWh/mile). This is about half of the annual electricity consumption of an average U.S. household[6]. So full adoption with two vehicles per household (roughly the U.S. average[7]) would essentially double residential demand.

But the Adoption Rate Tempers the Rate of Electricity Demand Growth

We noted in our prior post that we don’t expect EV adoption to offset oil demand growth for at least the coming decade, therefore global oil demand in 2030 likely remains at least as high as pre-COVID 2019 levels. So, how fast could electric vehicles grow electricity sales? Table 4 shows the relationship between the on-road EV conversion rate (using years to double residential demand as a proxy) and the implied rate of electricity demand growth under different EV adoption scenarios.

Table 3 – Potential Electricity Demand Growth Rates

Source: EIP.CAGR-Compound Annual Growth Rate.

An aggressive EV adoption rate could double residential electricity demand in a decade, but our work on fleet turnover points to a more likely two-to three-decade transition, which could increase annual demand by ~1%–not insignificant considering the potential to more than double the U.S. DOE’s projected sub-1% electricity sales growth rate.[8]

Investment in the Grid

An increase in electricity demand means higher sales growth for utilities. Sales growth benefits most enterprises, but the regulated utility business model is different. Regulated utilities do not make more money because of increased sales, they earn based on the following: net income equals the allowed regulatory return multiplied by “rate base” or the capital invested in poles, wires, transformers, and so on. So, utility earnings growth comes from the regulatory return that is tied to investing incremental capital in that “rate base”. Since EV’s will make the grid work harder, the infrastructure that transports, delivers, and manages electricity will require further investment. One study, a 2019 whitepaper by Boston Consulting Group (BCG) estimates incremental transmission and distribution investment ranging between $1,700 and $5,800 per electric vehicle.[9] There are fewer than two million EV’s in U.S. today, but a recent UBS equity research estimate puts that at over 36 million by 2030 (about 15% of the on-road fleet).[10]

Of course, these are just estimates, but they do provide a reference point to consider utility capital investment and attendant earnings growth potential from converting Conventional ICE to EVs. Using the $3,750 midpoint of BCG’s per-vehicle spend range and UBS’ 36 million-by-2030 vehicle count yields a cumulative ten-year investment approaching $140 billion, concentrated in later years. We estimate that incremental EV capex could raise current rate base growth 15% – 20%, adding a percentage point to the 5% – 7% utility sector earnings growth rate[11].

A potential 1% uplift to utility earnings growth, coupled with the group’s current 3% yield implies a 9% – 11% total return (not including any changes in valuation)[12], compared to the S&P 500’s 30-year 7% historic growth rate and 1.4% current yield[13].

EVs are a big part of the broader cleantech and decarbonization investor narrative, so a modest growth rate uptick for the electric utilities probably won’t excite tech investors. However, unlike most companies in the clean energy indices, utilities actually have earnings in support of a dividend. Their total return combines attractive growth, greater stability, less economic sensitivity, and very little of the commodity price risk that that has so often compressed margins of all energy producers, clean energy or otherwise. Further, EVs are just one piece of new investment[14] required for a future electricity system that includes more storage to complement renewable intermittency, distributed energy resources, grid intelligence and demand response.

[1] Sector earnings growth is based on regulated U.S. utilities as identified by UBS that are also in the EIP SMA Strategy as of 6/30/21. The five-year EPS growth rate of these companies is 6% on an equal-weighted average basis based on data provided by Bloomberg, while UBS estimates these same companies will be able to achieve EPS growth of 5.1% over the next five years.

[2] According to the U.S. DOE, EVs convert over 77% of the electrical energy from the grid to power at the wheels; whereas conventional gasoline vehicles only convert about 12%–30% of the energy stored in gasoline to power at the wheels. However, creating the electricity today for EVs comes with efficiency losses as well: using the U.S. DOE data from Table 1 the current Electric Power system in the U.S. consumes about 36 Quad Btu of primary energy to create 12.5 Quad Btu of electricity. This implies system energy losses of ~65%. When we incorporate the energy losses from each energy source and drivetrain and then compare the required primary energy needed, we find that EV’s would have about ~80% of the primary energy requirements that ICEs have today.

[3] Source: U.S. DOE – Alternative Fuels Data Center

[4] Source: U.S. Bureau of Transportation Statistics (BTS), 2019

[5] Bloomberg NEF estimates there are 241.9 million passenger vehicles in the U.S. This implies an average of 12,087 miles per passenger vehicle (2,924,053 total passenger vehicle miles (BTS) / 241.9).

[6] According to the U.S. EIA in 2019, the average annual electricity consumption for a U.S. residential utility customer was 10,649 kWh.

[7] Statista estimates (using US Census Bureau data) that there are 128.6 million households in the U.S. This implies ~1.9 passenger vehicles per U.S. household (241.9 million passenger vehicles / 128.6 million households).

[8] U.S. Department of Energy, Energy Information Administration, Annual Energy Outlook 2021

[9] https://www.bcg.com/publications/2019/electric-vehicles-multibillion-dollar-opportunity-utilities

[10]https://neo.ubs.com/shared/d2o2hxzkqZ01E2/?did=AC7-E-766731464&off_id=AC7-E-767754954&ma=Y526F575649435742&camp_id=EM:UNKW:2021-08:30:C

[11] See footnote 1 above

[12] While it’s our view that yield and growth are the primary drivers of total return, we of course recognize that valuation changes do affect that, more so in the short-term than the long-term. And while each investor has their own idea of “fair value”, we stay out of that debate for now to focus on the impact EV’s might have on the comparatively low-risk, long-term total return opportunity electric utilities offer.

[13] S&P 500 historical growth rate is the CAGR of the earnings of the index from 9/30/90 to 9/23/21 and the current yield of the index is based on the annualized divided of the Index on 9/23/21 per data provided by Bloomberg.

[14] It’s important to note that for simplicity’s sake our analysis doesn’t cover the potential electricity demand from commercial vehicles (trucks, buses). However, the electrification of commercial vehicles would require further capital investment in the electric grid and serves to support our investment view for electric utilities. Further, the cost per mile for each drivetrain technology highlighted in Table 2 is not a perfect comparison because we haven’t included the amortized cost of the battery and charger for EVs. Our analysis doesn’t consider the potential opportunities/role regulated utilities could have around BaaS (batteries as a service).

The Information provided in this article is believed to be accurate as of the date above. EIP reserves the right to update, modify or change information without notice. Any statements of opinion are EIP’s opinion and should not be relied upon as a prediction of any future event. The information is based on a number of assumptions that may or may not become true and may effect the analysis above. The information is based on data obtained from third party publicly available sources that EIP believes to be reliable but EIP has not independently verified and cannot warrant the accuracy of such information. Investors are encouraged to seek their own legal, tax, or other advice before investing.